Propelling the company to the edge with an audacious 'all-in' on Bitcoin, this tycoon had to relinquish the CEO position to a Vietnamese-origin engineer.

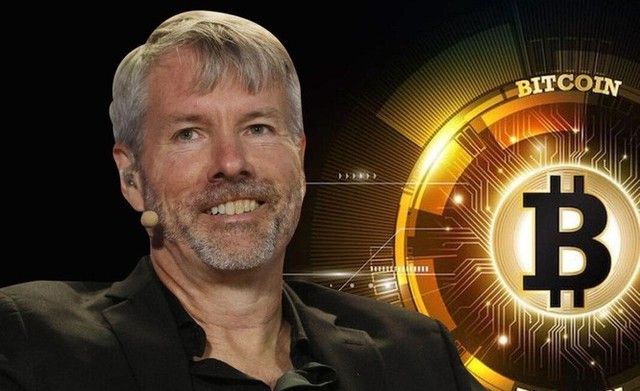

If anyone asked billionaire Michael Saylor why he gambled his company's future on bitcoin, he would tell you that there was simply no other choice.

In 2020, MicroStrategy Inc's stocks were nearly forgotten. This tech company struggled to compete with other software giants. 'We would either die quickly, fade away slowly, or pursue a risky strategy,' said Saylor.

Saylor chose to buy bitcoin – a lot of it. Ultimately, that decision backfired in the most disastrous way. In early August, MicroStrategy announced that Saylor would be ousted from his position as CEO of the company - a position the billionaire had held since 1989 - due to losses incurred from bitcoin.

Michael Saylor's bold bet on bitcoin began on August 11, 2020, when his company announced plans to convert $250 million – half of MicroStrategy's cash reserves - into bitcoin. They then continued to invest more money, and bet even more.

In total, MicroStrategy has raised $2.4 billion in debt financing. Additionally, they managed to raise another $1 billion through stock issuance. MicroStrategy used all of this money to buy bitcoin.

At times, this decision seemed justified. The price of bitcoin soared from $11,900 in August 2020 to nearly $69,000 in November 2021. MicroStrategy's stock price, which was $124 the day before, surged to a record high of $1,273 on February 9, 2021.

But on August 2, MicroStrategy announced its seventh consecutive quarterly loss within 8 quarters since starting to buy bitcoin. This time, the loss was significant: $1 billion, mostly attributed to bitcoin.

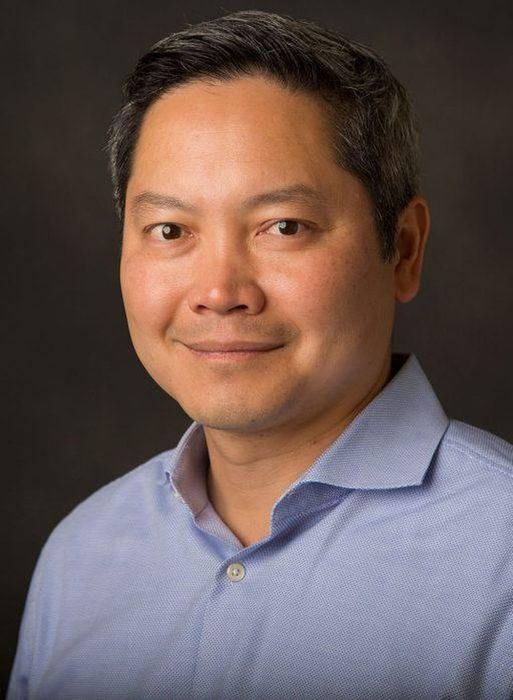

Also on that day, Phong Le - a Vietnamese-American engineer who joined MicroStrategy in August 2015 - took over the CEO position at MicroStrategy left by Saylor.

MicroStrategy is believed to be holding nearly 130,000 bitcoins, with a market value of around $3 billion. Meanwhile, the company's market capitalization is at $3.1 billion.

MicroStrategy's losses clearly reflect the volatility of bitcoin.

According to current audit regulations, the company needs to reassess the value of the bitcoins they hold each quarter and must expense any decrease in bitcoin price.

MicoStrategy has incurred such fees multiple times, totaling $2 billion.

By betting on bitcoin, billionaire Michael Saylor has also become one of the staunchest supporters of this digital currency.

His 'tweets' on Twitter, with about 2.6 million followers, are always filled with sarcastic remarks supporting bitcoin.

He also often appears overly optimistic in interviews. Once, Michael Saylor advised everyone to 'take all your money to buy bitcoin. Then spend all your time figuring out how to borrow more money to buy more bitcoin. Then spend all your time figuring out what you can sell to buy more bitcoin.'

Similarly, at a conference filled with cryptocurrency enthusiasts held in Miami, he advised people never to sell bitcoin.

This philosophy has caused some market observers to worry.

“MicroStrategy is not an ideal investment for most traders,” said Edward Moya, an analyst at Oanda exchange.

According to Moya, MicroStrategy's strategy is to buy and hold bitcoin, not to trade for profit when there is a profit and also to have no defense mechanisms for volatility or downturns of this cryptocurrency. Therefore, when a bitcoin sell-off occurs, MicroStrategy will bear all the negative impacts.

Another issue is that the company does not have many ways to earn additional money to buy more bitcoin, said Mark Palmer, an analyst at BTIG. “MicroStrategy is now only using money from software business operations, nothing else,” he said.

However, Palmer said that it is premature to evaluate MicroStrategy's bitcoin gamble until some of their bitcoin purchase debts come due. If the price of bitcoin declines, the company will face difficulties in paying off their creditors, he said.

“Time is ticking and MicroStrategy's debts are nearing maturity,” he said.

Despite numerous risks and criticisms, Saylor remains confident in his strategy, and in bitcoin. In an interview earlier this month, he emphasized that the stock price is still above pre-bitcoin purchase levels, and believes that his strategy will position the company well, despite the associated risks.

“Now I feel better about it than when we started,” he said.

Saylor stated that he will continue to lead MicroStrategy's investments in bitcoin. He has no plans to sell any bitcoins, and still expects them to regain value in the coming years. The company also reiterated that they have no intention of selling bitcoins.

Saylor said that the CEO role swap is just a long-term plan. “The company's new operating structure means I can focus more on my strategy, and continue to pursue bitcoin,” he said.

Who is the new CEO of MicroStrategy?

Mr. Phong Le holds a bachelor's degree in biomedical engineering from Johns Hopkins University and a master's degree in business administration from the Sloan School of Management at the Massachusetts Institute of Technology (MIT).

From 1998 to 2010, Mr. Le worked at Deloitte. Since March 2010, he has been working at NII Holdings - a telecommunications company listed on Nasdaq, holding various senior positions including Vice President of Financial Planning and Analysis, and Vice President of Strategy and Business Operations.

In August 2014, he joined XO Communications and served as CFO until August 2015.

MicroStrategy could be considered the technology enterprise that Mr. Phong Le has been most closely associated with in his career.

He joined MicroStrategy in August 2015 and held various senior positions at the company, such as Chief Operating Officer and Chief Financial Officer. In August 2022, Mr. Le was elected to the Board of Directors of MicroStrategy.