If you're considering investing in or selling a company, accurately assessing its value is essential for ensuring a fair deal. The market value of a company reflects investor expectations regarding its future earnings. We'll guide you through various approaches to calculating a company's market value, including evaluating its market capitalization (stock value and outstanding shares), comparing it with similar companies, and using industry-specific multipliers.

Steps

Calculating Market Value Using Market Capitalization

Determining the Suitability of Market Capitalization as a Valuation Method: The most direct and reliable method for assessing a company's market value is by calculating its market capitalization, which represents the total value of all outstanding shares. Market capitalization is computed by multiplying a company's stock price by its total number of outstanding shares. This metric serves as a measure of a company's overall size.

- It's important to note that this approach is applicable only to publicly traded companies, where share prices are readily available.

- An inherent drawback of this method is its vulnerability to market fluctuations. Even if a company's financial health remains stable, its market capitalization can decrease if the overall stock market experiences a downturn due to external factors.

- Market capitalization, influenced by investor sentiment, can be a volatile and somewhat unreliable indicator of a company's true value. Various factors contribute to stock prices and, consequently, a company's market capitalization. Therefore, it's advisable to interpret this metric cautiously. Nevertheless, potential purchasers of a company may align their expectations with market trends and assign similar value to its prospective earnings.

Obtain the current stock price of the company. You can find this information on various financial websites such as Bloomberg, Yahoo! Finance, or Google Finance by searching for the company's name followed by 'stock' or its stock symbol. Use the current market value provided on the stock report page.

Determine the total number of outstanding shares. This includes shares held by all shareholders, including insiders like employees and external investors like banks and individuals. You can locate this information on the company's balance sheet under 'capital stock' or on financial websites alongside the stock price.

- All publicly-held companies' balance sheets are available online for free, as mandated by law. A simple online search will yield the balance sheet of any public company.

Calculate the market capitalization by multiplying the number of outstanding shares by the current stock price. This value represents the total worth of all investors' interests in the company, offering an accurate assessment of its overall value.

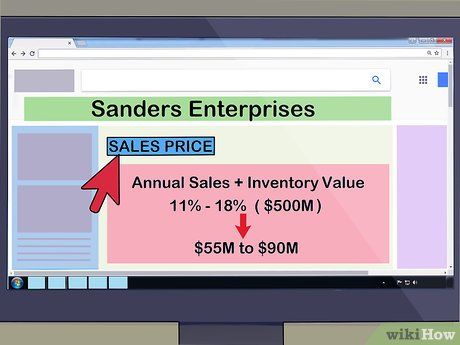

- For instance, consider Sanders Enterprises, a hypothetical publicly-traded telecommunications firm with 100,000 outstanding shares. If each share is priced at $13, the company's market capitalization is $1,300,000 (100,000 * $13).

Evaluating Market Value Through Comparable Companies

Assess the suitability of this valuation approach. This method is effective for privately-held companies or when market capitalization seems impractical for any reason. To gauge a company's value, examine sales prices of similar businesses.

- Market capitalization may seem impractical if a company's value primarily lies in intangible assets and if investor speculation inflates the price unreasonably.

- This method has limitations. It may be challenging to find adequate data, as sales of comparable businesses might be infrequent. Moreover, it fails to address significant disparities in business sales, such as whether the company was sold under pressure.

- Nevertheless, when determining the market value of a private company, options are limited, and comparison offers a straightforward means to obtain a rough estimate.

Select Comparable Companies. Choosing comparable businesses involves some discretion. Ideally, these companies should operate in the same industry, be of similar size, and demonstrate comparable sales and profits to the company being valued. Recent sales data from these comparable companies ensures relevance to current market conditions.

- For valuing private companies, publicly-traded companies in the same industry and size can serve as comparisons. Their market value can be easily determined using the market capitalization method available online.

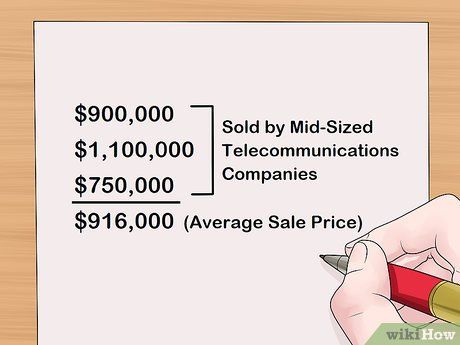

Calculate an Average Sale Price. After identifying recent sales of comparable businesses or valuations of similar publicly-traded companies, compute the average of these sale prices. This average serves as an initial estimate of the market value of the company under evaluation.

- For instance, if three mid-sized telecommunications companies recently sold for $900,000, $1,100,000, and $750,000, averaging these prices yields $916,000. This suggests that a market capitalization of $1,300,000 for Anderson Enterprises might be overly optimistic.

- You may adjust the weights of different values based on their similarity to the target company. A company closely resembling the one being valued may receive a higher weight in the calculation of the average sale price. For detailed information, refer to how to calculate weighted average.

Assessing Market Value Using Multipliers

Determine the Suitability of this Method. The multiplier method is most suitable for valuing small businesses. It involves multiplying an income figure, such as gross sales or net profit, by an appropriate coefficient to estimate the business's value. However, this method provides only a rough, preliminary valuation, overlooking several factors crucial in determining a company's actual worth.

Gather Essential Financial Data. Typically, valuing a company via the multiplier method requires information on annual sales or revenues. Understanding the company's total asset value, including current inventory and other holdings, along with profit margins, aids in valuation. While such data is readily available for publicly-traded companies in their financial statements, access to similar information for private companies requires permission.

- Income statements of companies report sales or revenues, commissions, and inventory expenses, if applicable.

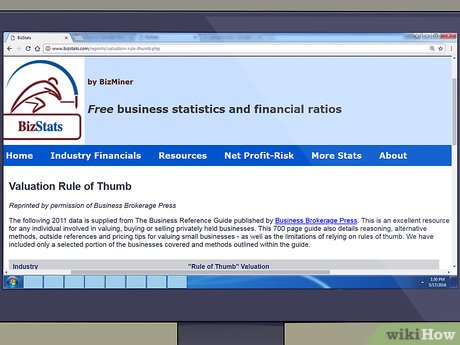

Determine the Suitable Coefficient. The coefficient selection depends on industry norms, prevailing market conditions, and specific business considerations. While somewhat arbitrary, you can obtain a reliable coefficient from your trade association or a professional business appraiser. BizStat's valuation 'rules of thumb' offer useful examples.

- The coefficient source also specifies the relevant financial metrics for your calculation. Typically, total annual earnings (net income) serve as the starting point.

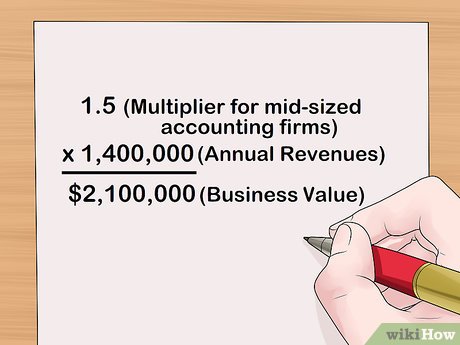

Compute the Value Using the Coefficient. Once you've identified the required financial data and the appropriate coefficient, simply multiply them to obtain an approximate value for the company. Remember, this method provides only a rough estimate of the market value.

- For instance, if the suggested multiplier for mid-sized accounting firms is 1.5 times annual revenues, and Anderson Enterprises' annual revenues amount to $1,400,000, then applying the multiplier yields a business value of (1.5 * 1,400,000) or $2,100,000.

Insights

-

The purpose of your assessment should influence the importance you attribute to the company's market value. If you're contemplating an investment, focus on calculating the company's CAGR (Compounded Annual Growth Rate) rather than its absolute value or size.

-

A company's market value can significantly diverge from other indicators of its worth, such as book value (the net asset value of physical assets minus liabilities) and enterprise value (a metric considering debt), due to variations in debt obligations and other factors.