In the era of robust modern technology, electronic wallets are gradually replacing traditional cash payments. ZaloPay, a popular payment method, is widely embraced. So, what is ZaloPay? What features does it offer? Is the registration process simple? Is it safe to use? Find all the answers right here on Mytour Blog.

What is ZaloPay?

The question of what ZaloPay is captures the attention of users. ZaloPay, also known as an electronic wallet, is a mobile payment method that allows you to conduct online transactions on devices such as phones, tablets, laptops, and more. Owned by Zion Joint Stock Company and VNG Company, ZaloPay has been licensed by the State Bank since January 18, 2016. In the diverse online payment market with various brands like Momo, VNPay, Mocapay, Payoo, ZaloPay maintains its strong position with many outstanding advantages.

Easily connect with multiple banks such as Vietinbank, Vietcombank, BIDV, Eximbank, Sacombank, VP Bank through ZaloPay. With its secure and safe features, along with swift transactions, this digital wallet is a tool that brings convenience to users in contemporary daily life.

ZaloPay is an online payment platform with various conveniences (Source: Internet)

ZaloPay is an online payment platform with various conveniences (Source: Internet)Key Features of ZaloPay

Do you have the basics of what ZaloPay is? So what features does this application offer? ZaloPay is not only simple but also widely preferred and used because of the conveniences it provides such as:

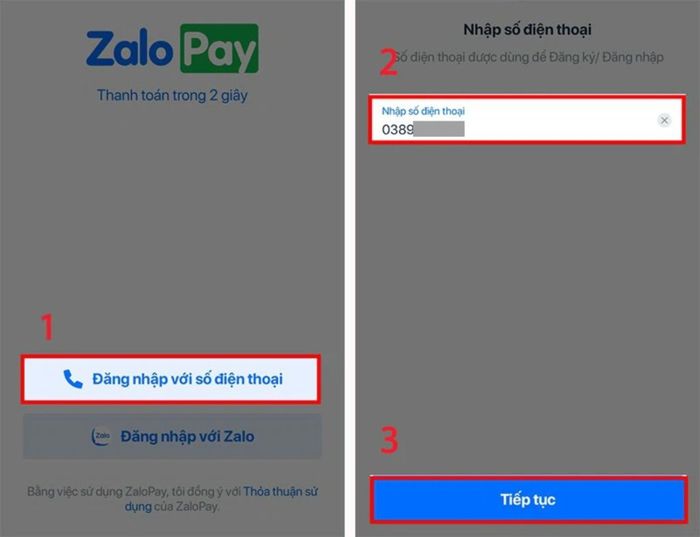

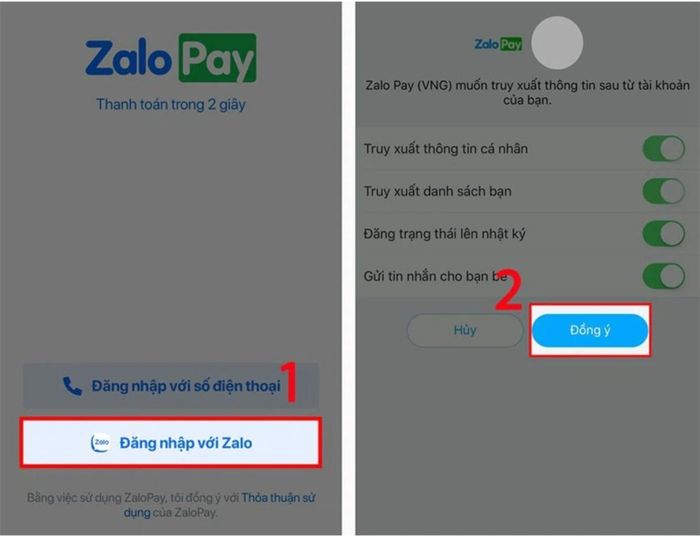

- Step 1: Access the ZaloPay online payment application

- Step 2: Choose the login method with your Zalo account -> press the “agree” button

- Step 3: Create a ZaloPay account password and confirm the password

- Step 4: Enter the phone number registered with ZaloPay and press “continue”

- Step 5: An OTP code will be sent to the phone number you registered in step 4. Enter this code and press “confirm” to complete the ZaloPay account registration.

Guidelines for registering ZaloPay using Zalo account (Source: Internet)

Guidelines for registering ZaloPay using Zalo account (Source: Internet)Register ZaloPay directly within Zalo

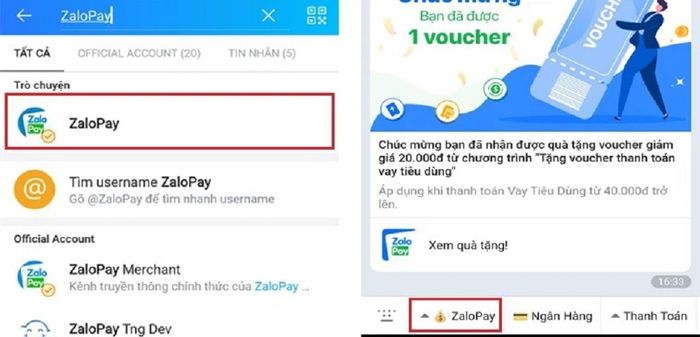

Once you understand what ZaloPay is, you can refer to the registration process below:

- Step 1: Access ZaloPay

- Step 2: In the search bar, enter the keyword “ZaloPay” and press search

- Step 3: Once found, press select ZaloPay

- Step 4: Zalopay wallet is integrated within Zalo, so the system will automatically create a ZaloPay account based on your Zalo account and the phone number used for Zalo registration.

Guide to registering ZaloPay integrated within Zalo account (Source: Internet)

Guide to registering ZaloPay integrated within Zalo account (Source: Internet)Frequently Asked Questions:

In modern life, the demand for cashless payments is increasing, and as you can see, ZaloPay completely meets the needs of users. This application provides many conveniences in transactions and payments, such as: quick 24/7 money transfers; online payment of electricity, water, cable TV, internet bills, mobile top-up, free bank account withdrawals…

However, some people still have concerns about the security of using electronic wallets. You can rest assured because ZaloPay implements PCI DSS security standards and security mechanisms using passwords/fingerprints or Face ID, ensuring the absolute safety of your information and money.

If the correct procedures are followed, it only takes a few seconds for the system to initiate the transfer from ZaloPay to the bank account. The money is transferred quickly, and the recipient receives it immediately.

Depending on the registration method, there are transfer limits, such as:

Registering transactions with just a password and phone number: maximum transfer of five million per day

Registering transactions with email and ID card: a limit of up to 200 million per day.

Currently, ZaloPay applies different fees for various types of money transfers, with some being free and others incurring fees. However, you can be confident that the fees are relatively low. Some transactions include:

Free payment of electricity, water, cable TV, internet bills…

Free money transfers between ZaloPay accounts.

Free withdrawals to domestic/international payment cards/bank accounts for the first five transactions in a month. The sixth transaction in the month incurs a fee of 0.5% of the transaction value, plus 3,100 VND.

Free transfers of up to five million total transaction amount/customer/month (unlimited number of transactions). If the limit is exceeded, a fee of 3,100 VND plus 0.65% of the transfer amount will be charged.

With the insights shared above, hope you now understand what ZaloPay is and the essential information about this application. Overall, it's an online payment platform with many conveniences, safety, and security for you to explore. To stay updated with more useful knowledge, don't forget to follow Mytour's page.