Just like a bespoke suit, your resume should be customized to match the specific job you're applying for. While many aspects of resume format and style remain consistent across different job applications, it's crucial to highlight skill sets that are particularly relevant to the banking industry. Below, we've compiled a list of recommendations to help you create a standout resume tailored for banking positions!

Key Steps

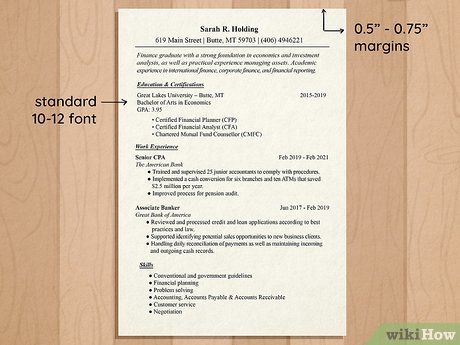

Adhere to Standard Formatting Guidelines.

Avoid reducing font size or margins to cram information. Maintain 0.5- or 0.75-inch margins and use size 11 font for the main body of your resume. If necessary, reduce font size to 10 while keeping margins consistent to ensure readability, as recruiters typically spend only around 30 seconds reviewing each resume. A cluttered page may cause important details to be overlooked.

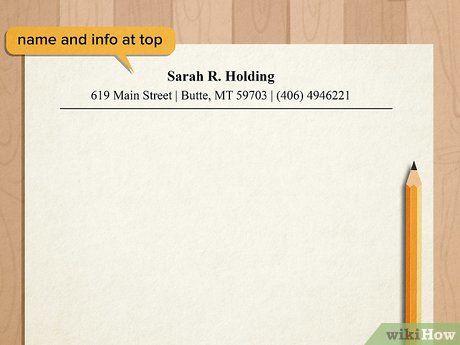

Start with Your Name and Contact Information.

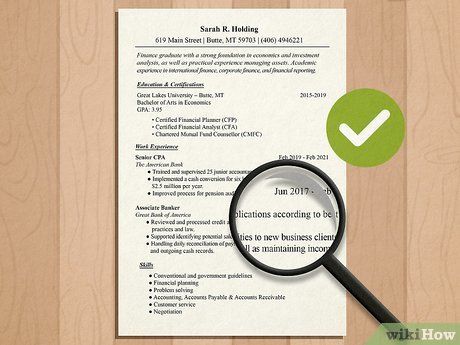

Center your full name at the top of the resume using a font size of 20 to 24. Beneath it, in size 11 or 12 font, list your current contact details, including phone number, email address, and home address. While you can choose a unique font for your name to add personality, ensure it remains professional and easy to read, avoiding overly ornate or playful styles.

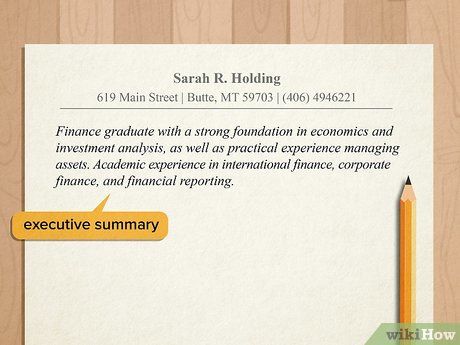

Compose an Executive Summary Below Your Contact Details.

This section highlights your relevant experience and skills. Keep it concise, with no more than two sentences. Avoid generic phrases such as 'detail oriented' and opt for specific examples like 'Proficient in recording transactions and managing accounts for over 100 clients.' An example of an effective executive summary could be: 'Finance graduate with a solid foundation in economics and investment analysis, coupled with hands-on experience in asset management. Academic background includes coursework in international finance, corporate finance, and financial reporting.'

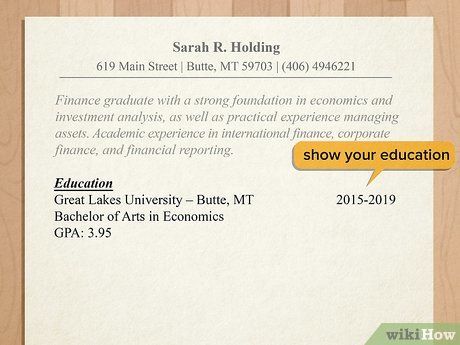

Include an Education Section.

Highlight your relevant finance-related education. Label this section as “Education,” and include details such as the institutions attended, degrees received, GPA, and any awards. Place this section after your executive summary if you are still in university or recently graduated, or beneath your work experience if you have been working for some time.

- High school education is typically unnecessary to include unless you are just starting your career or it was your only degree.

- If your college GPA is not as high as desired, you can supplement it with your major-specific GPA or your 3rd and 4th year GPAs, if significantly higher, to demonstrate improvement over time or expertise in your field.

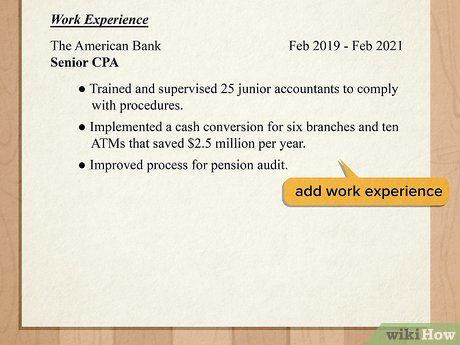

Detail your relevant work experience.

Highlight your finance-related employment history. Label this section as “Professional Experience.” List relevant jobs, internships, or unpaid work, omitting irrelevant positions.

- Include employer names, employment periods, and job locations.

- Describe your experience using bullet points, emphasizing achievements that showcase your suitability for the job.

- Even non-finance jobs can be relevant; for example, cashier experience demonstrates money handling and customer service skills akin to bank teller roles.

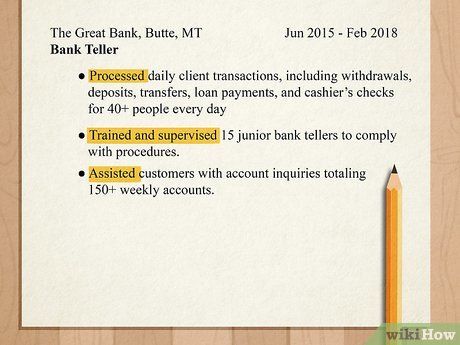

Utilize dynamic verbs to articulate your tasks.

Active verbs provide immediate insight to resume readers. Opt for words like “Wrote,” “organized,” “managed,” “supervised,” and “designed.” Avoid vague terms like “obtained,” “achieved,” and “accomplished” which fail to convey specific skills.

- For instance, use active verbs to outline your responsibilities and experiences in past roles.

- For example: “Supervised a team of 10 sales representatives,” or “Managed a portfolio of 7 commercial clients.”

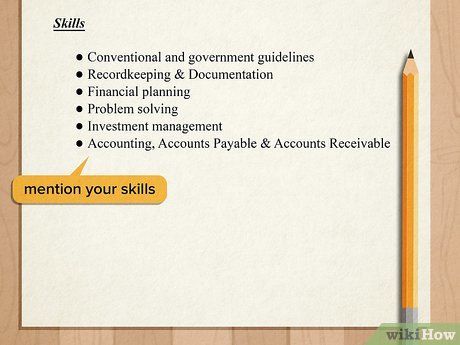

Enumerate any other relevant skills.

Employers seek individuals with specific, tangible skills. Include both “hard” skills, such as quantitative techniques and programming proficiencies, and “soft” skills, which pertain to interpersonal abilities. Highlight familiarity with financial software and customer service aptitude.

- Examples of skills to showcase: communication, financial analysis, retirement investing, teamwork, leadership, and client management.

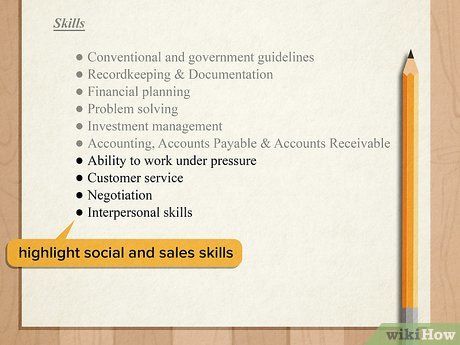

Accentuate interpersonal skills and sales prowess.

Banking roles, notably teller positions, heavily emphasize client interaction and sales. Highlight service industry roles requiring extensive customer engagement and any sales experience. For instance, emphasize commission-based positions in retail environments.

- Bank roles often necessitate continuous customer interaction and the ability to effectively promote services like mortgages and loans.

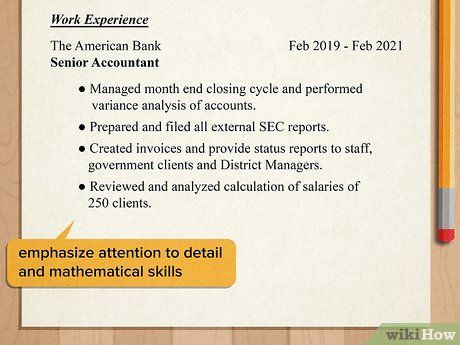

Highlight meticulousness and mathematical acumen.

Attention to detail and numerical proficiency are essential for any banking position. Highlight experiences and skills showcasing your ability to handle basic mathematical tasks. For instance, if you served as treasurer for a university club, include it on your resume.

- Emphasize any academic accolades indicative of mathematical aptitude. Detail any prior roles involving money handling or other mathematical competencies.

- Include instances where you adhered to strict workplace protocols, proofread documents, managed extensive databases, or verified coworker work for accuracy.

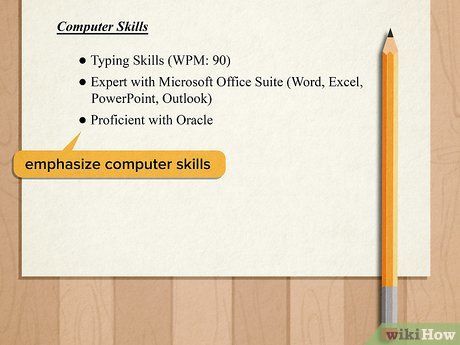

Showcase your computer skills.

Banking professionals heavily rely on computer systems for transaction recording. Mention software programs you're proficient in, particularly those related to finance, to demonstrate your technical proficiency. For example, highlight your use of Excel for financial reporting in college.

- Ensure to include any formal certifications you've obtained for specific software applications.

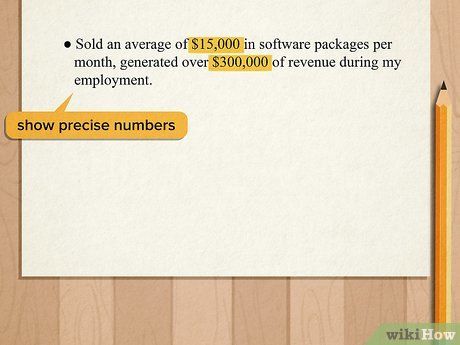

Demonstrate achievements with quantifiable results.

Employers seek concrete evidence of your accomplishments. Provide specific details and quantify your achievements whenever possible. For instance, if you held a sales position previously, include the monthly or yearly sales figures and the overall revenue you generated for the company.

- Under your role in the work experience section, include the company name, location, and write something like: “Averaged $15,000 in monthly software sales, contributing to over $300,000 in total revenue during tenure.”

Keep your resume to one page.

Employers prefer a concise overview of your background. If space runs short, prioritize relevant information, such as recent and pertinent roles. Condense job descriptions by eliminating unnecessary details or revising sentences.

- Various free one-page resume templates are available online and in Microsoft Office to assist in fitting all information on a single page.

Thoroughly proofread your completed resume.

Errors hinder your progress in the hiring process. Use spell check upon completing your resume to identify obvious mistakes. Then, meticulously review it 2-3 times to catch any other errors.

- Be vigilant for correctly spelled but contextually incorrect words, such as “complaint” versus “compliant.”

- Request a friend or family member to review your resume as well, as they may notice errors you overlooked.