Not everyone desires to labor until they reach the traditional retirement age of 65. The prospect of retiring young often appears unattainable to many. Yet, achieving early retirement is within grasp. Through diligence, discipline, and perseverance, you can transform your aspiration of retiring early into reality. Embrace this roadmap, and you'll soon relish life's simpler pleasures.

Key Steps

Essential Guidelines: Making Informed Choices

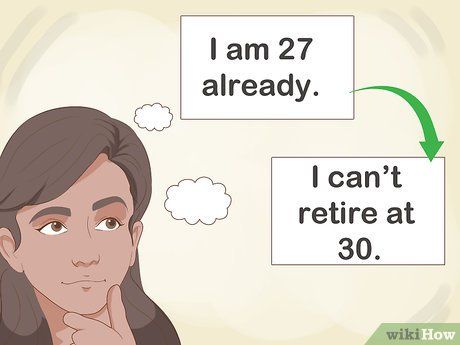

Define the concept of 'young' precisely. 'Young' could mean 40, 50, or even one's 30s. However, it's crucial to be realistic. If you're already 27 with minimal assets, retiring at 30 would be exceedingly challenging. Hence, the initial step involves determining the age at which you aim to cease working.

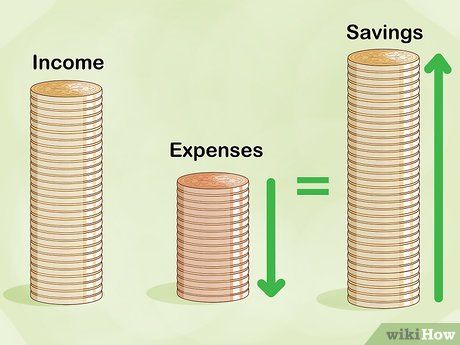

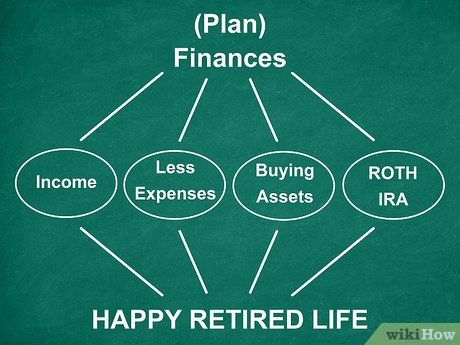

Master Financial Management

Invest in Higher Education

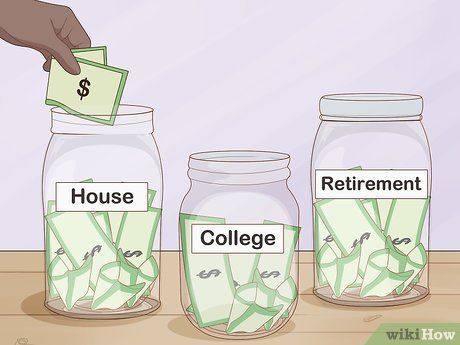

Start Saving Early and Regularly

Cut Down on Expenses

Digging into the Details: Amassing a Fortune

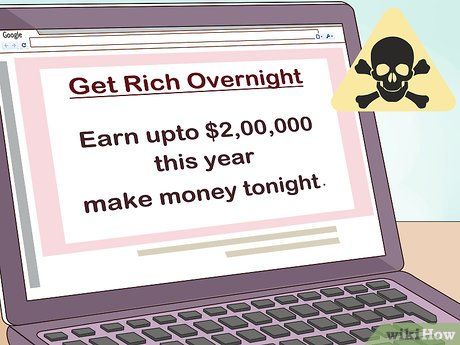

Beware of Get-Rich-Quick Schemes

Consider a Roth IRA for Tax-Free Savings

Explore Certificate of Deposit (CD) Investments

Invest in Assets that Appreciate in Value

Optimize Efficiency: Consider Outsourcing

Establish a Passive Income Stream

Steer Clear of Debilitating Debt

Seek Guidance from Financial Experts

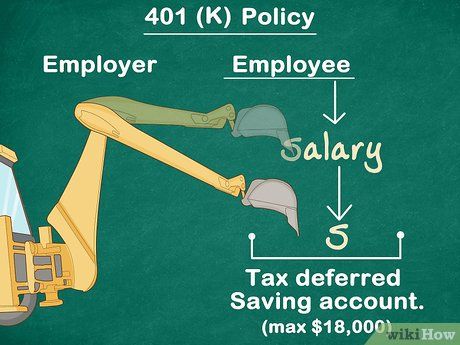

Utilize Employer's 401(k) Program

Time-Based Financial Planning

Valuable Insights

Remember Your Sacrifices

Important Cautions

Diversify Your Investments