Considering investing to increase your income? Contemplating the acquisition of an oil well could be on your radar. However, this venture entails substantial capital and long-term commitment, coupled with inherent risks. Seeking guidance from a licensed financial consultant or broker and conducting thorough due diligence are crucial steps when identifying a company for investment. With diligent research and the right partnerships, you can secure ownership of a lucrative oil well that yields regular royalties or profits.

Procedures

Evaluating Your Alternatives

Consult with a financial advisor or broker. A financial advisor, investment manager, or broker can assess your asset portfolio and assist you in making well-informed decisions regarding your oil well investment.

Engage a specialized broker in oil well transactions. Ensure that brokers are registered with the Securities and Exchange Commission (SEC) and are members of the Financial Industry Regulatory Authority (FINRA). Verify their licensure status at https://brokercheck.finra.org/. Seasoned brokers proficient in oil well acquisitions can source viable offers and guide you through the procurement process.

Explore online platforms for oil well investment opportunities. Websites like https://www.plsx.com/ and https://www.crudefunders.com feature listings of oil well ventures seeking investors. These platforms offer insights into available investments and project offerings.

Tap into personal networks for lucrative investment prospects. Leverage connections within the oil and gas sector to uncover potentially profitable oil well ventures. Ensure that your contacts possess relevant industry experience and a track record of successful investments in oil wells. They can facilitate introductions to reputable brokers for further guidance on securing a profitable investment.

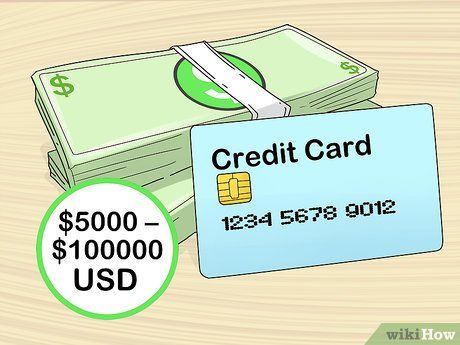

Consider participating in a Direct Participation Program (DPP) for modest investments. DPPs cater to investments ranging from $5,000 to $100,000 USD. Investing through a DPP grants partial ownership of the company and its assets, entitling you to a share of profits generated from oil sales. Consult your broker regarding available DPPs and evaluate your investment options with their assistance.

Assessing Your Investment Prospects

Retain legal counsel. An attorney will assist you throughout the investment process and conduct thorough due diligence on the company and its personnel. Seek out a reputable attorney with expertise in oil well investments through online research or referrals from your existing legal representation.

Conduct comprehensive company background checks. Utilize online resources to access SEC filings, news articles, press releases, annual reports, and litigation records. Request access to sales or investor materials and review the company's data room. Engage your attorney to perform due diligence on the company.

Evaluate the competence of the well's management team. Verify that the well's managers have a proven track record of success in the industry. Ensure that the team comprises skilled professionals such as geologists, engineers, and operators. Research individual team members online for additional insights.

Visit the oil well site. Physical inspection provides valuable insights beyond document analysis. Assess the site's infrastructure and operations firsthand. Look for signs of efficiency and competence. Consider obtaining a mineral and geological assessment to confirm oil presence in the area.

Engage in dialogue with key staff. Pose inquiries regarding production processes, operational experience, and past successes. Evaluate their responses for transparency and expertise. Avoid investments if staff responses are evasive or lack substance. Common questions include inquiries about the company's tenure, current drilling activities, and historical oil production.

Seek advice from fellow investors. Experienced investors can provide insights into past returns and the overall investment process, offering valuable guidance for your own investment journey. Inquire about their experiences with royalties, returns, and any challenges encountered during the investment process.

Verify funds raised. Ensure that adequate funds have been raised before committing to the investment. Request documentation demonstrating investor participation to confirm financial backing for the project, unless you intend to fully acquire the oil well independently.

Exercise caution against fraudulent schemes. Thoroughly assess the legitimacy of the oil well, including physical site visits and online research, to mitigate the risk of falling victim to scams. Be wary of deceptive offers and sales tactics, and consult with your state securities commission to verify the investment's legality.

Completing Your Purchase

Explore negotiation opportunities. Conduct a final evaluation of the deal to ensure fairness and profitability. If there is potential to secure a lower purchase price or reduce expenses, consider negotiating a lower offer than the initial asking price.

Consult with your legal and financial advisors. Before finalizing your decision to invest in a specific company or oil well, engage in a final discussion with your attorney and financial advisor. Your attorney will assist in drafting necessary documents and overseeing the transaction, while your financial advisor will offer insights into the investment's impact on your portfolio and provide last-minute guidance.

Complete the purchase process. Once negotiations conclude and a purchase price is agreed upon, coordinate with your attorney or financial advisor to transfer funds to the seller. Execute the necessary contracts to formalize the transaction. If investing through a DPP, ensure payment is made to acquire equity in the well, with your attorney clarifying the contract terms.