Ensuring Safety Measures for Unanticipated Cash App Transactions

Essential Insights

- Receiving funds from unfamiliar sources on Cash App often indicates fraudulent activity, typically involving compromised accounts.

- Avoid utilizing the received funds, as they will likely be retracted upon detection of fraudulent behavior by the legitimate account holder.

- In the event of a payment request soliciting a refund, it is advisable to decline and initiate the refund process through Cash App's designated feature.

Recommended Actions

Understanding the Puzzling Phenomenon of Unexplained Cash Transfers

Receiving money from unknown sources may signal a potential scam. Fraudsters often exploit stolen payment methods or compromised Cash App accounts to transfer funds to unsuspecting individuals, anticipating reciprocal transfers. Subsequent to receiving an unexpected deposit, individuals commonly encounter a payment solicitation for an identical amount, accompanied by a claim of accidental transfer. It is imperative to disregard such payment requests.

- Complying with the scammer's requested payment typically results in deduction from one's personal bank account. The scammer frequently proceeds to redirect the transferred funds to their own account or another compromised Cash App account.

- Upon discovery of a significant transaction to Cash App, the legitimate owner of the compromised payment method typically disputes the charge with their bank, resulting in deduction of funds from your Cash App balance or bank account. Consequently, not only does the scammer acquire the transferred funds, but you may also be obligated to reimburse the victim of the fraudulent activity!

Occasionally, unsolicited funds may indeed stem from a genuine error. An individual might inadvertently transfer money to you by erroneously entering the recipient's Cashtag. Nonetheless, even in the event of an inadvertent transfer, it is advisable to adhere to the same protocol as with a potential scam. This approach ensures safe refunding to the sender without incurring additional liabilities.

Managing Unexpected Cash Infusions

Initiate a refund. Upon receiving funds from an unfamiliar sender, refrain from expenditure or compliance with refund requests. Instead, execute a refund via Cash App utilizing the following procedure:

- Access the Activity tab located at the bottom-right corner of Cash App.

- Identify the unanticipated transaction.

- Access the three-dot menu.

- Select Refund.

- Confirm by selecting OK.

Decline any payment requests. If you receive a payment request from an unfamiliar individual, it's important not to comply. Instead, decline the request to refund the sent amount without impacting your bank account. Additionally, you have the option to report the sender while declining. Here's how:

- Tap the Activity icon located at the bottom-right corner of Cash App.

- Select the payment request.

- Tap More Options or the three-dot menu at the top-right corner.

- Choose Decline Request.

- Alternatively, for further action, select Decline & Report This Request to inform Cash App about the scammer.

Reach out to Cash App support if you've fallen victim to a scam. In the unfortunate event of being scammed on Cash App, contact support directly by dialing 1 (800) 969-1940. Provide the support team with comprehensive details regarding the scam, and they may assist you in recovering your funds.

Preventing Cash App Scams

Disable incoming requests from unknown individuals. Although you cannot prevent random strangers from sending you money, you can control who can request money from you:

- Access the profile icon.

- Scroll down and select Security & Privacy.

- Under 'Incoming Requests,' choose Contacts only. Alternatively, toggle the slider to disable all incoming money requests.

Block individuals who send unsolicited money or requests. Following a refund and cancellation of the payment request, you can block them to prevent future interactions:

- Tap the Activity tab.

- Select the individual's name.

- Scroll down and click Block.

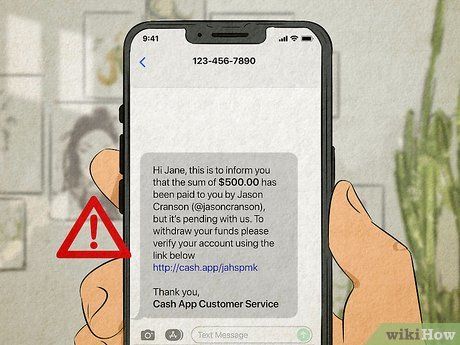

Stay alert for phishing attempts through email or text messages. While Cash App may send you emails and texts, legitimate messages will only contain website addresses such as square.com, squareup.com, cash.app, and cash.me. Emails will originate from addresses ending with @cash.app, @square.com, or @squareup.com. If you encounter any other links in the message (or if clicking or tapping a link redirects you elsewhere), it's not from Cash App.

- To avoid inadvertently providing your login credentials to scammers, only sign in to Cash App by opening the app on your Android or iPhone, or by typing https://cash.app directly into your web browser's address bar.

- If you have a brokerage account through Cash App, you may also receive emails from [email protected].

Exercise caution with emails, texts, and phone calls from individuals claiming to be from 'Cash App Support.' If someone contacts you purporting to be from Cash App, refrain from disclosing any personal information (username, PIN, social security number, or home address). Rather than responding or providing information, access Cash App on your phone or tablet, tap the profile icon, select Support, and then choose Chat. Inform the support team of your concerns regarding recent communication from Cash App and inquire whether the person contacting you is indeed from their support team.

- Cash App Support will never request test transactions or instruct you to download separate apps for support.

Beware of other fraudulent schemes. In addition to the mistaken deposit scam, there are other scams to be cautious of on Cash App:

- Cash flipping and clearance fees: If someone promises to increase or double your money in exchange for a fee for clearance or verification, do not comply. This is a scam, and you won't receive any funds.

- Payment and prize claims: If you receive communication via email, phone call, text, or social media instructing you to claim a payment, prize money, or any other form of payment, it's likely a scam. Never send money to someone claiming you've won something or are owed money.

- Deposit scams: These scams often target individuals shopping for pets, houses, or other expensive items on platforms like Craigslist, Facebook Marketplace, and OfferUp. Scammers will post realistic-looking photos and details, then request a deposit via Cash App to hold the item, property, or pet. Avoid making deposits via Cash App, Venmo, Zelle, or any other payment platform until you've met the seller in person and confirmed their legitimacy.

Enhance the security of your Cash App account. Utilize Cash App's built-in security features to safeguard your account against hackers and scammers. Access your profile, then tap Security & Privacy to review your options.

- Activate Security Lock to require a PIN, Touch ID, or Face ID for app access and fund transfers.

- Check the devices listed under 'Your Devices' to ensure no unrecognized devices are accessing your Cash App account.

- Implement two-factor authentication using an authenticator app like Google Authenticator or Authy. Enable the switch next to 'Use Authenticator App' to begin.

- Employ a strong password for your Cash App and email accounts.