Traders employ various strategies to dissect stock movements. Analysts gauge whether to enter or exit positions based on prevailing market conditions. Fundamental analysis delves into a company's financial health, particularly its profitability. Conversely, technical analysis scrutinizes price trends and trading volumes. Both methodologies aid in decision-making within the stock market realm.

Procedures

Leveraging Fundamental Analysis

Applying Value Investing Principles Value investing aims to acquire stocks below their intrinsic value. Investors anticipate capital appreciation as the company's fundamentals strengthen.

- Fundamental analysis assesses a company's financial performance to determine its intrinsic worth.

- Intrinsic value reflects a company's true worth based on its profit generation and cash flow.

- For instance, consider Acme Company, which has been publicly traded for two decades. Over this period, it has consistently increased sales by 15% annually.

- Thanks to prudent financial management, the firm's profits have grown at a steady rate of 5% per annum.

- Hence, Acme's performance benefits investors twofold.

- Firstly, profit growth enables Acme to enhance dividend payouts to shareholders.

- Secondly, Acme can reinvest profits to foster business expansion.

- Fundamental investors expect these financial outcomes to manifest in stock prices over time.

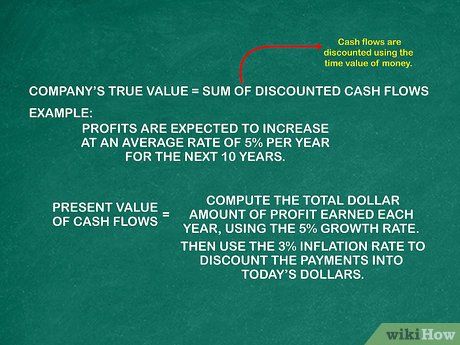

Evaluating Discounted Cash Flows of a Company Fundamental analysis suggests that a company's true value is determined by summing its discounted cash flows. Despite market perceptions affecting stock prices, fundamental analysis emphasizes the importance of these cash flows in valuation.

- After covering expenses with sales revenue, any leftover cash constitutes profit.

- These cash flows are adjusted to present value using the time value of money.

- The time value of money accounts for the diminishing worth of future cash flows due to inflation.

- Take the example of Acme, assuming a 5% annual profit increase for the next decade.

- Also, consider a 3% annual inflation rate over the same period.

- To calculate present value, first compute yearly profits with the 5% growth rate.

- Then, discount future profits to present value using the 3% inflation rate.

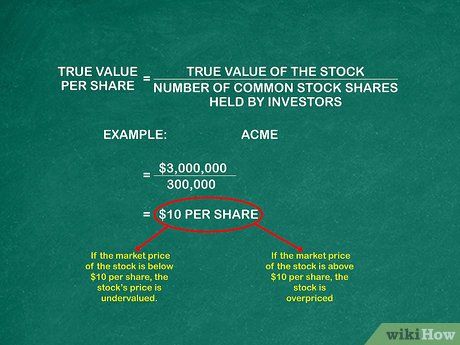

Utilizing Discounted Cash Flow Method for Stock Analysis Future cash flows derived from company profits are discounted using the time value of money. The aggregate of these cash flows represents the true value of the stock.

- The Equation: True value of the stock divided by the number of common stock shares held yields the true value per share.

- Significance: Calculating a per-share value enables comparison between true value and market price.

- Interpreting Price versus Value: If market price falls below true value, fundamental analysis suggests the stock is undervalued.

- Investors should consider purchasing undervalued stocks.

- Illustration: Acme's projected earnings amount to $3,000,000 with 300,000 shares held by investors.

- The true value per share equals ($3,000,000 earnings) / (300,000 shares) = $10 per share.

- Market price below $10 per share indicates undervaluation per fundamental analysis.

- Conversely, a price exceeding $10 per share suggests overvaluation.

Implementing Technical Analysis

Understanding Technical Analysis Techniques Technical analysis disregards a company's financial performance, focusing instead on market activity such as buying and selling.

- Statistical data concerning stock market activity, including price changes and trading volumes, are considered.

- This approach relies on historical price trends and trading volume indicators to forecast future price movements.

- Technical analysts believe these indicators can predict stock price changes.

- Changes in trading volume are also considered predictive of price changes.

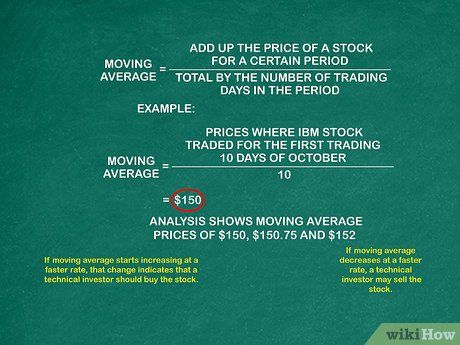

Employing Moving Averages to Identify Market Trends Moving averages involve summing a stock's prices over a specific period and dividing by the number of trading days. This statistical tool charts trends in a stock's price.

- If the moving average increases rapidly, it suggests a buying opportunity according to technical analysis.

- Rapid decreases in the moving average may prompt a sell-off.

- A reversal occurs when stock price diverges from the moving average line.

- For instance, calculate IBM's prices for the first 10 trading days of October, averaging $150.

- Repeat this calculation daily, dropping the earliest day and adding the latest to maintain a ten-day average.

- Each day's moving average may vary slightly.

- Consistent moving average prices of $150, $150.75, and $152 indicate a gradual price increase.

Analyze Stock Price with Trading Volume Trading volume represents the number of shares traded within a specific timeframe (day, week, month). Analysts combine trading volume data with other analyses to inform stock trading decisions. Most analysts view price movements without volume as insignificant.

- Consider IBM, typically trading 100,000 shares daily.

- Sharp increases or decreases in trading volume may signal trends.

- For instance, if daily trading volume jumps to 150,000 shares with a sharp rise in the stock's moving average, it could signal a buying opportunity.

- Rising volume alongside an upward trend suggests accumulation, while rising volume with a downward trend indicates liquidation.

- If trading volume rises while the moving average declines sharply, it may indicate a bearish trend.

- This scenario suggests increased selling pressure due to rising volume and falling prices.

Additional Considerations in Technical Analysis Technical analysts also evaluate short interest, support, and resistance levels to identify trading opportunities.

- Short interest tracks the total shares sold short but not yet covered.

- High short interest raises concerns.

- Support and resistance levels denote price levels where assets are expected to halt directional movement.