1. Money Manager

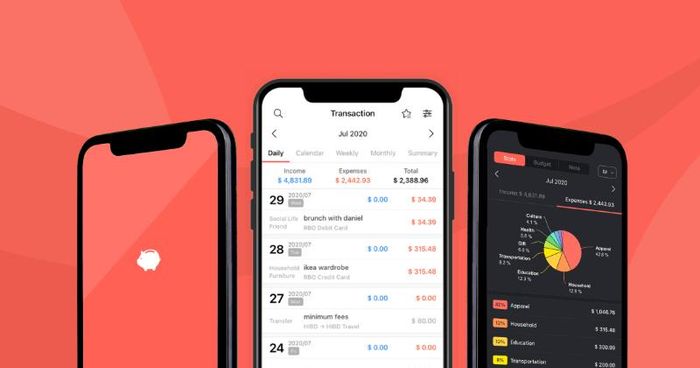

When planning to make significant purchases, you may need to save up over time, which can be a nightmare for those who struggle with managing their finances. Small, unexpected expenses often lead to debt. That's where Money Manager comes in to help you track and manage your cash flow and spending effectively. Money Manager is one of the most popular finance management apps, making expense tracking more engaging. This app allows you to plan your finances, manage assets, and track expenses. You can easily review your daily, weekly, and monthly financial data, monitor personal and business transactions, and oversee your assets.

With over 5 million downloads, Money Manager is one of the most powerful personal finance apps. It includes features like expense tracking, cash flow management, reporting charts, and budget setup. Users can set financial goals and categories with multiple accounts and currencies. You can create your own personal savings fund or use automatic double-entry bookkeeping, manage debit and credit cards, and enjoy features like auto money transfers, expense categorization, and data backup and recovery. A significant downside of Money Manager is its lack of support for the Vietnamese language.

Download link: https://play.google.com/store/apps/details?id=com.realbyteapps.moneymanagerfree&hl=vi&

2. Monefy

Monefy is one of the best personal finance management apps available today. It goes beyond just recording and calculating expenses; Monefy offers a wide range of tools from simple to complex to manage every aspect of your finances, whether big or small. Features like periodic report charts, budget creation, and future expense allocation make Monefy a standout choice for managing personal finances. When it comes to expense tracking, there are many options, but Monefy remains a particularly unique and powerful tool.

Monefy offers a variety of useful and reliable features that make saving money much easier. First, you need a clear and motivating goal, whether it's buying a house, a car, renovating your balcony, getting a camera, a phone, or insurance. These goals can drive you and become a powerful motivation. Make the most of them, as they reflect your efforts and guide you towards achieving your financial targets, helping you save money more effectively. Once you have a goal, you'll need a tool to manage every small detail of your spending. Managing your expenses helps you understand what’s worth spending on and what’s not, and reveals where you can make adjustments. A powerful app like Monefy can help you do this easily and efficiently.

Download link: https://play.google.com/store/apps/details?id=com.monefy.app.lite&hl=vi&

3. Expense Manager

4. Wallet

5. Dhani

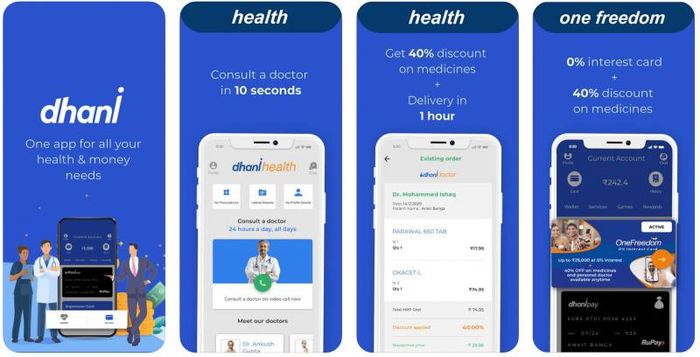

Dhani is one of the best personal finance apps, offering a comprehensive platform for all your financial needs. You can apply for personal loans, instantly open Demat/trading accounts, and manage all your payments seamlessly. The app also lets you earn money through games and listen to health and lifestyle podcasts. One of the standout features of this expense management tool is its user-friendly interface. The app even allows you to mark transaction locations on a map.

Additionally, Dhani makes it easy to create new transactions or set up joint accounts with family members. You can also customize categories or snap pictures of your receipts with just a tap. The app allows you to export data to CSV, Excel, or Google Drive for better management and storage. Dhani offers the most detailed reports among personal finance apps, providing a clear overview of your spending patterns and helping you stay within your preferred budget limits.

Download Link: https://dhani.softonic.vn/android

6. Walnut

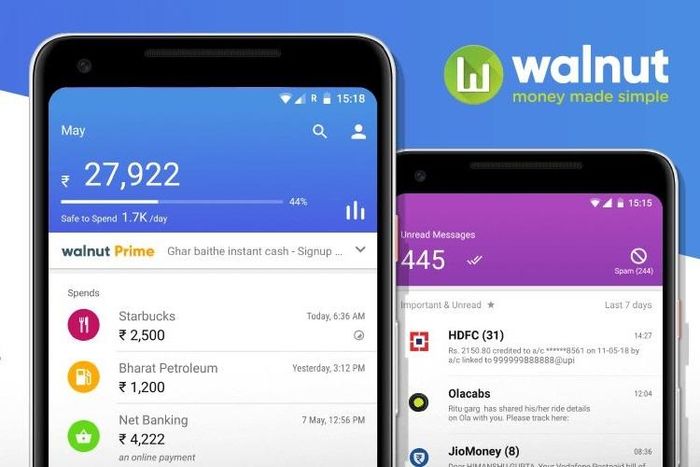

Walnut is a comprehensive money management app that helps you track all your transactions with ease. The app keeps a close eye on your expenses made through credit cards, internet, mobile wallets, ATMs, or online banking. By collecting data from your SMS messages, it categorizes your expenses according to their nature. Walnut also sends reminders for bill payments, ensuring that you never miss a due date. This handy tool also allows you to manage shared expenses between family and friends, helping you settle bills effortlessly.

Walnut is a basic budgeting app from Intuit, available on both Android and iOS. It’s an all-in-one finance tracker that integrates your bank accounts, credit cards, bills, and monthly expenses into a single account, giving you easy access to all your spending data whenever you need it. The app also tracks your investments and flags unnecessary expenditures. Walnut organizes your expenses into categories and calculates the average monthly spending for each one, helping you understand the breakdown of your budget. If you find yourself overspending in certain categories, you can make adjustments to reduce your spending based on clear, categorized insights.

Download Link: https://play.google.com/store/apps/details?id=com.daamitt.walnut.app&hl=vi&

7. CRED

CRED is the ultimate finance management app that helps you stay on top of all your bill payments. With CRED, you can pay for your utility bills, credit card bills, and even your monthly rent. Additionally, you can check your credit score for free and work on improving it. Use your CRED points to earn rewards, cashback, and exclusive deals.

CRED tracks your spending with interactive charts that make it easy to visualize where your money is going. The app automatically logs your bills, subscriptions, and monthly income. In addition to comparing monthly spending reports, CRED features tools designed to prevent overspending. It also displays your bank balance and provides cash flow graphs to illustrate your financial outlook and spending trends. With the innovation in financial management, CRED helps you take control of your finances, save money, and strategically invest to achieve your financial goals.

Download Link: https://play.google.com/store/apps/details?id=com.dreamplug.androidapp&hl=vi&

8. Supersplit

Supersplit is an intuitive expense management app available on both iOS and Android. It features a clean and user-friendly interface with four main tabs: home, accounts, search, and your profile. Overall, Supersplit provides a detailed overview of your personal finances. The app connects directly to your accounts, gathers information, and organizes your data in one place. It automatically categorizes your spending and sets sensible limits for each category, so you can easily track how much you’ve spent on food, transportation, entertainment, bills, shopping, and more.

Using Supersplit is a simple way to split expenses with friends, coworkers, and family without the awkwardness. The app allows you to create groups where you can divide costs, whether for rent, trips, movies, or meals. Supersplit helps you keep track of your share of the costs and makes it easy to receive payments. Additionally, the app sends payment reminders to everyone in the group, ensuring you avoid those uncomfortable moments of reminding others to pay their part.

Download Link: https://play.google.com/store/apps/details?id=com.Splitwise.SplitwiseMobile&hl=vi&

9. Moneyview

Moneyview is one of the most popular financial control apps today. With over 10 million downloads and an impressive 85% of users rating it 5 stars, Moneyview makes personal finance management, saving, and spending more straightforward and clearer than ever. One standout feature of Moneyview is its ability to manage all types of money, including cash, card payments, and even cryptocurrencies. It allows you to easily track your current financial status, monitor your spending, and see how much you’ve saved. This helps you proactively manage your personal finances and adjust your spending habits according to your current financial situation.

The Moneyview app provides real-time financial tracking. It reads all your financial data hidden in SMS messages related to your transactions and automatically updates your reports, eliminating the need for manual entry. Notable features include a dedicated section to track your expenses, income, bills, and bank balances, all displayed through easy-to-understand graphs and charts. With Moneyview, you can snap and attach pictures of your receipts, categorize fixed expenses, and even customize settings to automatically calculate your income.

Download Link: https://play.google.com/store/apps/details?id=com.whizdm.moneyview.loans&hl=vi&

10. Goodbudget

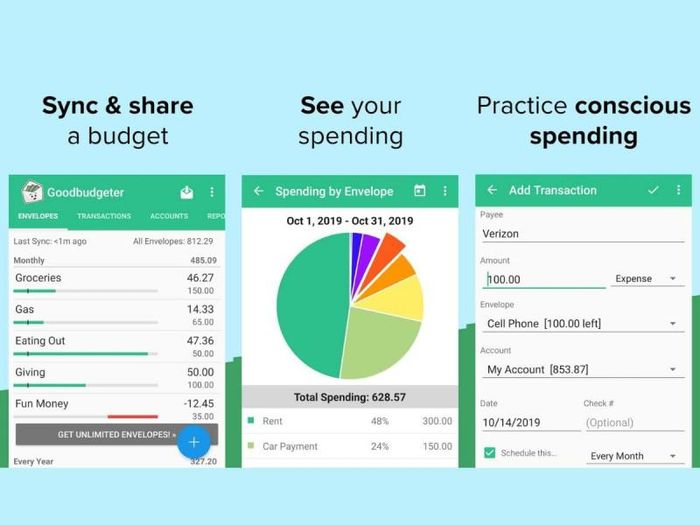

Goodbudget is your go-to app for managing daily expenses. Designed as a personal budgeting tool, this finance app helps you keep track of your budget, finances, and bills. It also sends you timely and consistent reminders to pay your bills and offers insights into your spending behavior. This budgeting software has earned high praise from users and consistently ranks among the top money management apps in tech magazines. One major advantage of Goodbudget is its ability to sync your spending accounts across multiple devices, with versions available for the web, mobile web, Android, and iOS apps. Simply remember your ID and password to access your data easily from any device, anywhere.

For those who frequently change devices, Goodbudget ensures that your data is always secure and accessible. The app’s features go beyond tracking daily expenses; it also allows you to set up budgets for regular spending categories such as food, entertainment, utilities, gas, clothing, cosmetics, and tuition. Additionally, Goodbudget offers advanced features for long-term savings and investments like housing, vehicles, travel, education, and retirement. You can allocate your funds into “envelopes” at the start of the month, giving you a clear view of your spending limits.

Download Link: https://play.google.com/store/apps/details?id=com.dayspringtech.envelopes&hl=vi&