Apple, a major player in the tech industry, has achieved significant success in sales, market share, and global market capitalization. However, the Indian market remains a challenge for Apple as their market share here is still low and hasn't reached the top 5. So what's happening with the company in India? Let's analyze with Mytour in the article below!

Apple's Achievements in the International Market

The global smartphone market is growing rapidly. The number of smartphone users is increasing every year, leading to high commercial mobile sales. This underscores the importance of capturing mobile device usage statistics when building digital marketing strategies.

Apple - a tech giant in the industry

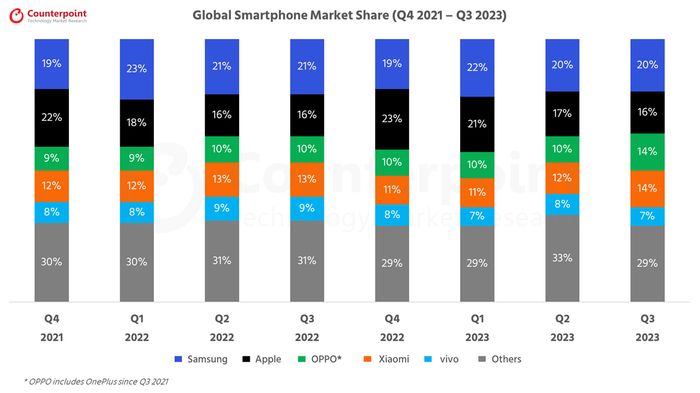

Apple - a tech giant in the industryAccording to the latest statistics, Apple is one of the leading smartphone manufacturers globally, commanding a 16% market share. Apple primarily produces high-end mobile devices, and this 16% is considered significant as other manufacturers mainly target lower segments. Even when considering the high-priced product line, Apple still holds a competitive edge.

Apple holds a 16% share in the global mobile phone market. Source: Counterpoint

Apple holds a 16% share in the global mobile phone market. Source: CounterpointIn the fiercely competitive landscape, Apple continues to maintain a significant influence in the international market. Although their market share is not always number one, positive quality, reputation, and user experience have helped them maintain a stable market share. In some countries, such as the United States and certain European markets, Apple still holds a leading position in the mobile technology industry.

What Challenges is Apple Facing in the Indian Market

India is the world's second-largest smartphone market, with a large scale that attracts many major players as there are over 140 brands competing in this market. It's a promising market with a large and increasingly affluent population. However, Apple has yet to capture a large market share in this market.

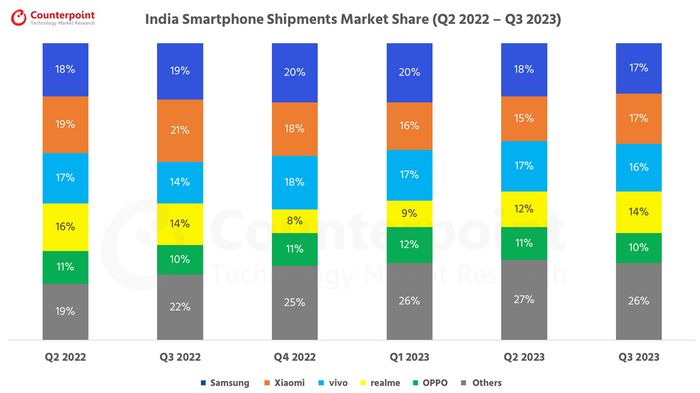

Apple fails to make it to the top 5 phone manufacturers holding a large market share in India

Apple fails to make it to the top 5 phone manufacturers holding a large market share in IndiaAccording to the latest report from Counterpoint, in Q3 2023, Apple held a 17% market share of smartphones in India, followed by (17%), (16%), (14%), (10%), and 26% for other brands.

Apple holds a significantly low share compared to the overall landscape, with less than 10% market share in India. Source: Counterpoint

Apple holds a significantly low share compared to the overall landscape, with less than 10% market share in India. Source: CounterpointMeanwhile, Apple, a global brand, struggles with low market share in India, failing to make it to the top 5 (less than 10%). During this period, Apple recorded its highest quarterly shipments ever, but the growth rate did not change significantly, and the market share increased compared to Q2.

What Leads to These Challenges for Apple

High Product Prices

There are multiple reasons why Apple cannot break into the top smartphone market share in India. One of the main reasons is the high prices of Apple products compared to the income level of Indian citizens. A phone priced at around $999 to $1200 or more at this time has become a luxury item for many people.

More than 90% of the Indian market falls within the sub-$300 price range, and Apple completely abstains from this segment with its new models and even the previous generation at high prices. Everyone knows Apple as a super-premium brand; they produce beautiful and quality devices that everyone desires.

The high product prices exceed the spending capacity of the average Indian population.

The high product prices exceed the spending capacity of the average Indian population.However, not everyone can afford one. With high prices, iPhones become out of reach for most consumers, making them desirable but hard to own. This contributes to Apple's lower market share in India compared to its competitors.

Limited Distribution Network

Adapting to local regulations, Apple had to adjust its retail strategy in India. Unlike the brick-and-mortar and online store model in many countries, in India, Apple cannot independently operate stores due to a 2018 regulation requiring foreign businesses to partner with local entities.

Tim Cook, Apple's CEO, declined to collaborate with a local entity at the time and upheld the principle of 'doing things our way.' Consequently, their products are not directly sold through Apple stores but via third-party partners. This creates a difference in their distribution strategy in India compared to many other markets worldwide.

Apple upholds the principle of 'doing things our way.'

Apple upholds the principle of 'doing things our way.'Until 2023, when restrictions were eased and Apple was allowed to open stores in India, there were still some limitations, so expansion has not yet occurred. Currently, Apple only has two retail stores in India, located in Mumbai and Delhi. This reflects Apple's distribution challenges in previous years. Although stores have been opened, it remains difficult for people in India, especially those living in remote areas.

Competition from Android Manufacturers

Android smartphone manufacturers dominate the market in India. Leading brands include Xiaomi, Samsung, realme, OPPO, and vivo. These manufacturers are fiercely competing to capture market share by offering affordable products that meet the needs of Indian consumers.

Android smartphone manufacturers in India have several competitive advantages over Apple. One advantage is product pricing. Android manufacturers typically offer lower-priced products compared to Apple. This makes Android manufacturer products more appealing to Indian consumers with lower to middle incomes.

Android smartphone manufacturers in India have several competitive advantages over Apple

Android smartphone manufacturers in India have several competitive advantages over AppleAnother advantage is the distribution network. Android manufacturers have a widespread distribution network in India. This makes it easier for Indian consumers to access Android products. Additionally, Android manufacturers frequently release new products with new features and technologies. This helps Android manufacturers attract new customers and retain current ones.

National Pride

This can also be seen as a factor influencing the loyalty of Indian consumers to domestic smartphone brands. Indian consumers tend to support domestic products, showing national pride. This also contributes to the popularity of domestic smartphone brands in India.

Indian consumers tend to support domestic products, showing national pride

Indian consumers tend to support domestic products, showing national prideIndian consumers tend to be loyal to domestic smartphone brands, such as Micromax, Lava, Intex,... This divides the market share in India and makes it difficult for Apple to compete in this promising land.

Conclusion

In summary, the major challenge Apple faces in the Indian market doesn't just come from the competition among phone brands but also from specific market factors. With prices significantly higher than the average income, limited distribution networks, and fierce competition from Android rivals, Apple is struggling to penetrate the Indian market.

Therefore, implementing strategic solutions and adapting to the specificities of the Indian market could open the door for Apple to capture a more significant portion of the smartphone market in this country. However, it requires sharpness, creativity, and long-term commitment from Apple to succeed in this challenging environment.

Read more:- Besides the new iPhone, what other groundbreaking products will Apple unveil in 2024?

- Article category: Market Insights