Utilizing the SUMIF function streamlines the process, whether you're calculating total revenue for a department, sales figures for a group of employees, or earnings over a specific period.

Excel's SUMIF Formula

=SUMIF (range, criteria, [sum_range])Where:

- Range: The range of cells you want to evaluate based on the given criteria. Example: A1: A10

- Criteria: Defines the values to be summed. It can be a number, expression, or text string. For instance, criteria could include “5”, “cherries“, “10/25/2014”, “<5”, “A1”...

- Sum_range: An optional parameter indicating the cells to be summed. If left blank, sum_range, the cells within the evaluation range will be used instead.

Using SUMIF with Examples

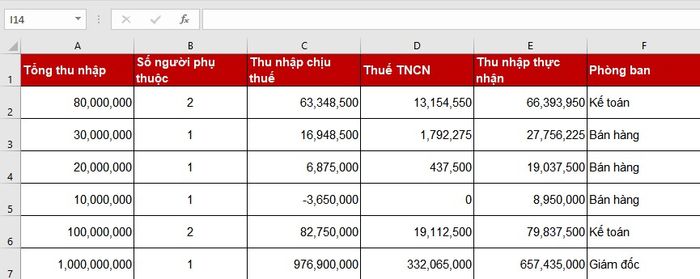

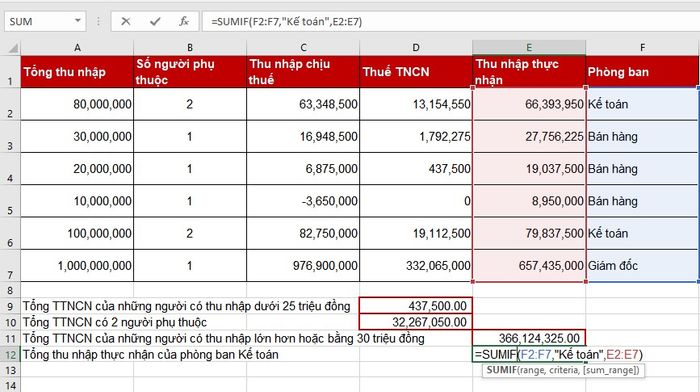

Imagine we have an Excel summary table of income and personal income tax as follows:

Table 1

Table 1Example 1: Using SUMIF to calculate total personal income tax

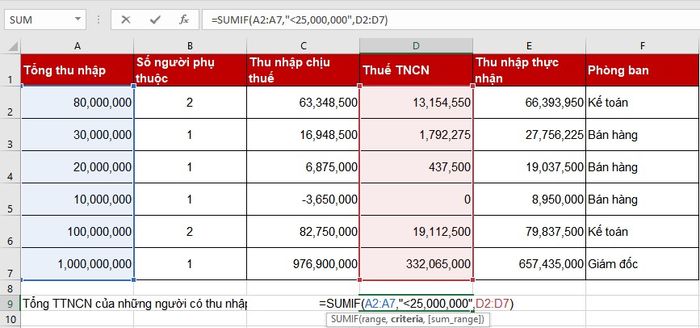

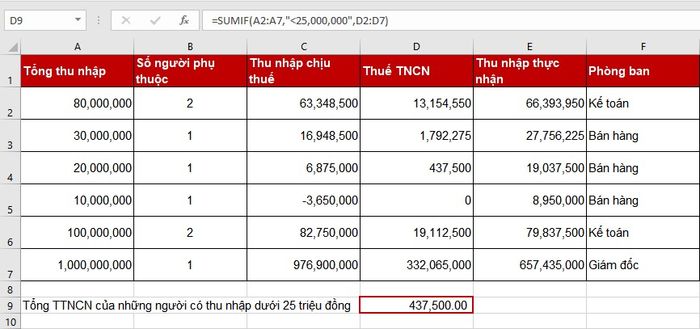

Calculating the total personal income tax for individuals with income below 25 million VND.

- Range: The column range containing total income, here it's A2:A7

- Criteria is <25,000,000, since it involves mathematical symbols, it needs to be set within '': '<25,000,000'

- Sum_range is the column range containing personal income tax to be summed, here it's D2:D7.

Step 2:Input

Step 2:Input

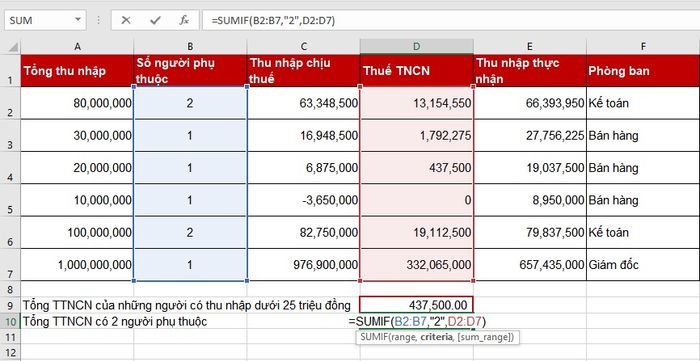

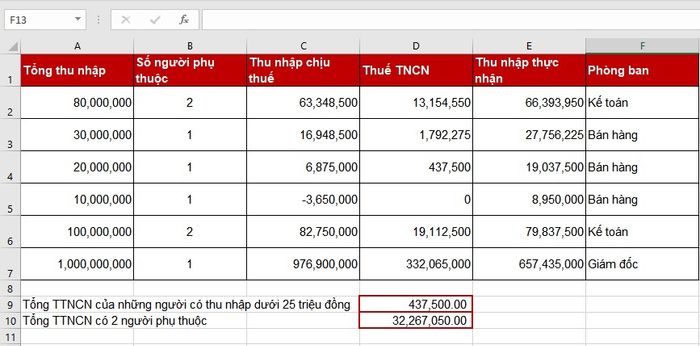

Example 2: Calculate the total personal income tax for individuals with 2 dependents

Step 1: Determine the parameters of the SUMIF function, specifically:

- Range: The column range containing the number of dependents, here it's B2:B7

- Criteria is 2 or '=2'

- Sum_range is the column range containing personal income tax to be summed, here it's D2:D7.

Step 2:Input

Step 2:Input

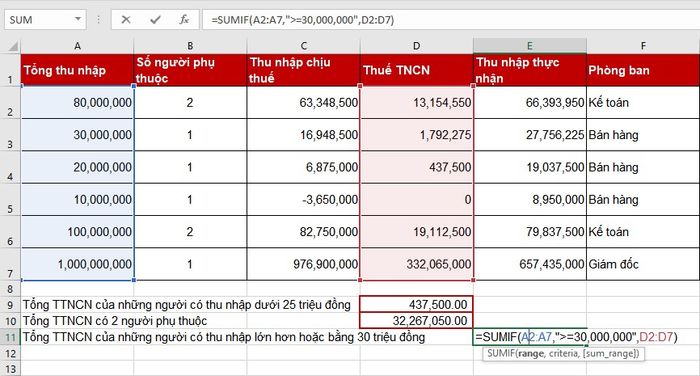

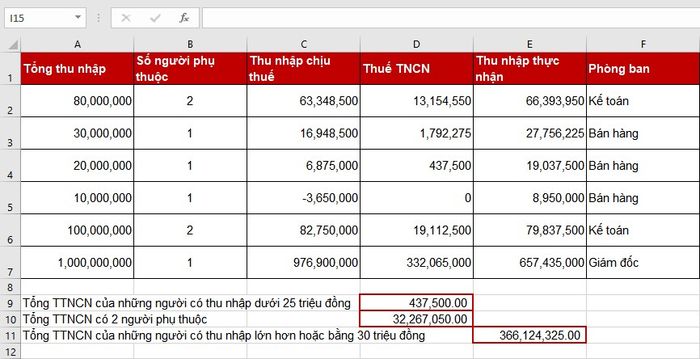

Example 3: Calculate the total personal income tax for individuals with total income greater than or equal to 30 million

- Range: The column range containing total income, here it's A2:A7

- Criteria is '>=30,000,000'

- Sum_range is the column range containing personal income tax to be summed, here it's D2:D7.

Step 2:Enter

Step 2:Enter

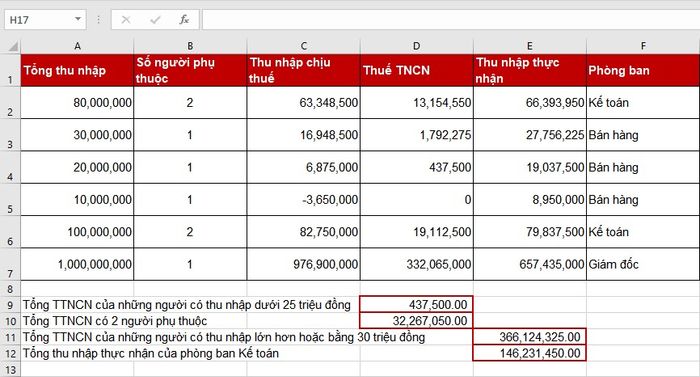

Example 4: Calculate the total actual income of the accounting department

Step 1:- Range: The column range containing the list of departments, here it's F2:F7

- Criteria is 'Accounting'

- Sum_range is the column range containing the actual income to be summed, here it's E2:E7

Step 3:Enter

Step 3:Enter

Some considerations when using the SUMIF function

- When the sum_range variable is omitted, the sum will be calculated based on the Range.

- Criteria containing text or mathematical symbols must be enclosed in double quotes ''.

- For numeric format range, double quotes are not required.

- The characters ? and * can both be used in Criteria. A question mark matches any single character; an asterisk matches any string of characters. If you want to find a literal question mark or asterisk, type a tilde (~) before the character.

Conclusion on using the SUMIF function in Excel

So, I've just guided you on how to apply the SUMIF function to calculate conditional sums. Pretty straightforward, isn't it? Just ensure you define the parameters correctly and input the formula, and you're done. Wishing you successful execution!

Explore more articles: excel tricks.BUY LAPTOPS AT SUPERB PRICES