If you’re reading this, you’re already way ahead of the game. Most people your age aren’t even thinking about their future yet. While they’re out there spending money and living for the moment, you’re laying the groundwork for a secure future! Your twenties are the ideal time to start because you have more flexibility to develop good habits, take calculated risks, and let compound interest work its magic. With careful budgeting, saving, and investing, there’s no reason you can’t retire with a hefty nest egg!

Steps

Pursue your career goals starting now.

If there are ways to enhance your future earning potential, go for them. Don’t delay college, grad school, or that certification course you’ve been eyeing for that future promotion. It’s tough to save for retirement if you’re not making enough money, so invest in your earning potential today for a comfortable retirement tomorrow.

- Start networking early and often. You never know how a connection might pay off down the road, whether it's landing a big client or discovering a new job opportunity.

- Acquire new skills that could lead to a raise or promotion in your field. For instance, if you’re a graphic designer, learning coding could make you a versatile website developer!

- If you’re not in your dream field, it’s time to start job hunting and updating your resume. Don’t waste time in a dead-end job.

- If you’re already in your desired field, discuss with your boss the steps needed to earn a promotion.

Diversify your income streams.

Make the most of your free time by earning some extra cash through a side hustle. Whether it’s driving for a ride-sharing service or delivering pizzas during the evenings, find ways to boost your income. If you have a hobby or passion that can generate income, pursue it. Selling handmade or thrifted items on Etsy or eBay can provide a simple way to earn extra money.

- Alternatively, if you aspire to start your own business, use your spare time now to lay the groundwork.

Eliminate high-interest or unsecured debts as soon as possible.

Prioritize paying off any burdensome debts before focusing on retirement planning. While some debts, like student loans and mortgages, serve a purpose, high-interest and unsecured debts can quickly spiral out of control. Aim to clear debts with interest rates exceeding 5% promptly to prevent them from becoming overwhelming.

- Unsecured debts, such as personal loans and credit card balances, are particularly problematic as they accrue interest rapidly. Try to minimize these balances as much as possible.

- Although interest rates can vary, a rate above 4% is generally considered high in today’s market.

Avoid accumulating credit card debt if you're unable to pay off the balances.

Avoid falling into the trap of credit card debt. Credit cards often come with high interest rates, so only use them if you can pay off the full balance monthly. Responsible usage can offer perks like travel rewards and improved credit scores, but discipline is key.

- Minimum payments are deceptive and inefficient. Clearing even small debts can take years if you only pay the minimum amount.

Cultivate the habit of saving from an early age.

Developing a saving habit is crucial, especially in your 20s. While saving may seem challenging initially, starting early makes it easier. Commit to saving a percentage of each paycheck, gradually turning it into a routine.

- Automate transfers to allocate a portion of your earnings into savings regularly.

- Aim to save at least 15% annually for retirement. Even if you start with 5-10%, any amount saved is beneficial in the long run.

Maintain financial discipline through budgeting.

Create and adhere to a budget, barring emergencies. Utilize spreadsheets or budgeting apps to monitor income and expenses monthly, ensuring you avoid debt, preserve savings, and spend wisely.

- Resist dipping into savings except for genuine emergencies to maintain financial stability.

- Apps like Mint, YNAB, and Goodbudget can help track spending patterns and warn against overspending.

- Regularly assess spending habits to adjust budget expectations and behavior for better financial management.

Embrace a lifestyle well below your financial means.

Consider the necessity of expenses before indulging in them. As you embark on your career journey, the allure of newfound financial freedom may tempt you to overspend. However, refraining from extravagant purchases early on allows for greater financial flexibility and growth opportunities in the future!

- Avoid storing credit card details on online platforms to prompt careful consideration before each purchase.

- Opt for alternative modes of transportation like biking or public transit to minimize expenses associated with vehicle ownership.

- Limit dining out and prioritize home-cooked meals for both cost-effectiveness and health benefits.

Initiate investment endeavors post-debt repayment and sufficient savings accumulation.

Commence market investments upon accumulating 3-9 months' worth of living expenses. Early investment facilitates the leverage of compounding interest for accelerated growth. Reinvest dividends and earnings to perpetuate exponential financial expansion! Establish brokerage accounts (e.g., 401(k), IRA, taxable) to allocate funds for investment, considering that savings accounts yield minimal interest rates insufficient to combat inflation.

- With an average annual inflation rate of approximately 2%, the purchasing power of savings diminishes over time.

- Contrary to savings accounts offering meager returns (0.3-0.5% as of 2021), investment in the US stock market yields an average annual return of approximately 10%.

- Investment decisions should align with individual circumstances, but index mutual funds such as the S&P500 are generally advisable.

Maximize contributions to your 401(k) plan if available.

Utilize the 401(k) as a primary retirement investment tool. Ensure your workplace offers a 401(k) plan, and arrange with HR to automatically allocate a portion of your earnings to your 401(k) up to the company’s matching percentage. This way, your contributions are matched by your employer, effectively providing you with additional funds for retirement!

- If self-employed or starting a small business, explore options for a self-directed 401(k) with your brokerage or bank.

- In the absence of a 401(k) at your job, alternative retirement saving avenues are available.

- While exceeding your company’s match is possible, it's not always recommended since you forfeit the benefits of matched contributions and lose control over investment decisions.

Evaluate between a ROTH and traditional IRA.

Following a 401(k), prioritize opening an IRA for retirement planning. IRA, or Individual Retirement Account, options offer tax advantages crucial for comfortable retirement. Choose between a ROTH and traditional IRA based on your current financial circumstances, as both present viable options with distinct tax implications.

- While a traditional IRA is accessible to everyone, eligibility for a ROTH is limited to individuals earning below $120,000-135,000 annually.

- A ROTH may be preferable for individuals with lower incomes, offering penalty-free withdrawals under specific conditions.

- Consider future tax implications when deciding between a ROTH and traditional IRA.

- Both IRA options offer valuable benefits, ensuring a secure retirement regardless of your choice.

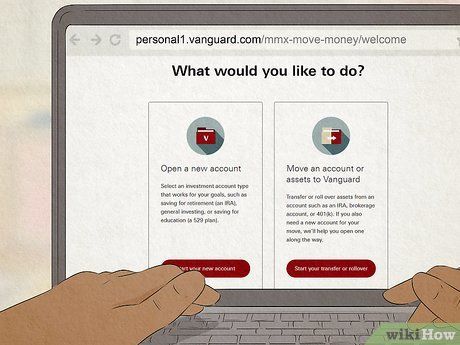

Inaugurate an IRA and maximize annual contributions.

Contribute the maximum allowable amount to your IRA annually. Select a reputable brokerage firm (e.g., Schwab, Fidelity, Vanguard) to open your IRA and commit to maxing out contributions each year. Despite the $6,000 yearly limit as of 2021, the tax advantages justify this investment strategy. Upon funding your account, proceed to allocate your investments wisely!

- Highlighting the significance of IRAs, consider investing in the S&P 500, historically yielding approximately 10% annually. Consistent maximum contributions from age 20 to 65 could result in retirement savings ranging from 3.5 to 4 million dollars, showcasing the power of compounding interest!

Invest any surplus funds in a taxable brokerage account.

After maximizing contributions to your IRA and 401(k), allocate remaining funds to a taxable brokerage account. While subject to taxes, capital gains taxes are only incurred upon sale, making long-term investments preferable despite taxation. Avoid active trading, as the majority of traders experience losses rather than gains!

- Exercise caution against engaging in active trading with surplus funds, as the vast majority of traders end up losing money!

Emphasize growth-oriented funds, ETFs, and stocks.

Given your age, prioritize investments with significant growth potential. Focus on 'growth' stocks and funds, which offer higher potential returns compared to 'value' investments. ETFs, comprising diversified portfolios of stocks, are ideal for risk-averse investors seeking market exposure.

- ETFs provide diversification and are suitable for investors seeking exposure to a broad market index, such as the US market.

- Delay investments in bonds, as their lower returns are outweighed by the long-term growth potential of stocks.

- Maintain a long-term perspective, disregarding short-term fluctuations in your portfolio.

Adopt a 'set it and forget it' approach.

Avoid obsessing over your investments; focus on consistent contributions instead. Rather than constantly adjusting your investments, maintain regular contributions and allow your portfolio to grow over time. Patience is key, as significant growth takes decades, so set it and forget it!

- During market downturns, continue regular contributions and practice dollar-cost averaging to mitigate risk.

Allocate a small portion of your portfolio to calculated risks.

Consider taking calculated risks while you're young. Investing in high-risk assets early allows time to recover from losses. However, limit such investments to no more than 5% of your total portfolio to manage risk effectively.

- Remember the adage, “Never invest more than you can afford to lose,” and conduct thorough research before investing in volatile assets.

Explore the FIRE movement for early retirement.

Explore financial independence and early retirement (FIRE) if you aim to retire early. FIRE advocates extreme frugality and aggressive saving and investing to retire well before traditional retirement age. While demanding, it can lead to early retirement if executed diligently.

- Strive to save 70% of your income annually, embracing frugal living and aggressive investing strategies.

- Adopt a minimalist lifestyle, cutting unnecessary expenses and focusing on free or low-cost hobbies.

- Invest a significant portion of your income in high-growth stocks, gradually transitioning to dividend-paying investments as you approach retirement age.

- FIRE requires significant sacrifice but offers the potential for early retirement for those willing to commit.

Pointers

-

Diversification is crucial for a stable portfolio, but focus more on stocks and ETFs in your 20s to capitalize on long-term growth potential. Bonds and fixed income can wait until your 30s when you need more stability.

-

If you opt for less volatile investments, limit them to less than 5-10% of your portfolio. Embrace market volatility and time to maximize market growth.

-

Delay detailed retirement planning until later years. Goals are essential, but plans are likely to evolve as you progress through your 20s. Flexibility is key.