1. P/S Toothpaste Sold to Unilever

The P/S toothpaste brand was developed in 1975 by the P/S Chemical Company, a subsidiary of the Ho Chi Minh City Department of Industry. Initially, two popular toothpaste brands, Hynos and Kolperlon, merged to form Phong Lan Toothpaste Factory. However, due to poor sales, the company decided to rebrand the product using the name P/S, a toothpaste that had been imported earlier. The name P/S quickly gained recognition, capturing 60% of the market between 1988 and 1993.

For more than 20 years (1975–1995), P/S dominated the oral care market in Vietnam, becoming a trusted name for generations of Vietnamese. It became a symbol of Vietnamese pride, an indelible mark on consumer goods.

As the economy opened up, foreign companies entered the market, creating challenges for local businesses. In 1997, Unilever successfully convinced P/S Chemical to enter a joint venture, creating P/S Elisa to co-manage the P/S brand.

Unilever, a global consumer goods giant, began its expansion into Vietnam in 1995, quickly negotiating to acquire the P/S toothpaste brand.

At that point, P/S Chemical no longer produced toothpaste but only made aluminum toothpaste tubes for the joint venture. Unilever requested P/S to switch from aluminum to composite tubes, but P/S could not meet the requirement.

By 2003, Unilever paid $6.5 million for P/S to build a factory for plastic tube production, in line with Unilever’s specifications. When the factory began production, Unilever rejected the product due to quality issues. Unilever then invested an additional $ million to cover workers' wages and $5 million to purchase the P/S brand outright. At this point, P/S had no further involvement with its toothpaste brand.

2. X-Men Sold to Marico (India)

In 2003, the X-Men shampoo was launched with an aggressive marketing campaign and the slogan “Real Men” quickly making it the number one men's shampoo brand.

X-Men made its mark by redefining men's cosmetics, breaking away from the old habit of using products marketed to women. With its distinctly Western-sounding name, many assumed it was a product from a multinational corporation, but in reality, it was created by the Vietnamese company International Consumer Products (ICP).

ICP was founded in 2001 by Phan Quốc Công and a business partner after eight years of savings. Recognizing they were newcomers in the industry, ICP took a strategic approach, learning from major chemical corporations worldwide to improve production techniques instead of starting from scratch.

Alongside its unique name, ICP focused heavily on a comprehensive production strategy, creating everything from body washes, soaps, and facial cleansers to building a brand image tied to a heroic culture, reflected in its slogan.

At its peak, X-Men led the haircare and body wash market, holding a 40-50% market share, with the deodorant segment following Nivea with a 23% share. In 2011, as investment funds withdrew, ICP sought a strong industry investor. In March 2011, the Indian cosmetics giant Marico acquired 85% of ICP’s shares while retaining the existing management. By 2014, Marico had full control, holding nearly 100% of the voting shares.

Marico’s investment marked a turning point for ICP. According to Phan Quốc Công, the founder of X-Men, after three years of Marico’s ownership, the company’s revenue soared to over 1,000 billion VND, double what it had been before the sale.

3. Diana Sold to Unicharm (Japan)

Founded in 1997, Diana was a Vietnamese sanitary napkin brand created by Diana Joint Stock Company, established by brothers Đỗ Minh Phú and Đỗ Anh Tú with an initial investment of $600,000. By 2011, the company’s value skyrocketed to around $200 million when it was offered for sale. Known for the slogan “It’s Great to Be a Girl,” Diana quickly gained recognition in Vietnam.

Facing fierce competition from Kotex (owned by the US-based Kimberly-Clark), Diana relentlessly invested in advanced equipment and technology to enhance product quality and compete in all market segments.

In 2011, Diana’s sale became one of the largest M&A deals in Vietnam’s private sector. The deal was valued at nearly 4,000 billion VND for a company with revenue of 1,000 billion VND and a profit of only 40 billion VND in 2010, which surprised many.

However, Diana showed impressive growth that year, with revenue reaching 1,700 billion VND and a net profit of 100 billion VND. By the time the deal was finalized, Unicharm valued Diana at 40 times the company’s profit (P/E ratio of 40). Diana continued its high growth in the following years. Just three years after the change of ownership, Diana’s financial situation dramatically improved. By the end of 2014, the company achieved 3,900 billion VND in revenue and more than 800 billion VND in net profit.

4. Viso Sold to Unilever

Founded around the same time and both under the Thiên Nga brand, Vinabico and Viso can be considered sibling companies. While Vinabico became known for its reputable confectionery products, Viso earned recognition for its laundry detergents. However, in the wave of foreign brand acquisitions, Viso couldn’t keep up and was eventually sold to Unilever.

Viso detergent, originally owned by the Ho Chi Minh City Chemical Company, was a beloved local brand in Vietnam. Established in 1961, it became one of the nation's proudest products. It was initially the property of Trương Văn Khôi, also known as the 'King of Viso Detergent.' The brand targeted everyday consumers with affordable pricing while maintaining strong quality, quickly capturing a significant market share.

Despite its reputation for both quality and affordability, Viso couldn’t retain its status as a Vietnamese brand. Much like P/S toothpaste and Dạ Lan, it ultimately became a foreign-owned label.

Unilever acquired Viso through a joint venture rather than an outright purchase. The multinational corporation made it a priority to convert such joint ventures into fully foreign-owned subsidiaries. In the end, like Dạ Lan and P/S, Viso transitioned into a foreign brand, with the acquisition process largely happening behind the scenes.

Much like the fate of Haso, Viso, once a proudly Vietnamese company, became a joint venture and ultimately lost its identity as a local detergent brand.

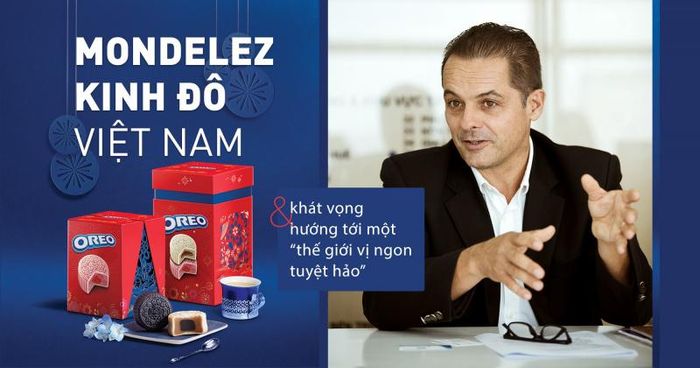

5. Kinh Đô Sold to Mondelez International

Kinh Đô is a joint-stock company based in Vietnam, specializing in the production and distribution of snacks, including cakes, candies, and ice cream. The brand is often considered synonymous with Vietnam, but in reality, its story is quite different.

Founded in 1993, Kinh Đô began with a small workshop in Phú Lâm, District 6, with an initial investment of 1.4 billion VND. In its early years, under the leadership of Trần Kim Thành, Kinh Đô implemented effective strategies, investing heavily in production lines and technology. Between 1994 and 2001, they spent a total of $13 million on upgrading equipment such as industrial bread production lines worth over $1.2 million and European-made Cracker production lines valued at over $2 million. By 2001, Kinh Đô had expanded its presence and began exporting to major markets like the U.S., France, Canada, Germany, Japan, and several Southeast Asian countries. In 2003, it acquired Wall’s Vietnam, the ice cream brand from Unilever, which was subsequently rebranded as Kido’s.

The reason Kinh Đô was sold to Mondelez International was complex. In early 2014, Kinh Đô was a dominant force in the Vietnamese snack market, holding 28% of the market share. However, in the same year, Kinh Đô sold off 80% of its confectionery business (around 8,000 billion VND) to Mondelez International.

The preference for foreign products among Vietnamese consumers, particularly in the gift segment, had made it difficult for local companies to compete. Imported snacks were often more appealing due to their attractive packaging and superior quality, making them popular among consumers. Additionally, the ASEAN common market meant zero import taxes, allowing foreign brands to flood the Vietnamese market.

After years of strong growth, Kinh Đô recognized that the confectionery industry no longer held the same potential as it did in the company’s early years. The company then shifted its focus to exploring investment opportunities in other sectors.

The result of this strategic shift was Kinh Đô’s sale to Mondelez International. In 2015, Mondelez officially acquired 80% of Kinh Đô’s shares for approximately $370 million (around 8,000 billion VND). The company was then rebranded as Kido Corporation.

6. Nguyễn Kim Sold to Central Group (Thailand)

Nguyễn Kim Trading Corporation (NKT) was established in 2014 with an initial capital of 800 billion VND. At that time, Nguyễn Văn Kim, along with his family members, held nearly 90% of the parent company of the Nguyễn Kim electronics chain. Nguyễn Văn Kim himself served as the Chairman of the Board. In 2015, the Thai retail giant Central Group acquired 49% of NKT’s shares and began placing its own executives to help manage Nguyễn Kim.

After holding a 49% stake in the Nguyễn Kim electronics chain for five years, Central Group’s subsidiary, Central Retail, eventually completed the acquisition of the entire chain, marking the full takeover of this long-established Vietnamese retail brand. The Chirathivat family, behind the success of Central Group, is the second wealthiest family in Thailand, with an estimated fortune of $21 billion, according to Forbes.

As per recent financial disclosures from Central Retail Corp, a subsidiary of Central Group, which was published after its listing on the Thai stock exchange, it was confirmed that the company had finalized its full acquisition of Nguyễn Kim’s electronics retail chain. On June 7, 2019, a third-party intermediary related to Central Retail Corporation (CRC), a member of Central Group, acquired the remaining 51% of Nguyễn Kim’s shares for a reported value of 2.6 trillion VND, including 2.25 trillion VND in cash and 350 billion VND recorded as long-term debt.

7. SABECO Sold to Vietnam Beverage (Thailand)

Saigon Beer-Alcohol-Beverage Joint Stock Corporation, also known as SABECO, is a Vietnamese public joint-stock company. Despite being a publicly traded company, the Vietnamese government still holds nearly 90% of its shares, with the Ministry of Industry and Trade acting as the state representative for the company’s stake. SABECO is the owner of iconic brands like Saigon Beer and 333.

In December 2017, Vietnam Beverage, a subsidiary of Thai billionaire Charoen Sirivadhanabhakdi, acquired 59% of SABECO’s government-owned shares for a total of $4.8 billion USD.

With this purchase, Vietnam Beverage, a Thai company, effectively gained control of SABECO, allowing it to dominate the most successful distribution network in the Vietnamese beer and beverage industry.