Accumulation is a term commonly used in the business sector. Whether or not you are engaged in business activities, it is essential to be familiar with and explore its significance. This article focuses on deciphering what accumulation is and delves into the formulas for calculating accumulation.

1. What is Accumulation?

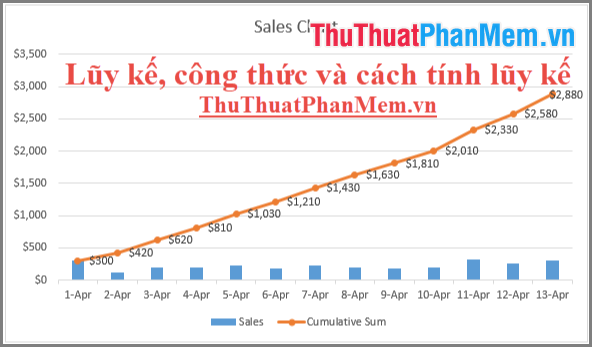

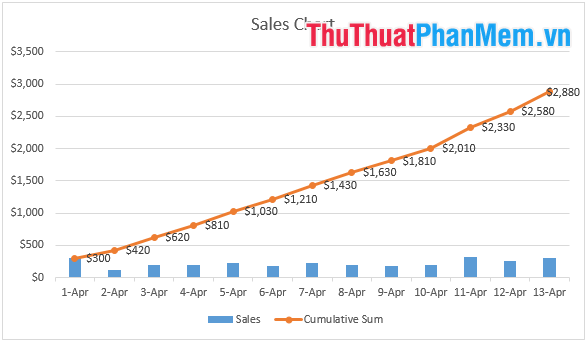

Accumulation (Cumulative) is the aggregated figures from previous calculations brought forward into the next accounting section for further computation.

Quarter 1: Loss of 3 million.

Quarter 2: Gain of 6 million.

Quarter 3: Gain of 2 million.

Quarter 4: Loss of 3 million.

=> Accumulated for the whole year is: (-3) + (6) + (2) + (-3) = 2 million, meaning a profit of 2 million.

3. Cumulative payment value

Cumulative payment value: Includes cumulative advance payments and cumulative payment by volume.

Where:

- Accumulated advance payment = Remaining contract value unrecovered by the end of the previous period – Advance payment discount + Proposed payment value for this period.

- Accumulated payment for completed volume = Amount paid for completed volume by the end of the previous period + Advance payment discount + Proposed payment value for this period.

=> Therefore, Accumulated payment value = Accumulated advance payment + Accumulated payment for completed volume.

4. Accumulated depreciation

Firstly, understand that depreciation is a gradual recovery of the invested value in fixed assets.

Accumulated depreciation is the total depreciation for this year and several previous years combined.

5. Accumulated losses

Accumulated losses refer to the decrease in assets, meaning the value recorded on the books is higher than the actual recovery value of that asset.

In such cases, we need to recognize an accumulated loss.

Example: For instance, a company purchases machinery and equipment for paper production with a depreciation period of 5 years. However, by the 4th year, the asset has fully depreciated in value. In this scenario, the asset has worn out faster than the depreciation calculation => Hence, an accumulated loss exists.

=> Accumulated loss = Book value of CGU – recoverable value of CGU.

With CGU being a cash-generating unit.

Accounting for accumulated losses:

- In a historical cost model, accumulated losses are determined as follows:

+ Debit = the cost of accumulated losses determined by gains or losses based on the value of those assets.

If this model is implemented, accumulated losses are recognized.

+ Debit = revalued surplus or equity on the assessed assets.

When calculating accumulated losses in this case, consider depreciation costs.

Is it possible to reverse accumulated losses?

Depending on the situation, you can reverse the scenario of accumulated losses. Specifically: Reversal is only possible when certain indicators allow for a reduction in accumulated losses and a return to the state of accumulated losses. Debit represents assets on the reversal of accumulated losses.

Please note: It is essential to adjust depreciation costs for the next period, and reversing accumulated losses in the trade advantage is not allowed.

So now you understand what accumulation is, how to calculate it in business. We hope from this article, you can plan whether your business is profitable or not. Wishing you all success!