As a business owner or accountant, understanding the Tax Identification Number (TIN) is crucial. Discover why TINs exist and their practical benefits in the article below.

Defining the Tax Identification Number

In English, the Tax Identification Number is known as the Tax Identification Number, consisting of a sequence of encoded digits assigned by tax authorities based on tax regulations.

Explore some English terms related to taxation:

Tax Identification Number: Personal Income Tax ID

Individual Taxpayer Identification Number: ID for Individual Income Tax Declaration

Personal Income Tax: Tax on Individual Income

Exploring the realms of Profit Tax: Unveiling the corporate income tax

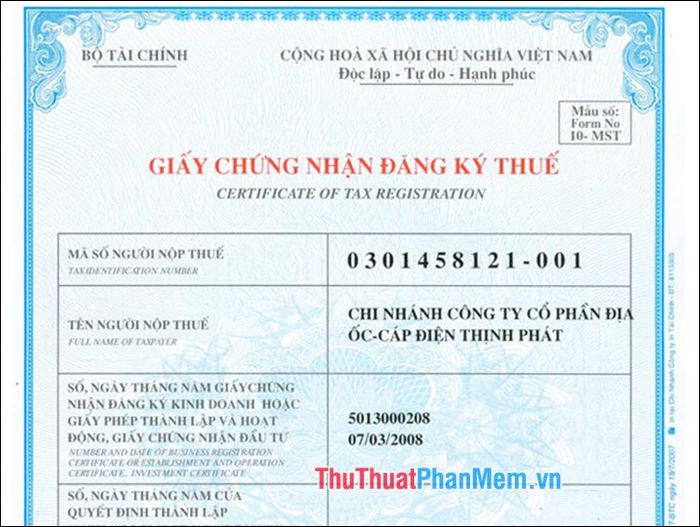

Decoding the essence of tax identification numbers

The company tax code is structured as a sequence divided into various groups, illustrated as follows:

N1N2 N3N4N5N6N7N8N9 N10 N11N12N13

In this context:

- The first two digits N1N2 represent the provincial code of the tax identification number, as specified in the provincial code list.

- The seven digits N3N4N5N6N7N8N9 are assigned sequentially from 0000001 to 9999999. The digit N10 is the check digit.

- Ten digits from N1 to N10 are assigned to individual taxpayers and main units.

- Three digits N11N12N13 are sequential numbers from 001 to 999 assigned to each subunit, branch of individual taxpayers, and main units.

Please note:

There are 2 groups of tax identification numbers:

The tax identification number consists of 13 digits and is assigned to:

- Branches, representative offices, and business locations of enterprises with tax obligations for direct tax declaration to the tax authorities;

- Subsidiary entities under the parent company, affiliated entities with tax obligations.

The tax identification number with 10 digits is assigned to:

- Individuals with taxable personal income, Family household organizations engaged in business, production, as well as providing goods and services;

- Authorized fee-collecting organizations, Individuals and organizations responsible for tax payment and deductions to the state budget according to the law;

- Entities related to taxes: Project management boards, business entities, individuals and organizations without additional tax obligations or receiving orders from abroad;

- Foreign organizations without Vietnamese legal entity status, foreign individuals independently conducting business in Vietnam in accordance with Vietnamese laws;

- Individuals and organizations with incurred liabilities to contribute to the state budget.

What is the purpose of an individual tax identification number and the benefits it brings?

Individuals with a personal tax identification number are only subject to a temporary 10% income tax deduction (instead of 20% for those without a tax identification number) when earning occasional income over one million dong for a single instance of providing services without a labor contract.

Having a personal tax identification number allows you to get a refund for any excess tax deducted monthly compared to the actual tax you are required to pay, according to tax laws. Additionally, you can receive tax reductions in the event of natural disasters, fires, sudden accidents, or serious illnesses. Individuals with a personal tax identification number can benefit from free tax guidance provided by the tax authorities.

Thank you for taking the time to read the article What is an English Tax Code? and don't forget to leave your comments below to contribute your thoughts to the article.