Exchanging old currency might become necessary for various reasons. If your currency is old and worn-out, you might want to exchange it for newer and more usable money. You might also possess notes and coins from currencies that are no longer in use (such as the Italian Lira, for instance). Understanding how to exchange old money will assist you in converting your worn or obsolete currency into usable cash.

Steps to Follow

Dealing with Damaged Currency

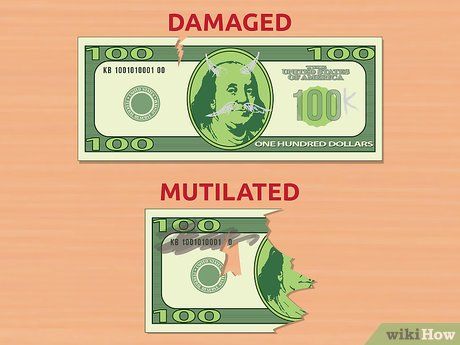

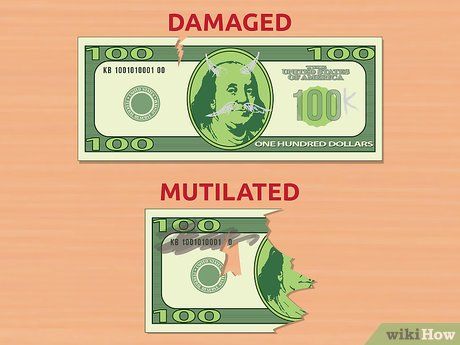

Grasp the concept of damaged currency. If you have U.S. currency that is severely damaged, there are two primary methods to have it replaced. The appropriate procedure depends on whether the currency is considered 'damaged'.

- Damaged currency refers to any currency that is impaired to the extent where determining its value is challenging, or if at least half of the currency is missing.

- For instance, a bill that is damaged to the extent where only 25% remains would be classified as damaged.

- Additionally, missing or impaired security features constitute damaged currency.

- Destruction usually results from fire, water, chemicals, burial, or damage caused by animals/insects.

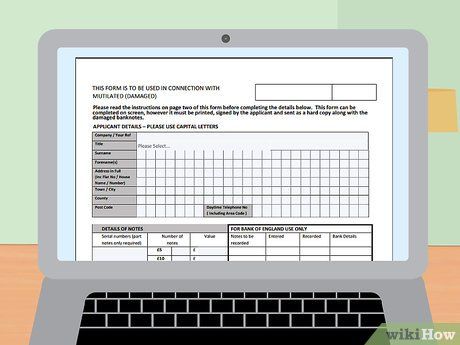

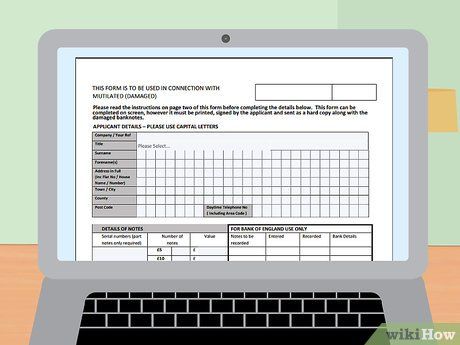

Prepare for Redeeming Damaged Bills. If your bill is damaged, the only way to redeem it is by filing a reimbursement claim with the Office of Currency Standards within the Bureau of Engraving and Printing. Trained experts at the Bureau will assess the currency's validity before any reimbursement occurs.

- You need to mail or personally deliver the damaged currency to the Bureau of Engraving and Printing. Alongside the currency, include a simple letter stating the estimated value, your contact details, and how the currency was damaged.

- Include your bank account and routing number if you prefer direct deposit reimbursement. For a check reimbursement, provide your mailing address and payee information.

Send or Deliver the Damaged Currency. Once you've prepared your letter, it's time to send the currency. Proper precautions should be taken to minimize the risk of further damage during mailing.

- If the currency is fragile, pack it gently in cotton and place it in a secure container.

- If the currency was flat when damaged, do not attempt to roll or alter it in any way.

- If the currency was in a roll, do not unroll it; simply send it as is.

- Mail your package to: Bureau of Engraving & Printing, MCD/OFM, Room 344A, P.O. Box 37048, Washington, DC 20013.

- If you're in the Washington DC area, you can deliver your submission to: Bureau of Engraving & Printing, MCD/OFM, Room 344A, 14th and C Streets SW, Washington, DC 20228.

- Claims typically take between 6 and 36 months to process fully.

Trading Damaged Currency

Recognize the Distinction between Damaged and Mutilated Currency. Any bill that is clearly more than half of its original size and does not require special training to assess its value is considered damaged.

- Damaged bills often include dirty, worn, slightly torn, or defaced bills.

- These bills can be exchanged easily at your local bank.

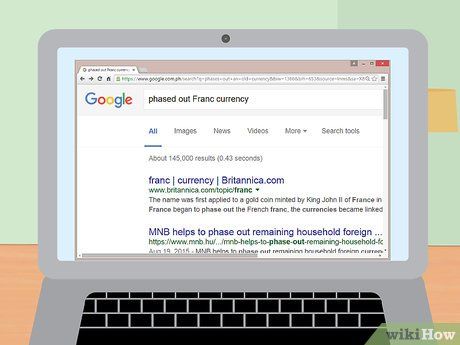

Ensure the Currency You're Exchanging Is Valid. While this isn't typically an issue in the United States, it's crucial to verify that the currency is still recognized as legal tender or exchangeable elsewhere.

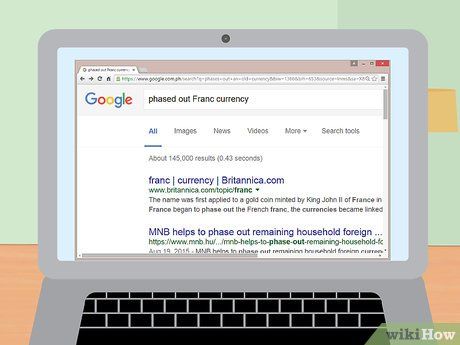

- This can usually be determined by searching online for the currency's name and value or by contacting a bank for confirmation.

Verify Values for Antique Currency. Antique currency might hold more value than its face worth. Certain notes are highly sought after by collectors, often selling for more than their nominal value. For instance, silver-backed one-dollar bills from the U.S. commonly fetch prices higher than $1 when in decent condition. Always ensure to ascertain its actual worth if this is the case.

- If you suspect your currency is old and potentially valuable, consult websites that specialize in collectible currency values by searching 'collectible currency values'. These sites offer comprehensive price guides.

- Websites like Papermoneyguide.com or coinquest.com can serve as valuable starting points.

- This consideration is crucial before immediately exchanging the currency at a bank. Currency from the early 1900s, for example, may hold more value than its face worth, warranting confirmation of its actual value before exchanging.

- In general, older currency tends to carry higher potential value.

Q. David Bowers, Renowned Numismatist

Expect to provide evidence of authenticity for rare or high-value pieces. Set realistic expectations for appreciation over time. Maximize value by selling individually rather than in bulk. With diligence, you can effectively convert old money into its current fair cash value.

Explore Local Banks for Currency Exchange. Some banks may only accept worn, torn, or otherwise damaged currency from their own customers, while others offer exchange services to anyone. It's advisable to contact the bank branch beforehand, especially if you don't hold an account there.

Swap Worn-Out Currency at a Nearby Bank. Valid but worn, torn, or damaged currency can be exchanged at a local bank. Deposit the money into your account, and the bank's affiliation with the central bank and minting service ensures its replacement with fresh currency. Alternatively, you can request a direct swap without depositing.

Exchanging Obsolete Currency

Determine if the Currency is Still Eligible for Exchange. Occasionally, a new government or central bank takes control and phases out an old currency. Alternatively, a currency merger might replace the old one. One common instance is the Euro replacing Francs, Lira, German Marks, and other European currencies.

- Most countries transitioning to the Euro set a final exchange date for old currency. For early adopters like France and Germany, this date was in 2012. Consequently, after this deadline, old Francs hold no exchange value.

Find a Bank for Currency Exchange. If you're in the currency's home country, exchanging old currency for new shouldn't pose much difficulty. Follow the steps outlined in method 1. However, if you're abroad, you'll need to inquire with banks to see if they facilitate the exchange.

Compare Different Banks for Optimal Exchange Rates and Minimal Fees. When exchanging currency outside its home country, seek out the best exchange rates and assess associated fees. Since few institutions carry the new notes, you'll likely need to convert the currency into dollars or a widely accepted currency. Each institution may offer slightly varying exchange rates, so it's advisable to shop around.

Conduct the Currency Exchange. The exchange process itself is straightforward. The bank will accept your old notes and issue new ones in return. If you're exchanging foreign currency for dollars, the bank should furnish a receipt detailing the exchange rate applied and any incurred fees.

Exploring Alternative Currency Exchange Methods

Seek Out a Third-Party Dealer or Currency Exchange Service. Third-party currency changers often handle notes that some banks refuse to exchange. Banks may decline currency from less frequently visited countries or refuse to exchange expired currency.

Hunt for the Best Rate and Lowest Fees at Third-Party Services. Every dealer and currency exchange profits from the spread—the difference between what they pay for a currency and what they sell it for. Due to significant variations, search for the best rate and lowest fees by comparing rates from different dealers. Inquire about any additional fees as well.

- Dealers should provide exchange rates based on the spot price for the currency. Keep in mind that currency markets fluctuate, so today's rate may differ tomorrow.

Exchange Old European Currency via a Third-Party Service. If reaching a bank in the issuing country isn't feasible, consider contacting a third-party company specializing in currency redemption. While old Francs may be ineligible, currencies like Lithuanian litas can still be converted into Euros. Companies like Travelex specialize in currency exchange.

- Several companies of this nature offer redemption for obsolete currency. They purchase old currency from customers at a discounted rate and exchange it in bulk with national banks. The Currency Commission is one such entity.

- Using such services may yield lower exchange rates but may be the only recourse after the issuing government's exchange deadline lapses.

Address Expired Currency. If the currency has surpassed its deadline, exchanging it may not be possible. In some cases, collectors might express interest if the currency is rare; otherwise, it may only serve as decorative paper. Explore eBay to ascertain if it holds any value for potential buyers.

Helpful Advice

Cautionary Notes