By knowing the loan amount and the interest payment, you can determine the maximum interest rate you are willing to accept. Additionally, reviewing annual interest payments allows you to identify the annual percentage rate (APR). Calculating interest rates is a straightforward task that can also help you save significant money when making investment decisions.

Steps

Calculate Interest Rates

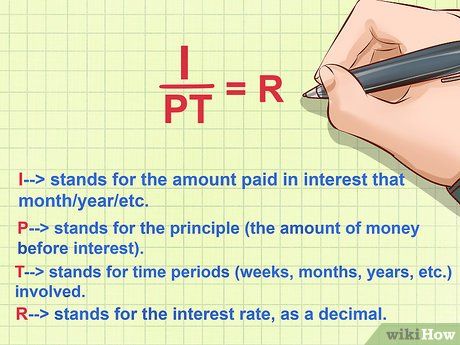

- I represents the interest amount to be paid for that specific month/year/etc.

- P is the principal amount (the initial amount before interest).

- T is the time period (weeks, months, years, etc.) involved.

- R is the interest rate (in decimal form).

Convert the interest rate to a percentage by multiplying it by 100.

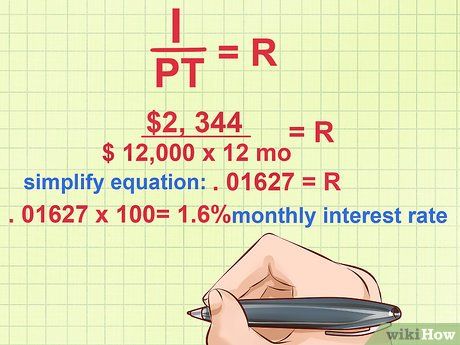

Convert the interest rate to a percentage by multiplying it by 100. Refer to the latest statement to input values into the interest rate calculation equation.Interest Rate Calculation Equation:Substitute the values:Simplify the equation:Multiply this value by 100 to get the percentage:1.6% monthly interest rate.

Refer to the latest statement to input values into the interest rate calculation equation.Interest Rate Calculation Equation:Substitute the values:Simplify the equation:Multiply this value by 100 to get the percentage:1.6% monthly interest rate.

Ensure that the time period and interest rate are calculated on the same scale. For example, if you want to find the monthly interest rate for a loan after one year, and you input "1" for T, meaning "one year," the final interest rate will be the annual rate. To calculate the monthly interest rate, you must use the correct time frame. In this case, you would use 12 months.

- The time period refers to the duration over which interest payments are made. For instance, if you are calculating monthly interest payments over a year, you would make 12 payments.

- Always confirm with the bank how the interest is calculated—whether monthly, yearly, weekly, etc.

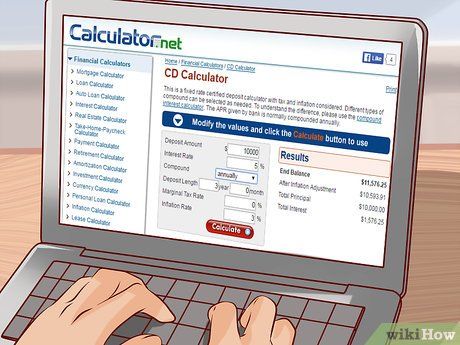

Use online calculators to determine interest rates for complex loans like mortgages. Interest rates for loans should be provided when you apply for a loan or credit card. However, confusing terms like APR (“annual percentage rate”) and variable interest rates can make it difficult to understand how these rates are calculated. Variable interest rates are nearly impossible to calculate manually, but online tools can help you find specific values for complex loans. Bankrate.com and CalculatorSoup are reliable and independent websites.

- Search online using phrases like “Calculator + Interest Rate + Loan Type.” For example, search for “mortgage interest rate calculator,” “savings deposit interest rate calculator,” or “annual percentage rate calculator.”

Understanding Interest Rates

Negotiate with a bank loan officer to secure a lower interest rate. Interest rates are often the primary point of negotiation for loans. To succeed, you must be well-prepared before entering negotiations. Before visiting the bank or making a call, know the amount you need, the interest you’re willing to pay, and what rate is too high for you. Financially stable individuals with credit scores of 650+ have a higher chance of successfully negotiating rates.

- Call your credit card issuer and inform them you’ve found better rates elsewhere. If you’re a reliable customer who pays on time, they may work to retain your business.

- Discuss the lowest possible rate the bank can offer. Compare different banks to expand your options.

- Be cautious with variable annual percentage rates (APRs)—they may seem attractive initially but often spike significantly after 1-2 years.

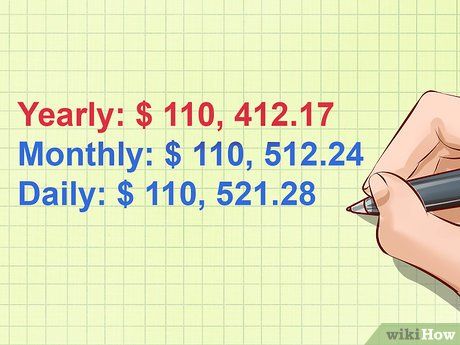

Opt for longer compounding periods to pay less interest. Compounding frequency determines how often interest is added to the principal. If the compounding period is too short (e.g., daily), unpaid interest at the end of the day is added to the principal. This means next month’s interest will be higher due to the increased principal. For example, consider a $100,000 loan at 4% interest compounded in three different ways:

- Annually: $110,412.17

- Monthly: $110,512.24

- Daily: $110,521.28

Pay more than the required interest whenever possible, regardless of the interest rate. Remember, interest is calculated as a percentage of the principal. Simply put—the more you owe, the more interest you pay. If you can pay down the principal along with the interest each month, even if the rate remains unchanged, the total interest paid will decrease.

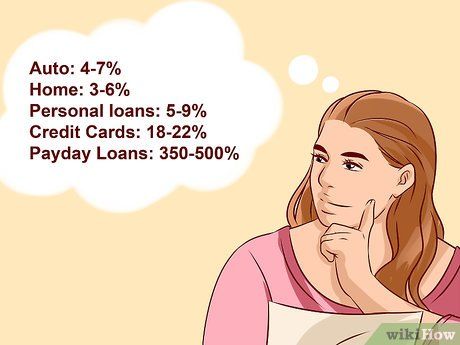

Monitor prevailing interest rates before borrowing money. Interest can be seen as the cost of borrowing. Whether you’re paying interest or the bank is paying you for “borrowing” your savings, you need to know the rates before signing any agreements.

- Car loans: 4-7%

- Mortgages: 3-6%

- Personal loans: 5-9%

- Credit cards: 18-22%

- Payday loans: 350-500%.

Understand investment interest rates to use your money wisely. Safer accounts, such as savings accounts, certificates of deposit, and bonds, typically offer lower interest rates. However, these secure, slow-growth accounts can be beneficial for retirement savings. Other accounts with higher interest rates may yield more money but come with increased risks.

- Savings accounts: 1-2%

- Certificates of deposit: 1-2%

- U.S. Treasury bonds (30+ years): 3-4%

- 401k & IRA: 6-10%

Tips

- Always research and fully understand interest rates before signing any documents. Know how much interest you’ll be paying before committing to an agreement.

Warnings

- Double-check calculations for critical figures. If in doubt, use an online calculator or consult a bank representative.

What You'll Need

- Pencil

- Paper

- Calculator

- Bank/Loan Details