If you're considering a shift from the conventional bank setup, Chime might have caught your attention. Chime, an online financial technology entity, offers a compelling alternative, but skepticism persists regarding its legitimacy. Despite not being a bank itself, Chime extends legitimate financial services through its affiliated banks. Dive deeper to grasp the essence of Chime, exploring its functionalities, charges, and a comprehensive list of pros and cons.

Essential Insights

- Chime, although not classified as a traditional bank, operates as a legitimate financial service.

- Functioning as a neobank, Chime collaborates with two FDIC insured banks to deliver online banking amenities, yet it doesn't hold FDIC insurance itself.

- On the whole, Chime garners favorable feedback across various online review platforms, notwithstanding occasional reports of abrupt account terminations sans prior notice.

Guiding Principles

Is Chime trustworthy?

- FDIC deposit insurance shields your funds in the event of a bank failure or cessation of operations. Deposits encompass checking accounts, savings accounts, CDs (certificate of deposit accounts), and MMDAs (money market deposit accounts). Deposits are insured up to at least $250,000 per depositor, per bank, per ownership category (e.g., trust accounts, business accounts, individual accounts, etc.).

- Although Chime's partner banks possess FDIC insurance, the FDIC does not extend insurance coverage to the closure of non-bank entities such as neobanks. This implies that if one of Chime's partner banks shuts down, you are safeguarded by the FDIC. However, if Chime itself ceases operations, you are not covered.

- In 2021, Chime informed ProPublica that many of these account closures were prompted by suspected fraudulent activities following government stimulus payments, albeit acknowledging the possibility of erroneous closures.

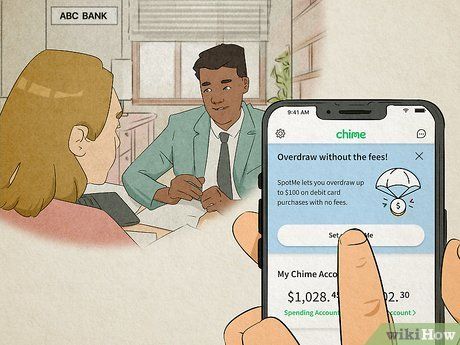

Chime Attributes

- Checking account: Chime furnishes a standard checking account accessible to any U.S. resident aged 18 or above with a valid social security number. Chime's checking account comes devoid of monthly or transaction fees, and you can make deposits via mobile deposit (paper checks) or cash deposits in-person at various retailers (e.g., Walmart, Walgreens, Target, or CVS). However, Chime checking accounts aren't eligible for joint ownership.

- Savings account: Chime also presents a 2% APY savings account, requiring you to have a Chime checking account beforehand. You can effortlessly transfer funds from your checking account, and Chime offers two automated savings schemes to aid your savings efforts after each transaction or direct deposit, with no minimum balance requirement.

- Credit builder: Chime offers the Chime Credit Builder Secured Visa Credit Card, designed to assist users in improving their credit. Eligibility necessitates a Chime checking account and receipt of at least one $200 direct deposit into your Chime checking account from your employer. Upon approval, you can deposit funds into your credit builder card as a security deposit, which determines your spending limit.

Chime Charges

Advantages and Disadvantages of Chime

- Chime levies minimal fees

- The Chime app is user-friendly and straightforward

- Applying for Chime is swift and hassle-free

- Chime is compatible with CashApp or certain cash advance apps

- Chime's Credit Builder aids individuals with low credit scores in enhancing their creditworthiness

- Chime lacks physical branches

- Joint accounts are not supported by Chime

- Some ATMs may impose out-of-network fees

- Recent reports highlight complaints about Chime closing accounts

- Chime does not integrate with Zelle

Advantages and Disadvantages of Neobanks

- Convenience, eliminating the need to visit a physical bank branch

- Convenient for individuals receiving direct deposits

- Convenient for individuals who infrequently visit physical banks

- Neobanks generally have lower fees compared to traditional banks

- Neobanks typically offer higher interest rates on savings compared to traditional banks

- Most neobanks collaborate with FDIC-insured banks to provide their services

- Neobanks offer fewer services compared to traditional banks (e.g., no loans, wealth management, etc.)

- Neobanks generally do not offer the same level of customer service as traditional banks

- Neobanks represent a relatively new concept, making it challenging to establish trust

- If a neobank ceases operations, retrieving your funds may prove difficult, as the FDIC only insures banks