If you possess a commendable credit history and exhibit responsible financial management, you might contemplate imparting your knowledge as a credit repair specialist. Though no stringent prerequisites govern this career path, obtaining relevant certifications can enhance your credibility with prospective clients. Once equipped with the requisite knowledge and training, you can seek employment with established agencies or embark on an independent journey as a credit repair specialist.

Procedures

Education and Accreditation

Select an Appropriate Field of Study. While no specific educational mandates exist for credit repair specialists, many professionals in the field hold at least a bachelor's degree in a finance-related field.

- If you're currently pursuing your education or contemplating a return to academia, prioritize coursework in personal finance and the consumer credit sector. Enroll in classes covering topics such as bankruptcy, taxation, and other legal aspects that may impact clients with poor credit.

- Acquire proficiency in effective negotiation tactics on behalf of your clients, coupled with clear and articulate written communication skills.

Consider Pursuing Additional Credentials. If you're inclined towards furthering your education, obtaining a certification as a certified public accountant (CPA) or pursuing a law degree can significantly propel your career forward. These credentials also broaden the spectrum of services you can offer to your clientele.

- Evaluate the investment required and weigh its potential benefits. It's often advisable to commence your professional journey after obtaining your bachelor's degree. Should you opt for additional credentials later, explore part-time programs to accommodate your schedule.

Obtain Certification. While certification is typically not mandatory, undergoing a certification program can enhance your credibility and provide specialized knowledge pertinent to the consumer credit domain.

- Given that certification is voluntary, numerous companies offer licensing or certification programs. Research these programs online to identify the most suitable option for you.

- Consider the popularity of certification programs among seasoned credit repair specialists in your vicinity. Opting for a certification with wider recognition can bolster your credibility with potential clients.

- Anticipate dedicating time to exam preparation and budget for certification fees, typically ranging from a few hundred dollars or less.

Leverage Continuing Education. Many certification programs mandate a certain number of annual continuing education hours to maintain licensure. These courses ensure you stay abreast of evolving trends and issues in the realm of personal finance.

- Seek out courses or programs directly relevant to your existing clientele or target demographic.

- Compile a list of common legal and financial challenges faced by your clients, and stay informed on relevant updates in those areas.

Exploring Opportunities with Established Credit Repair Agencies

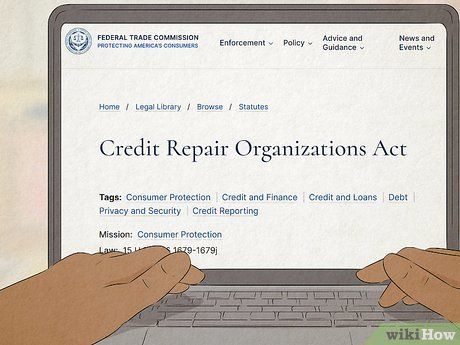

Familiarize Yourself with Applicable Legislation. The credit repair sector is subject to rigorous regulatory oversight. As a credit repair specialist, it's imperative to grasp the legal framework governing your operations, even if you're employed by a third party.

- For instance, in the United States, both federal and state laws govern the credit repair industry, dictating the permissible scope of service promises and advertising practices.

- Exercise caution when encountering credit repair agencies operating outside legal boundaries. Association with such entities could tarnish your professional reputation and potentially entail legal repercussions.

Explore Local Agencies. Legitimate credit counseling or repair agencies are typically government-licensed. Your local government consumer finance department usually maintains a list of authorized agencies in your vicinity.

- Conduct an online search for these agencies and review their websites for potential job openings. Alternatively, you can contact them directly via phone or in-person visit to inquire.

- When reaching out to an agency, maintain a professional demeanor. Clearly state your job-seeking intentions upfront to avoid being mistaken for a potential client.

Scrutinize the Agency's Background. Prior to interviewing with any credit counseling or repair agency, assess their background and reputation as you would if you were a prospective client. Investigate any complaints lodged against the agency and gather feedback from past clients regarding their experiences.

- An agency with a history of complaints or reported incidents to regulatory bodies may raise concerns about its legitimacy.

- Thoroughly examine the agency's website and promotional materials, paying close attention to the commitments and guarantees made to clients. Unreasonable promises often contribute to client dissatisfaction.

Explore Franchise Opportunities. Numerous established credit repair agencies offer franchise options, albeit requiring a higher initial investment compared to independent ventures.

- Franchising presents a middle ground between launching an independent venture and joining an existing agency as an employee. It grants autonomy while leveraging the reputation of an established brand.

- Prior to committing to a franchise, thoroughly research its reputation. Opt for a franchise that enhances your credibility as a credit repair specialist.

Embarking on a Credit Repair Entrepreneurial Journey

Seek Guidance from Seasoned Professionals. Collaborating with an experienced credit repair specialist can provide invaluable insights for launching your business. A local practitioner can offer pertinent knowledge of regulatory frameworks applicable to your operations.

- Conduct a comprehensive background check on the specialist, ensuring their credibility within the industry.

- Especially during the initial stages, consider partnering with a seasoned specialist to gain practical experience.

Determine Your Specialization. The credit repair industry is vast, so carving out a niche can propel your business forward. By targeting specific consumer segments, you can offer tailored solutions that address their unique financial challenges.

- Draw upon personal experiences to identify your niche. For instance, if you've successfully repaired your credit post-divorce, consider focusing on clients undergoing similar circumstances. Your firsthand experience fosters empathy and a deeper understanding of their needs.

Develop a Comprehensive Business Blueprint. While launching a credit repair business often requires minimal initial investment, crafting a formal business plan ensures organizational clarity. Utilize the plan to establish realistic objectives and delineate actionable steps for their achievement.

- Conduct market research as part of your business plan to determine service pricing and offerings. Begin modestly and gradually expand your scope as your business matures.

- Factor in startup expenses and devise strategies for securing necessary funding. Although independent credit repair ventures typically entail minimal initial investment, be prepared for licensing or registration costs.

Familiarize Yourself with Regulatory Requirements. Depending on your location, compliance with local, state, or federal regulations may necessitate licensing or registration. As a credit repair entrepreneur, it's incumbent upon you to obtain any requisite permits.

- In the United States, you can typically ascertain licensing prerequisites by consulting your state attorney general's website.

- Some jurisdictions may mandate home business licensure, particularly if client meetings are conducted on-site.

- Additionally, obtain essential tax identification numbers for accurate income reporting to governmental bodies.

Secure Mandatory Insurance Coverage or Bonds. Regulatory authorities may stipulate liability or business insurance to safeguard both your interests and those of your clients against potential errors impacting credit profiles.

- Even if not legally mandated, investing in liability insurance is prudent. Premiums are typically reasonable, offering financial protection in the event of litigation.

- Consider structuring your business as an LLC to mitigate personal liability risks and maintain separation between business and personal finances.

Cultivate Relationships with Credit Reporting Agencies. As a credit repair professional, frequent interaction with credit bureaus is inevitable. Establishing ongoing rapport with bureau representatives can facilitate smoother resolution of client issues.

- Inquire about direct contact options with customer service personnel for client-related inquiries.

- Express gratitude for exceptional assistance through concise thank-you notes or emails, fostering positive professional relationships.

Opt for Business Software and Services Subscriptions. Numerous companies offer apps and subscription-based web services tailored for independent credit repair specialists. Assess these offerings meticulously to select those that truly add value for both you and your clients.

- Many products provide complimentary trial periods. Utilize these trials to determine the most suitable solutions for your business needs. Keep track of trial expiration dates and set reminders, as some automatically transition to subscription billing post-trial.

- Even without specialized credit repair software, investing in basic business accounting software is essential for maintaining financial organization. This facilitates meticulous tracking and claiming of business deductions during tax filings.

Acquire Initial Clientele. Establishing credibility and trust is paramount for launching your credit repair venture. Securing references from satisfied clients demonstrates your competence and reliability in managing personal finances.

- Launching a blog serves as an effective platform to showcase your expertise and attract potential clients. Offering valuable financial insights helps establish credibility. Incorporate promotional messages advertising your services at the conclusion of each blog post.

- Strategically utilize select social media platforms to engage with target demographics. Consistency is key, so focus on maintaining an active presence on one or two platforms rather than spreading yourself thin across multiple channels.

- Explore referral services that facilitate client acquisition. Conduct thorough research to understand fee structures and evaluate the potential return on investment before committing.