For online transactions, banks often require you to enter an OTP code to authenticate the transaction. However, do you know exactly what an OTP code is? How many types of authentication OTP codes are there? And important security measures for OTP codes. In this article, Mytour will clarify all the details about this information.

Explore more:What is FYP? How to use #FYP to make videos trend on Tiktok

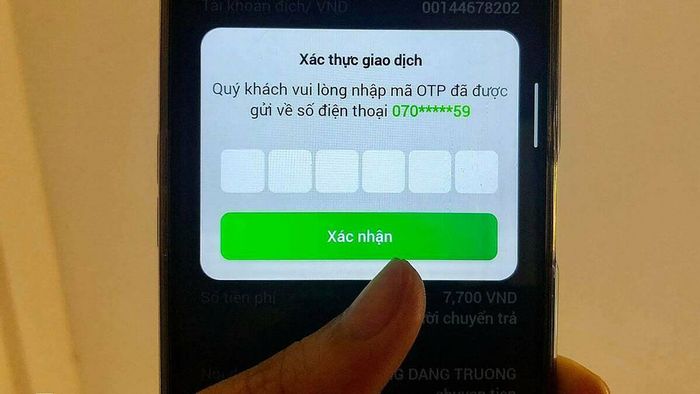

Using OTP codes to secure your bank transactions

Using OTP codes to secure your bank transactionsUnderstanding OTP Codes

OTP Code (an abbreviation for One Time Password) is a single-use password provided by banks or financial apps to authenticate an online transaction. An OTP code can be a number, character, or a combination of both.

The OTP code is used only once and corresponds to a specific transaction you are performing. To enhance security, OTP codes have a very short usage period, typically ranging from 30 seconds to 5 minutes.

Explore more:What is saline solution? Ingredients and uses of saline solution

OTP codes have a brief usage window and require absolute security.

OTP codes have a brief usage window and require absolute security.How many types of OTP codes are there?

To gain a deeper understanding of the Smart OTP PIN and what OTP authentication entails, please refer to the information below:

SMS OTP Code

The SMS OTP method is widely used in current transactions, applicable with most banks. Users receive the OTP authentication code on their registered phones via SMS. To proceed with transactions and perform subsequent actions, users need to enter the received OTP code.

Most banks nowadays utilize SMS OTP.

Most banks nowadays utilize SMS OTP.Token Key

Differing from obtaining OTP codes on the phone, the Token key is a device used to generate OTP codes without requiring internet access. As a portable device with a compact size, the Token key needs to be carefully stored to avoid loss.

Each Token key is designated for use with a specific bank account, and users need to replace it with a new token after a certain period.

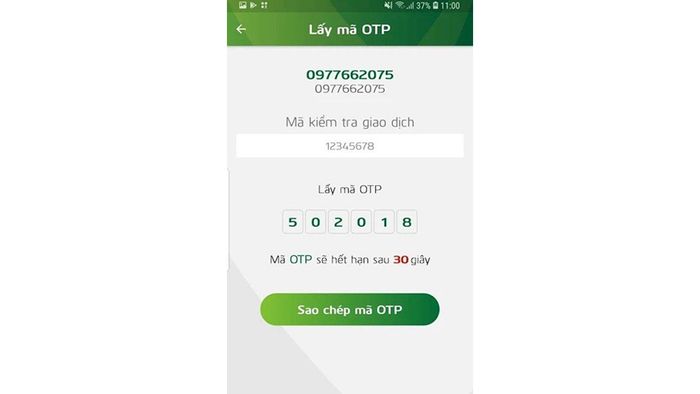

Smart OTP PIN

The combination of Token key and SMS OTP creates the Smart OTP PIN. The Smart OTP PIN is increasingly popular in current transactions as it integrates with applications on smartphones and tablets.

With the outstanding advantage of being software installed directly on smart devices, Smart OTP helps users easily retrieve OTP codes quickly and completely autonomously. Additionally, Smart OTP is encrypted with multiple layers of special security, minimizing potential risks.

Voice OTP

Voice OTP is a method of obtaining OTP codes implemented by some banks recently. So, how does the process of obtaining OTP codes through Voice OTP work? Users will receive a system call to the registered phone number to play an audio with the OTP code.

Recent times have witnessed the widespread implementation of Voice OTP.

Recent times have witnessed the widespread implementation of Voice OTP.The Most Popular Way to Obtain OTP Nowadays

For the quickest OTP retrieval, users should opt for the phone-based method, commonly known as SMS OTP retrieval. Specifically, log in to your bank's app and initiate the desired transaction. Press the 'Get OTP' button, and instantly, the bank will send the OTP to the registered phone number. Finally, input the OTP back into the bank app to confirm the transaction.

Similar to payment transactions, the OTP will be sent to the phone number linked to your bank account. You only need to input the OTP to settle the bill as required.

Enter the OTP to confirm the transaction.

Enter the OTP to confirm the transaction.Key Considerations When Using OTP

In recent times, some malicious individuals often exploit OTP codes for fraud, seizing assets, or stealing personal information. Therefore, users of OTP codes need to keep the following in mind:

Never share OTP codes with others

OTP codes should be kept secure and used by the rightful owner. Typically, bank employees or official agencies will never ask you to provide OTP codes. If such a case occurs, it is likely impersonation for fraudulent purposes. Absolutely do not send OTP codes to those entities.

Avoid providing OTP codes to safeguard accounts and personal information.

Avoid providing OTP codes to safeguard accounts and personal information.Do not enter OTP codes in unfamiliar URLs

This is a common form of fraud that has been present for a long time. However, many people, for some reason, have entered OTP codes into those links and lost hundreds of millions in an instant.

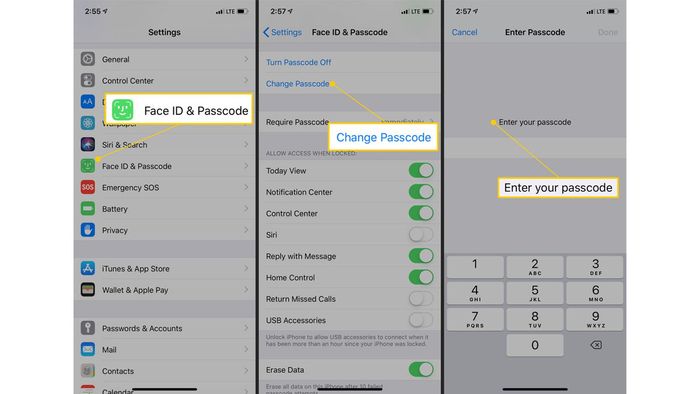

Set up passwords for smartphones and tablets

Setting up a password for your smart devices is an effective way to prevent malicious actors from executing SMS OTP code retrieval methods. Smartphones nowadays serve not only the traditional call and text functions but also store a wealth of information and money. Establishing a password will greatly minimize the risk of unauthorized individuals infiltrating your phone and siphoning money from your bank account.

Choose Face ID & Passcode to set up passwords for phones.

Choose Face ID & Passcode to set up passwords for phones.Lock SMS OTP when losing your phone

If unfortunately, you lose your phone, promptly contact the bank and manually lock the SMS feature. Your SMS OTP code may very well appear on the lock screen.

Frequently Asked Questions about Using OTP codes

When using OTP codes for transaction payments, you often encounter certain issues. So, how to address these issues? Check out the information below for solutions.

Why should you not provide OTP codes to others?

As per the guidelines for using OTP codes, providing OTP codes to others can lead to strangers making transactions or seizing the entire amount in your bank.

Absolutely refrain from providing OTP codes to others to avoid losing money.

Absolutely refrain from providing OTP codes to others to avoid losing money.Why is the OTP code not sent to the phone during transactions?

There are various reasons affecting the delivery of OTP codes to the phone.

Firstly, users need to check the SIM status. During usage, your phone may encounter an issue causing the SIM to become loose or fall out.

If the SIM is still functioning well on the phone, check if it's blocked. You can call someone or directly contact the network provider to inquire about the SIM status.

If your SIM is not blocked, verify if you are blocking messages from the bank. Go to an area with stronger mobile signal to easily receive messages.

Double-check if the registered phone number matches the one you are using. If there's any discrepancy, immediately contact the bank.

What to do when you lose the registered OTP receiving SIM?

This situation is not uncommon; if unfortunately, you lose the SIM registered for receiving OTP codes, simply contact the bank and follow some procedures to switch the OTP receiving phone number.

Additionally, you can also block OTP code reception and then visit the network provider to get a new SIM.

Conclusion

Once you understand what OTP codes are, along with the precautions and methods to obtain them, you will no longer worry when using them. This makes transactions from the bank much quicker, simpler, and significantly safer. If you have any questions about OTP codes, feel free to leave a comment below for Mytour to address. Thank you for reading the article.

OTP