ATMs, also known as Automated Teller Machines, offer individuals a convenient means of managing banking transactions 24 hours a day. Basic machines allow users to withdraw funds from their accounts, while more advanced ones provide additional features such as depositing funds, transferring funds between accounts, checking balance statements, and facilitating credit card payments. However, the widespread use of ATMs has led to an increase in ATM-related crimes. Understanding how to safely use an ATM is essential for ensuring personal safety during each transaction.

Procedures

Ensuring Your Safety

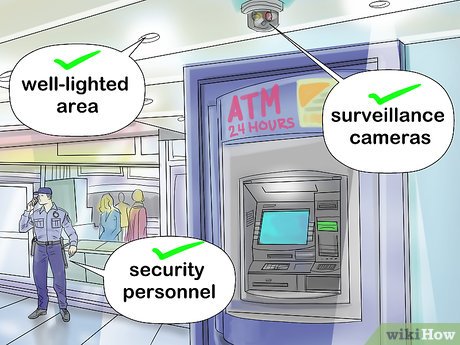

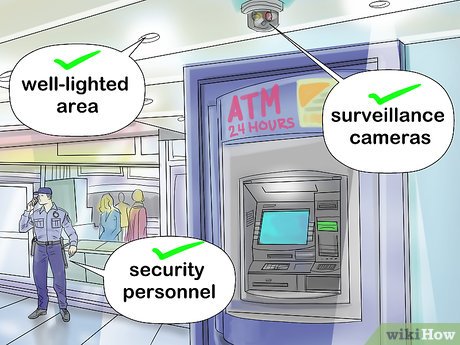

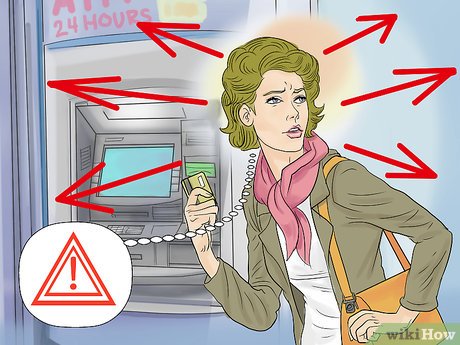

Choose ATMs that are well-monitored and well-lit. Use ATMs located in well-lit areas or those monitored by surveillance cameras or security personnel. This applies to both indoor and drive-up ATMs. Whenever possible, conduct transactions during daylight hours.

- Drive-up ATMs generally offer greater safety compared to walk-up ATMs due to the privacy and security provided by your vehicle and locked doors.

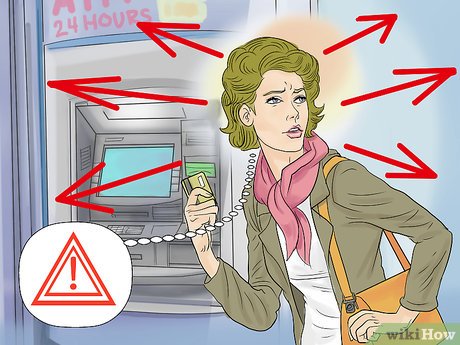

Stay vigilant of your surroundings. Prior to using your card, be observant and scan the area for anyone who may seem suspicious. If you sense any unease, avoid using that specific ATM and seek out a safer alternative.

- When using a drive-up ATM, keep your engine running, ensure your car doors are locked, and keep all windows rolled up (except for the one you're using).

- At a walk-up ATM, always lock your car doors and take your keys with you. Never leave your vehicle running unattended.

- Some ATMs require you to use your card to access the ATM area. Refrain from allowing anyone to enter behind you, and ensure the door is fully closed after entering the vestibule.

Minimize your time spent at the ATM. Prepare all transactions before reaching the ATM. Have your card ready to avoid fumbling with your purse or wallet. Additionally, if you're depositing funds, ensure all checks are endorsed and the envelope is sealed if using one.

Keep your PIN secure. Never disclose your PIN to bank personnel, strangers, or anyone not affiliated with the account. When entering your PIN, use your free hand to shield the keypad. While some ATMs are equipped with privacy screens, it's always best to err on the side of caution.

Securely manage your funds promptly. After withdrawing cash from an ATM, securely store your card, money, and receipt in a safe location such as your wallet or purse before leaving the ATM area. Count your cash discreetly to ensure accuracy and promptly secure it.

Avoiding Fraudulent Schemes

Opt for bank ATMs over non-bank locations. Bank ATMs typically have enhanced surveillance, making them less susceptible to tampering by criminals. Non-bank ATMs, found in places like grocery stores, shopping malls, or convenience stores, are easier targets for criminals to manipulate.

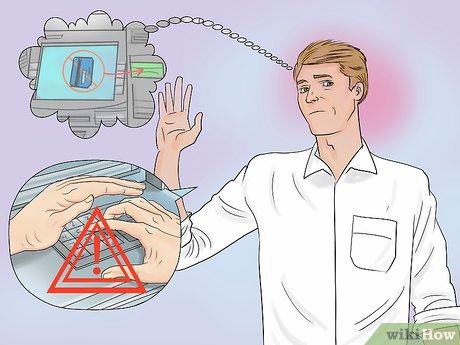

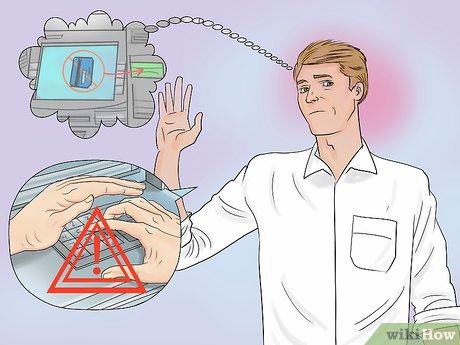

Avoid re-entering your PIN if the ATM retains your card. Criminals may insert a blocking device into the card slot, causing your card to become stuck. If you re-enter your PIN, criminals gain access to both your trapped card and your PIN. Upon your departure, criminals remove the blocking device to make unauthorized withdrawals from your account.

- Criminals may also masquerade as helpful individuals, suggesting you re-enter your PIN or offering to hold down the cancel button while you do so. In reality, they're attempting to memorize your PIN number.

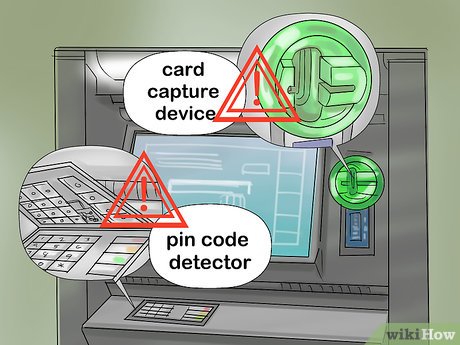

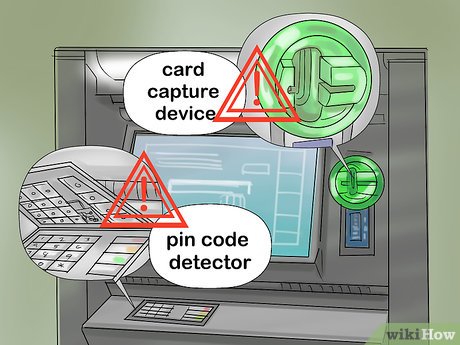

Be vigilant for card skimmers. Card skimmers are devices attached to ATMs to illicitly capture personal information, including your account number, PIN, and account balance. They're often affixed to the machine's side or directly over the card entry slot, resembling legitimate card slots or scanners. Watch out for duplicate card slots or suspicious labels like 'card cleaner' or 'slide card here first.'

Stay alert to cash trapping scams. Criminals employ thin sleeves or other devices to trap your cash when it's dispensed from the ATM. Although your transaction appears normal, you won't receive your cash. After you leave (either to inform the bank or out of frustration), the thieves retrieve the device and abscond with your money. If you have a companion nearby, ask for assistance. Otherwise, leave the area and promptly contact your financial institution.

- Avoid using your cell phone while at the ATM, as it may distract you and put you at greater risk.

Tips for ATM Usage

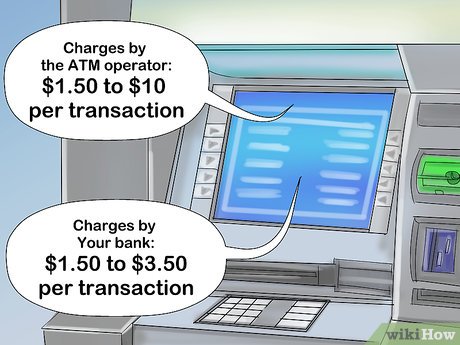

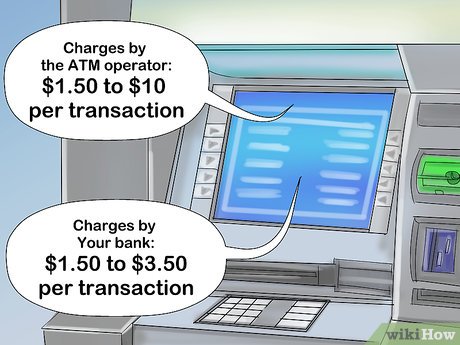

Opt for your ATM wisely. You can utilize your debit or credit card at any ATM owned by your bank without incurring charges. While your bank card may work at ATMs operated by other financial institutions, there are often associated fees. Both the ATM operator and your bank may impose fees. Try to select an ATM operated by your bank to avoid these fees.

- ATM operator fees can vary from $1.50 to $10 per transaction in certain areas.

- Bank charges typically range from $1.50 to $3.50 per transaction.

Insert your card correctly. The insertion slot is usually labeled and illuminated. Look for visual instructions on the ATM showing the correct way to insert your card. Incorrect insertion may result in the machine being unable to read your card.

- Some machines require you to insert and remove the card for it to be read. Others will pull the card into the ATM and not return it until your transaction is complete.

Select your preferred language. The machine will prompt you to choose a language based on its location. Press the button corresponding to your desired language. Sometimes the machine will remember your choice for future use, so you won't need to repeat this step.

Enter your PIN or Personal Identification Number. Your ATM PIN is a 4-digit code used to verify your identity and authorize transactions. You must set this up before using your bank card at an ATM. If you know your 4-digit PIN, enter it using the numeric keypad, and then press “enter”.

- Press the “clear” button if you make a mistake while entering your PIN.

- Always ensure your PIN entry is covered to prevent others from accessing your account.

- Make sure you enter the correct PIN for your card to avoid being locked out of your account due to multiple incorrect attempts.

Choose your account type. The ATM will prompt you to select the bank account for your transactions. Choose the desired account; for example, if you have both a checking and savings account, select the appropriate one.

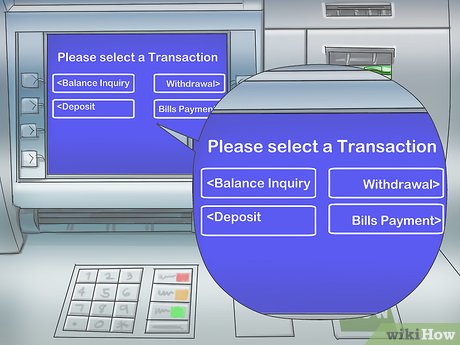

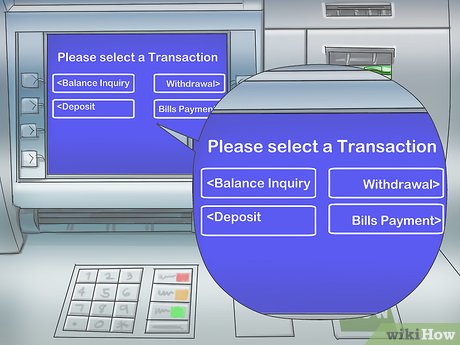

Choose a transaction type. Transaction options vary across ATMs, but commonly include withdrawals, deposits, and balance inquiries.

- A withdrawal entails selecting a specific amount to be deducted from your chosen account and dispensed by the ATM.

- Deposits involve adding cash and/or checks to credit into your selected account.

- Balance inquiries allow you to check the current available balance in your chosen account.

Input the withdrawal or deposit amount. Use the keypad to enter the numerical value of the funds being withdrawn or deposited into the ATM, then press “enter”. Ensure the requested amount does not exceed your available balance when withdrawing.

- Most ATMs only accept funds in multiples of $10 or $20. Except for fund transfers or bill payments, avoid entering amounts involving coins or less than $20.

- For deposits, some ATMs require envelopes. Follow on-screen instructions carefully to insert cash and checks properly.

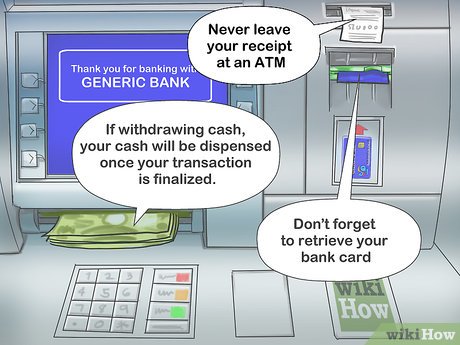

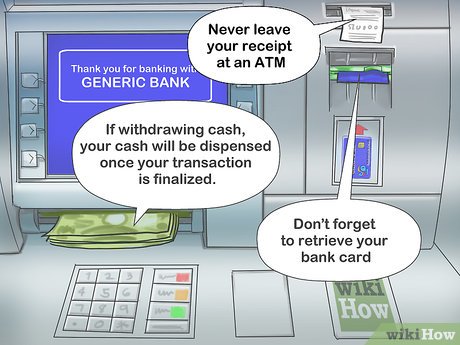

Retrieve your cash, receipt, and card. Upon finalizing your transaction, cash will be dispensed if withdrawing. Count your money discreetly to verify the correct amount. If prompted for additional transactions, select “no” (unless necessary). Opt for a receipt when prompted, and ensure you take your receipt and bank card to complete the transaction.

- Do not forget to take your bank card. This is crucial for safeguarding your account.

- Always take your receipt with you to prevent unauthorized use of your card.

Additional Tips

-

Always request a receipt for your transactions to cross-reference with your monthly statements and guard against unauthorized transactions.

-

Trust your instincts and prioritize safety. If something feels off, leave the ATM.

-

If you notice anything suspicious, cancel your transaction immediately and contact your financial institution to ensure the transaction was voided.

Important Notes

Keep your PIN confidential. Do not share it with anyone, including family, friends, or bank representatives, and never disclose it over the phone.

If you suspect your card or account has been compromised, notify your bank immediately to have your card deactivated and replaced.

Regularly update your PIN for added security.

Essentials

-

A companion, especially when using an ATM at night

-

An ATM or Debit card

-

An ATM machine

-

A memorized PIN

-

A secure location for your ATM or Debit card