The most effective ways to monitor your expenses and handle your finances

Keeping track of your finances might seem daunting, but it doesn't have to be! Whether you prefer manual methods or using apps, managing your money can be straightforward. This article explores various techniques for tracking personal finances and offers budgeting advice to help you become a wiser spender quickly. Learn more about smart money management here.

Essential Knowledge

- Categorize your expenses such as housing, transportation, and dining for easier tracking.

- Record expenses promptly after spending to stay organized financially.

- Utilize personal finance apps for digital expense management and analysis of spending patterns.

- Establish a separate entertainment spending account to prevent inadvertent expenditure of bill funds.

Procedures

Manual Financial Tracking Methods

Establish a personalized tracking system. Consistency is key in managing your finances. Ensure your tracking method allows for easy and reliable reference, including essential details such as date, transaction amount, and expense category. Regular and consistent recording is crucial to maintaining an updated log of your expenses.

Maintain an expense and budget journal. Keep track of your spending by recording each transaction in a notebook. You can opt for a simple expense log or a more comprehensive budget tracker to monitor your financial activities. Transferring data to a computer spreadsheet monthly or yearly provides additional record-keeping.

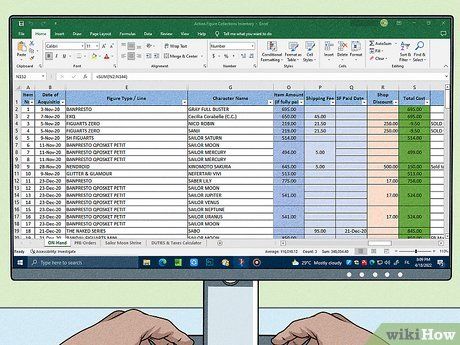

Utilize computer spreadsheets for budgeting and expense management. Microsoft Excel or Google Sheets offer efficient solutions for organizing finances. Create a personal budget and input expenses using your chosen tracking system. Online templates are available for those who prefer pre-designed spreadsheets.

Maintain a checkbook for tracking deposits and transactions. Despite its traditional nature, a checkbook remains a reliable method for financial tracking. Record transaction amounts and descriptions to monitor account balances and detect errors or fraudulent charges. Regular reconciliation with bank statements ensures accuracy.

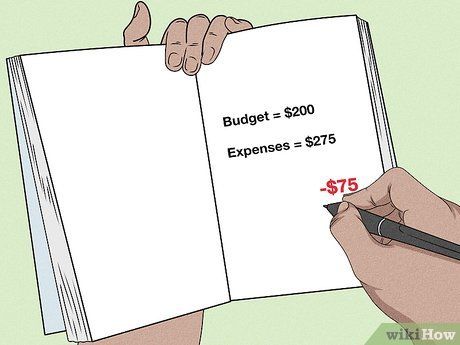

Review your finances monthly to establish a functional budget. Evaluating your income and expenditure habits monthly aids in future budgeting. Identify areas of significant spending and assess whether you saved or earned less. Adjust your budget and spending practices accordingly for the upcoming month.

Utilizing Personal Finance Apps

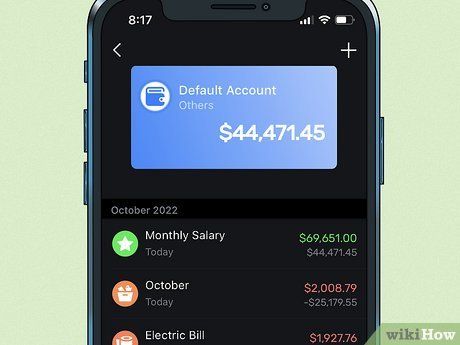

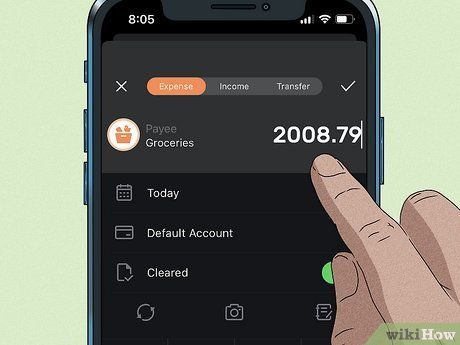

Choose a personal finance app suited to your requirements. Numerous personal finance apps cater to various needs, ranging from simple budget creation to comprehensive asset tracking. Select an app that aligns with your preferences and financial goals.

Input your data into the chosen app. If the app requires bank details, provide the necessary information and allow it to sync with your accounts. Alternatively, manually enter transaction details to facilitate automatic compilation of your finances.

Track the app's analyses to monitor your finances. Regularly review the app's analyses of your spending patterns and consider adjusting your habits accordingly. Some apps may offer suggestions for saving money in specific areas.

Effective Money Management Strategies

Record your purchases immediately after shopping. Avoid overspending by promptly logging your expenses in your finance tracker after each purchase. This practice helps you stay aware of your available funds and upcoming payments.

Monitor and allocate your spending per store. If you notice excessive spending at particular stores, consider setting budgets for each. By doing so, you can curb impulse purchases and manage your expenses more effectively.

Establish a dedicated spending account. Separate your discretionary spending from essential expenses by creating a distinct bank account. This ensures that your discretionary funds remain separate, preventing them from affecting your bill payments.

Opt for cash transactions whenever possible. Using cash promotes better spending awareness compared to card payments. Employ techniques like the envelope-saving method to allocate funds for specific purposes and encourage saving.

Establish an emergency fund. Prioritize your financial security by setting aside funds for unexpected expenses. Consistently saving a portion of your income each month can provide peace of mind and financial stability in times of need.

- Financial experts typically advise saving a minimum of 10% of your monthly income for emergencies.

Personal Finance Terminology Glossary

Illustrative Glossary of Personal Finance Terms

Illustrative Glossary of Personal Finance TermsInsights

-

Tracking both your budget and expenses is essential for effective financial management. Regularly logging and evaluating these aspects can enhance your money management skills.