Online loan apps typically offer small loan amounts, ranging from 500,000 to 10,000,000 dong, with repayment periods from 30 days to 3 months. While the interest rates on these loans are often higher than those from banks, the borrowing process is simpler and disbursement is faster.

Online loan apps can be a suitable option for individuals in urgent need of funds to address short-term financial needs. However, users should be aware that these loans may come with high risks, including high interest rates, additional fees, and the risk of fraud.

Borrowing money online through apps is quick and easy (Source: Mytour)

Borrowing money online through apps is quick and easy (Source: Mytour)MoMo - The most reliable online loan app

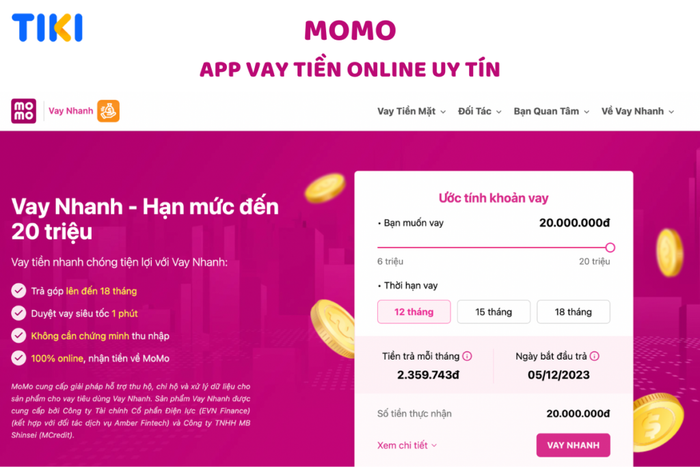

MoMo is known as a mobile payment application and also provides services for trusted online money lending apps that are popular today. Thanks to its flexible lending policies and diverse options for different customer segments along with a quick registration and approval process, the MoMo e-wallet app becomes the top priority choice for many people when they need to borrow money online.

The borrowing period of the MoMo Quick Loan service can be extended up to 18 months, with loan amounts ranging from 6,000,000 VND to 20,000,000 VND. The system also offers competitive and reasonable interest rates compared to similar services in the market. You can borrow money and repay debts conveniently and easily through the MoMo app on your mobile phone.

Borrowing money online on the reputable MoMo app (Source: Mytour)

Borrowing money online on the reputable MoMo app (Source: Mytour)Timo Plus – Monthly installment money lending app

Timo Plus, the convenient monthly installment online loan app in Vietnam. Developed by Viet Capital Bank, it aims to provide straightforward financial solutions to users.

The system offers users monthly installment loans with fixed interest rates and flexible repayment terms from 3 to 36 months. Depending on individual needs, loans on this app range from 10,000,000 VND to 100,000,000 VND. Approval and disbursement typically take only a few hours or the next working day.

Online borrowing on Timo Plus comes with a 0% interest rate (when you apply before 5 p.m.) and reasonable service fees. Additionally, the system integrates various support services such as bill payment, transfers, savings, and investments.

Online borrowing on Timo Plus (Source: Mytour)

Online borrowing on Timo Plus (Source: Mytour)Fast Online Loan Application with MB Bank

MB Bank offers loans ranging from 10,000,000 VND to 100,000,000 VND through the MB Mobile Banking app with loan terms from 3 to 60 months. This is a top-notch online loan app owned by Military Commercial Joint Stock Bank (MB Bank). MB Bank's loan interest rates are quite competitive compared to other financial companies, calculated based on the loan term and amount. Remaining loans will be repaid gradually within the agreed-upon period.

To utilize MB Bank's loan service, you need to be a customer of the bank and meet the account registration requirements of the system.

Simplify your online loan process with the MB Bank app (Source: Mytour)

Simplify your online loan process with the MB Bank app (Source: Mytour)Trustworthy Fast Cash Loan App by Home Credit

Home Credit Vietnam's app is managed by a multinational financial company headquartered in the Czech Republic and operates in over 10 countries worldwide. The system offers loans ranging from 4,000,000 VND to 50,000,000 VND with loan terms from 6 to 36 months. With just 3 - 10 minutes of registration on this reputable online loan app, you'll receive a notification about whether your application has been approved or not. Especially, if you have an online loan for less than 3 months, you'll receive a 0% interest rate.

Online Loan App by Home Credit (Source: Mytour)

Online Loan App by Home Credit (Source: Mytour)TPFico Mobile – Reliable Fast Cash Loan App

Another top-notch online loan app on mobile is TPFico Mobile – provided by TPBank International Financial Group. TPFico does not support cases with previous bad debts at TPFico or any other credit institution in the Vietnamese market. The system allows users to borrow online up to 100,000,000 VND at an interest rate of 1.67% per month. To have a valid loan application, you need to ensure you are between 21 and under 55 years old and have Vietnamese citizenship.

High-quality and reputable online loans with TPFico Mobile (Source: Mytour)

High-quality and reputable online loans with TPFico Mobile (Source: Mytour)Viettel Money – Reliable Online Loan App

Viettel Money is renowned as a reliable online loan app guaranteed by EasyVay and Viettel. The app supports both online loan services, including consumer loans with a maximum limit of 80,000,000 VND per transaction and Easy Vay with a maximum limit of 10,000,000 VND per transaction. The highlight of the Viettel Money app compared to others is that it does not require personal income proof even if you choose any loan service.

Viettel Money is renowned for its reputable online loan app (Source: Mytour)

Viettel Money is renowned for its reputable online loan app (Source: Mytour)HD Saison – Free Online Loan App for Various Services

HD Saison supports users to borrow online completely free of service fees. With quick online loan applications, if you are not in the bad debt group, the likelihood of your application being approved is very high. Additionally, with this app, you don't need to go through cumbersome procedures or present personal income proof documents.

Online loan support with HD SaiGon (Source: Mytour)

Online loan support with HD SaiGon (Source: Mytour)VPBank – Fast Monthly Installment Payment

VPBank is a reputable online loan app trusted by many. The app offers a maximum limit of up to 500,000,000 VND. When borrowing money quickly, you can repay the principal and interest monthly. The interest rate at the system is only from 14% per year and is specifically calculated on the reducing balance. Registering for a loan on VPBank requires users to be Vietnamese citizens, aged 23 to 60, and have a minimum income of 5,000,000 VND per month. Additionally, you also need to prepare all types of personal documents as required by the app.

Convenient online lending with VP Bank (Source: Mytour)

Convenient online lending with VP Bank (Source: Mytour)RoboCash – Instant Online Transfer Loan App

When it comes to instant online transfer loan apps, RoboCash cannot be overlooked. You'll get funded quickly just 30 minutes after valid registration. However, if you choose RoboCash, you'll incur an initial consultation fee of up to 600,000 VND and a service fee of 1,360,000 VND. In case of choosing pre or post-agreed payment terms with RoboCash, you'll also have to pay additional corresponding fees.

RoboCash is a beloved online loan app (Source: Mytour)

RoboCash is a beloved online loan app (Source: Mytour)Zaimoo – Low Interest Rate Loan App

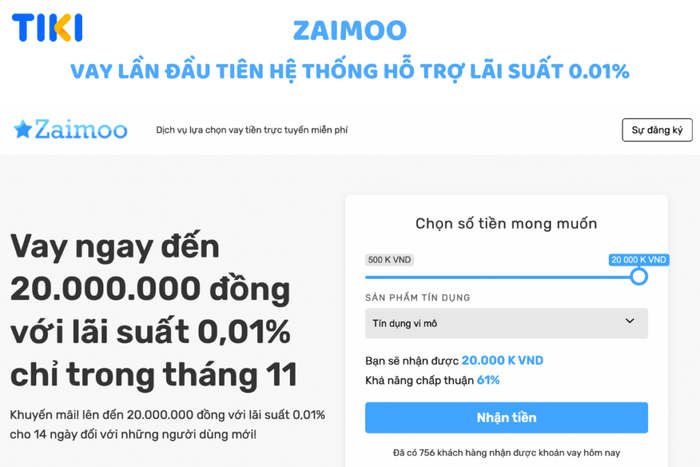

With the first loan on Zaimoo, the system will support users with an interest rate of 0.01%. Subsequent loans will apply an interest rate of 16.7% per year with a maximum limit of 20,000,000 VND. To have a successfully approved application, you need to ensure you're over 20 years old, have an income of over 3 million VND per month, not work in the state system, and also not have bad debts from any bank.

Simple and Safe Online Loaning with Zaimoo (Source: Mytour)

Simple and Safe Online Loaning with Zaimoo (Source: Mytour)Is it advisable to borrow money on non-assessment apps?

Borrowing money online on non-assessment apps is becoming popular in Vietnam. However, while using non-assessment loan apps, you may encounter some risks, so users need to carefully consider before registering.

Online loan apps without assessment are usually not managed by functional agencies and do not have legal protection for users. If there are financial conflicts, you may face difficulties in safeguarding your rights.

Using non-assessment loan apps may involve some risks (Source: Mytour)

Using non-assessment loan apps may involve some risks (Source: Mytour)Interest Rates on Online Loan Apps

The interest rates of reputable online loan apps can be quite high and are often calculated by adding daily, weekly, or monthly service fees. However, these types of apps also often have many promotional programs and interest rate discounts for new users or first-time loans. You need to carefully read the terms and conditions of each app and ensure that you have the ability to repay the debt on time before using online loan services.

Online loan interest rates depend on the bank's service fees (Source: Mytour)

Online loan interest rates depend on the bank's service fees (Source: Mytour)The article above has shared with you information about 10+ popular and reputable online loan apps on the market. Hopefully, after reading, you'll be able to choose a convenient and suitable loan app for your needs. To discover more useful apps, don't forget to follow the articles on Mytour's blog!