This detailed article guides you through the process of utilizing the CoupDays function in Excel.

Functionality: The COUPDAYS function calculates the number of days within an interest period, including the settlement date.

Syntax: COUPDAYS(settlement, maturity, frequency, [basis])

In this context:

- settlement: Securities settlement date is the day after the securities are sold following the issue date.

- maturity: Maturity date or expiration date of the securities.

- frequency: The number of interest payment periods for the securities per year. It can take the following values:

+ With frequency = 1: Annual payments.

+ With frequency = 2: Semi-annual payments.

+ With frequency = 4: Quarterly payments.

- basis: The basis used to calculate the number of days.

+ For basis = 0 or omit: Day-count basis 30/360 according to US standards.

+ For basis = 1: Calculate actual days / actual year.

+ For basis = 2: Actual month / 360 days / year.

+ For basis = 3: Actual month / 365 days / year + basis = 4: 30/360 days according to European standards.

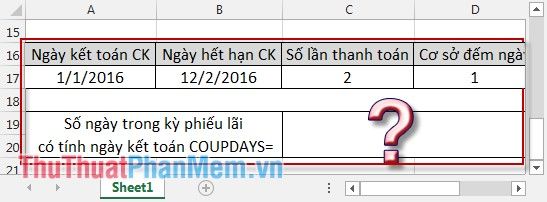

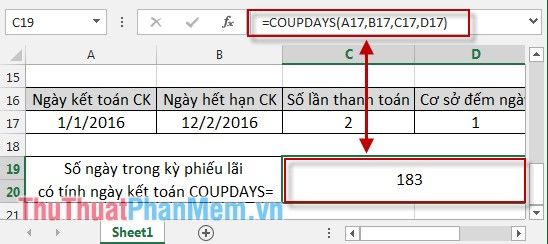

Example: Calculate the number of days in the interest period including the settlement date.

In the cell where you want the result, enter the following formula: COUPDAYS(A17,B17,C17,D17).

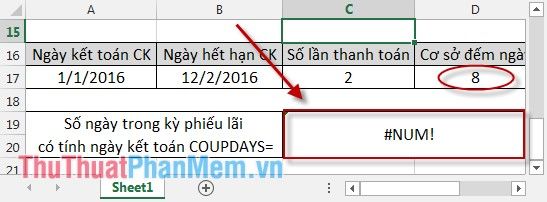

Note: In the given example, the default basis is not specified, meaning it defaults to the value of 0. When entering dates, ensure they are formatted according to the day-count basis. If you input the wrong basis => it will return an error #NUM!

Above is a detailed guide on how to use and apply the COUPDAYS function, hoping it will be helpful for you.

Wishing you all success on your journey!