Automated Teller Machines (ATMs), also known as “Automated Teller Machines,” revolutionize banking, providing a quick, convenient, and dependable solution. These versatile machines facilitate cash withdrawals, check deposits, and bill payments. If you're new to ATMs, this walkthrough will demonstrate how effortless they can be. Continue reading to discover how to use an ATM with a debit card, execute cash withdrawals or deposits across various accounts, and select the optimal ATM to evade unnecessary fees and economize.

Key Points to Consider

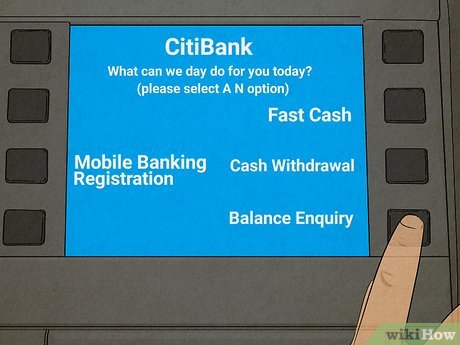

- Insert your card into the ATM with the chip facing forward. Enter your PIN, then follow the on-screen instructions to finalize your transaction.

- Whenever feasible, opt for ATMs affiliated with your card's issuing bank to avoid additional charges.

- For security purposes, utilize ATMs situated in well-lit, high-traffic areas. Always remember to retrieve your card, cash, and receipt upon completing your transaction.

Step-by-Step Guide

Accessing Your Account

- Certain ATM features, like cash deposits, may only be accessible at ATMs associated with your bank.

- Your bank and the ATM itself may impose extra fees.

- Prior to traveling, inform your bank and inquire about potential fees for international ATM transactions.

- Opt for ATMs situated in well-populated locations, preferably during daylight hours.

- If the card is inserted incorrectly, remove it, reorient it, and retry.

- The ATM may provide a visual guide or instructions on proper insertion.

- The length of your PIN may vary depending on your bank's policies.

- For security reasons, never disclose your PIN to anyone.

Withdrawals, Deposits, & Other Transactions

- At affiliated ATMs, you can select the account from which to withdraw funds.

- For instance, you can withdraw from your savings instead of your checking account.

- Take care not to exceed withdrawal limits, which vary by ATM and bank.

- You can specify the destination account for the deposit if you have multiple accounts.

- Deposits may have delayed availability, and cash and check deposits are typically separate transactions.

- Deposits are not possible at non-affiliated ATMs.

- Choose the account for which you want to check the balance, or view all accounts if available.

- Some ATMs may charge fees for balance inquiries if not affiliated with your bank.

- Some banks facilitate bill payments through their ATMs.

- For instance, if you possess a credit card from the same bank, you might settle your credit card dues by transferring funds from your bank account.

- Verify with your bank regarding ATM bill payment facilities. Certain banks may require prior authorization for ATM bill payments via online channels.

- Pressing the red “X” post-transaction completion won’t reverse the transaction. For example, completing a check deposit and then pressing “X” won’t retract the check.

- In case of forgetting your card, promptly return to the ATM for retrieval. If lost, contact your bank immediately to block the card and request a replacement.

Recommendations

-

If your card is misplaced or stolen, promptly notify your bank to arrange for a replacement.

-

Several ATMs offer audio cues, spoken guidance, and braille support for visually impaired users.

-

Certain ATMs feature headphone jacks catering to users with visual impairments.

Cautionary Notes

- When entering your PIN, shield the keypad with your hand.

- Do not disclose your PIN to anyone.

- Remember to conclude your ATM session and retrieve your card, cash, and receipt.

- Before utilizing an ATM, assess your surroundings. Whenever feasible, opt for ATMs located in well-lit, busy areas.