Outwit skimmers with our straightforward advice. Skimmers—disguised as ordinary ATM components like card readers and cameras—slyly harvest your data. Their convincing appearance often masks their presence. Secure your financial info by inspecting ATMs for any tampering signs before usage. Conduct both a visual and physical assessment for any anomalies. Absolute skimmer detection is challenging, but adopting prudent ATM use practices can minimize your exposure.

Key Points to Remember

A skimmer is a deceptive device mimicking an ATM’s card reader and camera to capture your card details. Wiggle the card insertion slot to check for looseness, and observe for adhesive residue indicators of a skimmer. A counterfeit keypad might feel different, with buttons being overly soft or not aligned properly, hinting at a scam.

Actionable Steps

Spotting a Skimmer: Key Indicators

Inspect the card insertion slot for tampering clues. A secure card reader is integral to the machine, so anything amiss could indicate skimming attempts. Signs of tampering include:

- Visible adhesive residues around the slot.

- Tape protruding beneath the slot.

- A misaligned or loosely attached reader.

- Odd pieces of plastic or devices jutting out from the slot.

Survey for concealed cameras. Tiny cameras may be strategically placed to capture your PIN. Look for them above the keypad, on the screen, or camouflaged within nearby items. Indicators include:

- A small hole on the ATM might conceal a camera.

- Objects like books or cups near the ATM could be hiding cameras.

- Bank-installed cameras are usually conspicuous with signage, unlike the discreet or hidden skimmer cameras.

Verify any unusual additions atop the ATM. Anomalous bars, especially rectangular and attached to the ATM, might house skimming tools. Look out for:

- A pinhole in these additions likely hides a camera.

- Be cautious of anything obscuring the ATM's lighting, such as bars attached to lights.

- If doubtful about an attachment, gently testing its stability might reveal its true nature as a skimming device.

Analyze the keypad for any irregularities. Skimmers might overlay the original keypad with a counterfeit to record your PIN. Signs of a fake keypad include:

- Unusually large or thick keys.

- A keypad that seems elevated or not flush with the ATM surface.

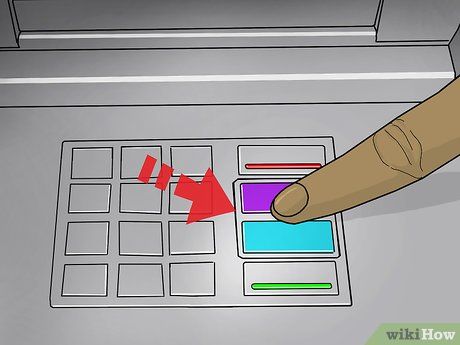

Inspect graphics for obstructions. Misaligned or obscured graphics may indicate a counterfeit casing. Legitimate ATMs display clear, unobstructed graphics and shapes.

- Examine the area beneath the card reader for unobstructed graphics, particularly arrows.

- Partially covered or truncated instructions next to the card reader may suggest the presence of a plastic skimmer overlay.

Stay vigilant for abnormalities. Regular users of an ATM should remain alert to any unusual alterations. Trust your instincts and switch ATMs if anything seems awry, such as:

- Uncommon colors, especially on the card reader.

- Abnormally protruding card readers.

- Cracks near various ATM components.

- Missing indicator lights.

ATM Functionality Assessment

Test the card scanner's stability. Any movement or instability in the card reader suggests a skimmer attachment. Genuine ATMs are securely constructed and should not exhibit any movement.

- Apply pressure to the card scanner to detect any movement, indicative of a skimmer attachment using tape, glue, or similar methods.

Assess the keypad's responsiveness. Press random keys to gauge responsiveness. Stickiness, sponginess, or rigidity may signal a counterfeit keypad.

- Press down on the keypad to assess its tactile feedback, as a legitimate keypad should feel firm and responsive.

Utilize Skimmer Scanner app on your smartphone for skimmer detection. This application employs Bluetooth technology to identify if the ATM is transmitting data to another device. You can obtain the app for Android devices free of charge from the app store.

Discontinue ATM usage if card insertion becomes problematic. Legitimate ATMs should promptly accept your card. If the process is slow or the card insertion is difficult, cease operation and notify the bank or establishment immediately.

Shielding Against Skimmers

Opt for ATMs located in bustling, well-populated areas. Criminals tend to install skimmers in secluded spots to evade detection. While no ATM is entirely immune, selecting machines situated indoors or in high-traffic areas reduces the risk.

- For indoor ATMs, prioritize those within clear view of staff rather than secluded or obstructed locations.

- When using outdoor ATMs, ensure they are positioned near building entrances or facing busy thoroughfares.

Conceal your PIN entry with one hand. This precautionary measure prevents cameras from capturing your PIN after card insertion. However, be aware that it offers no protection against counterfeit keypads.

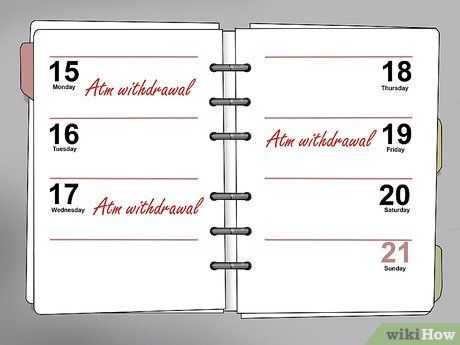

Visit the ATM during weekdays. Skimmers are commonly installed over weekends when banks are closed. Weekdays typically have lower risks of encountering skimmers.

Regularly monitor your bank account multiple times per week. Promptly reporting suspicious transactions allows your bank to reimburse any unauthorized charges. Check your account 2-4 times weekly to ensure security.

- For added reassurance, enroll in your bank's fraud alert service. Typically, your bank sends text notifications for suspicious activities.

Opt for a different ATM if uncertain. Identifying a skimmer is challenging, so if you're unsure, choose another ATM. Always trust your instincts.