Kickstart your ministry and make a positive impact on the world. Establishing a ministry requires dedication, perseverance, and a clear sense of purpose. Fortunately, you possess all these qualities! You envision creating an organization that serves your community or even extends its reach globally. But where do you begin? And once your ministry is up and running, how do you ensure its success? With your passion as your driving force, let's delve into the legal aspects of launching your ministry. You're on the brink of making a difference.

Essential Insights

Key Steps to Success

Navigating the Journey

Defining Your Ministry's Mission

Craft your vision. Prior to establishing a legal framework for your ministry, distill your concept to its core elements. What precise goals do you aim to achieve? Who will benefit from your ministry? Will it operate physically or online?

Craft your ministry's purpose statement. After refining your concept, articulate your ministry's objectives and principles in a succinct mission statement. Clearly outline your organization's values and intentions in a sentence or two.

Establish your ministry's regulations. While the mission statement communicates your ministry's purpose and values, the regulations define how your organization will execute its mission.

Form a governing body. Identify individuals who align with your ministry's objectives and possess relevant expertise. Recruit individuals who share your ministry's objectives, as well as those with relevant expertise.

Initiating Your Ministry

Complete the formalities. Choose a legal structure for your ministry and file necessary paperwork with the appropriate authorities. The structure you choose will affect your tax obligations and legal liabilities. Most ministries opt for nonprofit status, such as 501(c)(3) corporations.

Pursue tax exemption. Apply for tax-exempt status through the IRS using Form 1023. If your ministry is affiliated with an existing organization, you may already have tax-exempt status under their umbrella.

Obtain an EIN. After registering your ministry, obtain an Employer Identification Number (EIN) from the IRS. This is essential for tax purposes, hiring employees, and opening a bank account.

Secure appropriate insurance. Select an insurance agent experienced in dealing with ministries to ensure your organization's specific needs are met. Opt for an independent agent for a wider range of insurance options.

Selecting the Right Insurance Coverage

Building Your Team: Hiring for Your Ministry

Crafting an Employee Handbook

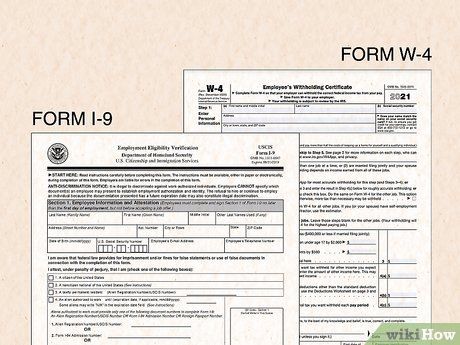

Completing Tax Forms for New Hires

Complying with Labor Standards

Embracing Ethical Standards

Fostering Transparency Within Your Organization

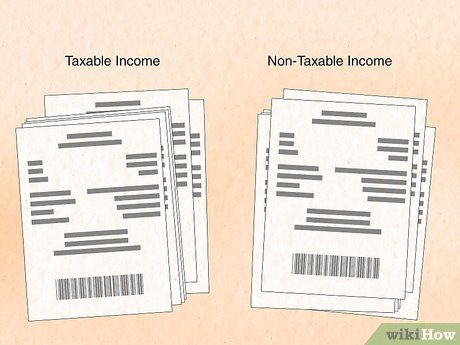

Ensuring Financial Accountability

Promoting a Safe Community