When it comes to delegating financial responsibilities in your bank account, there are diverse avenues to explore. You can opt to confer financial authority to another individual through a power of attorney, delineating the specific transactions they are empowered to execute. Alternatively, you may opt for account modification to grant access to a designated party. Each financial institution has its own protocols and requisite documentation, necessitating direct communication with your bank to determine the most suitable course of action for your circumstances.

Navigating the Protocol

Empowering Another Individual with Financial Authority

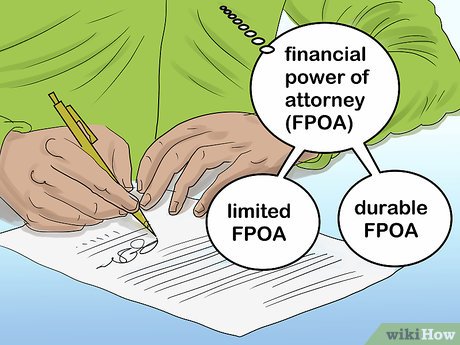

Delve into the realm of conferring financial authority for targeted transactions. Most financial institutions mandate explicit authorization for non-account holders to conduct transactions, typically achieved through the execution of a power of attorney (POA) document stipulating the authorized transactions. By endowing an individual with POA, you furnish them with the ability to execute withdrawals, issue checks on your behalf, and undertake requisite actions during your absence.

Securing a Power of Attorney Form from Your Bank

Crafting Your Own Power of Attorney Documentation

Submitting Your Documentation to the Bank

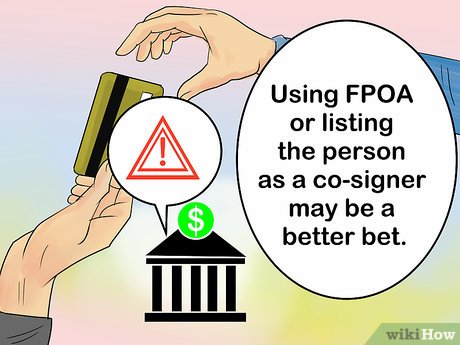

Exploring Alternative Account Arrangements

Exploring Convenience Account Options

Exploring Co-Ownership Options for Your Account

Exercising Caution with Full Account Access

Authorizing Account Usage

Facilitating Deposits into Your Account

Facilitating Withdrawals from Your Account

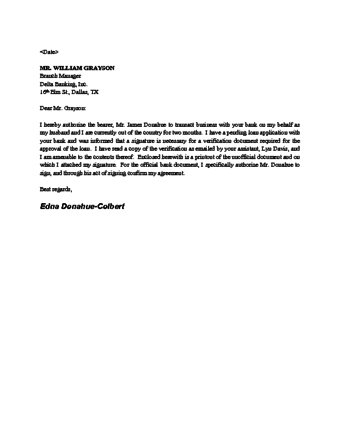

Bank Letter Example

Formal Sample Letter of Bank Authorization

Formal Sample Letter of Bank Authorization