As prices surge on various essentials in your daily life, it becomes crucial to compute these increments for future planning or financial records. Calculating the percentage increase of an item is straightforward once you have the historical and current costs at hand. Let's explore the steps involved!

Simple Steps

Obtaining Cost Data

Recall the previous price of the item. Retrieving past cost information can be as simple as relying on your memory. Perhaps there's an item you regularly purchase whose price has remained constant over time, like a gallon of milk. Suppose it has been priced at $2.50 for several years, serving as the base for your cost increase calculation.

Check the current price of the item. Before calculating the percentage increase in cost, it's essential to know the current price of the item. Visit the store to find out the current cost. For instance, if a gallon of milk, previously priced at $2.50, is now $3.50, you can compute the percentage increase to understand the difference between the old and new prices.

- Ensure both values (old and current) pertain to the same product for accurate comparison.

Explore historical cost data. Sometimes, recalling past cost data isn't feasible, especially when comparing costs over extended periods or for unfamiliar items. In such cases, you'll need to search for historical cost data elsewhere, such as the Consumer Price Index (CPI) or historic price databases.

- Conduct online research to find cost data for specific items and years.

- Platforms like http://mclib.info/reference/local-history-genealogy/historic-prices/ offer historic price information for various consumer goods.

Find current cost data. Alongside historical cost data, you'll need current figures for accurate comparisons. Locate the most recent data for the item or measure you're analyzing. Ensure that you're comparing similar items to avoid discrepancies due to quality or features.

Calculating Percentage Increase in Cost

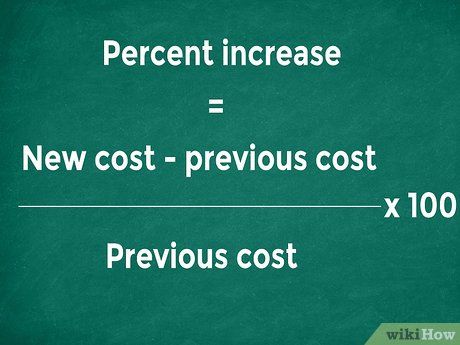

Grasp the concept of the percentage increase formula.

Grasp the concept of the percentage increase formula.

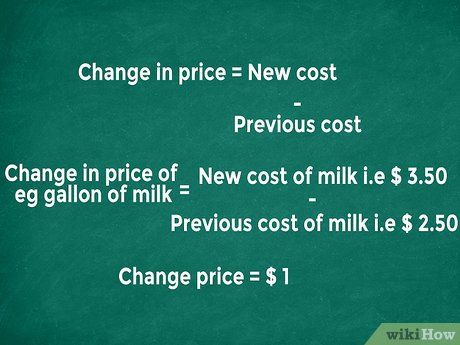

Determine the difference between the new and previous costs. Kick off your calculation by plugging in your figures into the equation. Then, simplify the portion within parentheses by subtracting the previous cost from the new one.

- For instance, if a gallon of milk cost $2.50 a month back and now it's $3.50, subtract $2.50 from $3.50 to get the dollar difference, which is $1.00.

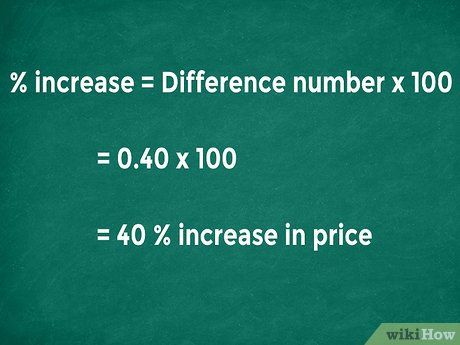

Divide the outcome by the previous cost. Your subsequent move is to divide the result from the prior step by the previous price. This effectively transforms the discrepancy between the new and old costs into a fraction of the previous cost.

- In the example, it would be $1.00 (the outcome of the previous step) divided by $2.50 (the previous cost).

- The outcome is 0.40, expressed as a numerical proportion rather than a dollar amount.

Transform the result into a percentage.

Transform the result into a percentage.Utilizing Cost Increase Percentage

Analyze expense escalations. Your cost increase computations can help gauge expense escalations across your budget. Tracking these changes over time allows you to assess if certain expenses are rising faster or slower than others. Compare these escalations to your income increments to ensure they align with your cost of living adjustments.

Monitor business expense hikes. Businesses can employ cost increase percentages to assess their impact on projected or actual profit margins. This data informs decisions on supplier changes or price adjustments. For instance, if a business observes consistent rises in the cost of production inputs, it may seek alternative suppliers or adjust selling prices accordingly.

Evaluate appreciation in collectibles. Items like vintage cars, watches, and art may gain value over time. This increase can be quantified using the cost increase percentage method. Compare past and present prices to determine the appreciation. For instance, if a watch was priced at $100 in 1965 and now sells for $2,000, it reflects a 1900 percent increase in value.

Apply the same technique to other percentage calculations. The formula and process used for calculating percentage cost increase can be extended to various other calculations. You can utilize the same approach with different parameters to compute percentage errors (comparing expected and actual values), determine percentage differences between time periods, or make numerous other comparisons between two quantities.

Calculator, Exercises, and Solutions

Sample Cost Increase Percentage Calculation

Sample Cost Increase Percentage Calculation Sample Exercises for Calculating Cost Increase Percentage

Sample Exercises for Calculating Cost Increase Percentage Answers for Sample Practice Problems on Calculating Cost Increase Percentage

Answers for Sample Practice Problems on Calculating Cost Increase Percentage