The article below provides a detailed guide on the syntax and usage of the SLN function in Excel.

Description: Returns the depreciation value of an asset using the straight-line method over a specified period.

Syntax: SLN(cost, salvage, life).

Here are the parameters:

- cost: Initial cost of the asset, this parameter is mandatory.

- salvage: Value after depreciation, also known as salvage value, this parameter is mandatory.

- life: Number of periods of asset depreciation, also known as useful life of the asset, this parameter is mandatory.

Note:

- The SLN function is calculated using the formula:

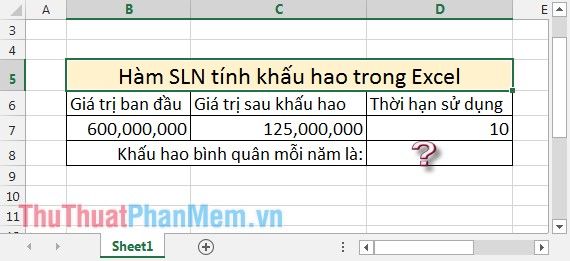

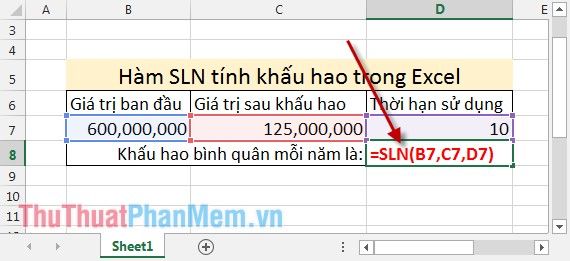

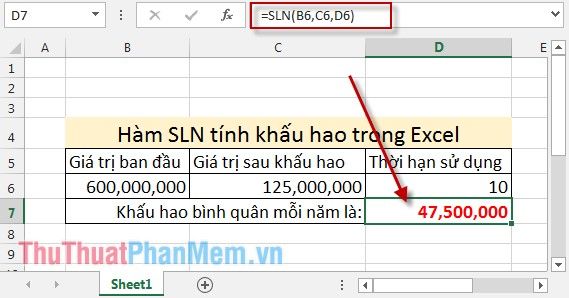

Example: Calculate the average annual depreciation for an asset with an initial value of 600,000,000, salvage value of 125,000,000, and a useful life of 10 years.

In the cell where you want to calculate, enter the formula: =SLN(B7,C7,D7).

Press Enter -> the average depreciation per year of the asset over 10 years is:

Above is the detailed guide on how to use and specific examples of the SLN function. Hope it helps you in cases where depreciation needs to be calculated.

Wishing you success!