If you know how to calculate the loan repayment amount, you can plan your expenses effectively. It's recommended to use an online loan calculator, as it prevents errors that may occur when using a standard calculator with lengthy formulas.

Steps

Use an Online Loan Calculator

Open an online loan repayment calculator program. You can click on the “sample” calculator at the top of the page, then open it in Google Drive or download it (check the instructions) to open it in Excel or another program. Alternatively, you can visit the following links:

- Bankrate.com and MLCalc are simple calculators that show your complete repayment schedule, including your loan balance.

- CalculatorSoup is great for loans with irregular payments or interest calculations, such as Canadian mortgages that compound interest every six months. (The above calculators assume monthly interest and payments.)

- You can create your own spreadsheet in Excel.

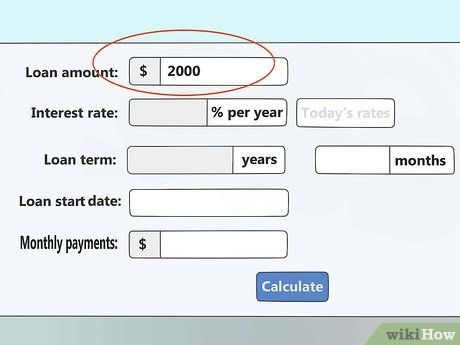

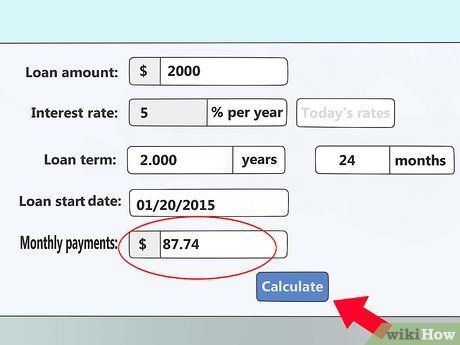

Enter the loan amount. This is the total amount you have borrowed. If you want to calculate the remaining balance on a partially repaid loan, enter the outstanding amount you still need to pay.

- This is referred to as the 'principal debt.'

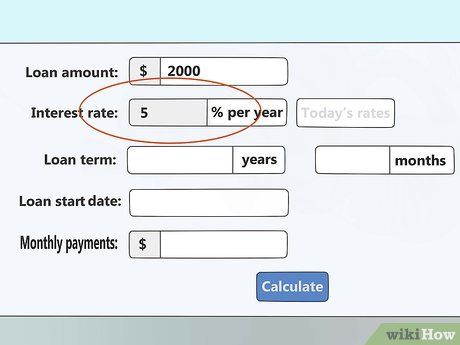

Enter the interest rate. This is the annual interest rate for your loan, in percentage form. For example, if your interest rate is 6%, enter '6'.

- The period for compounding interest does not affect this. The interest rate here is the nominal rate, including interest calculated frequently.

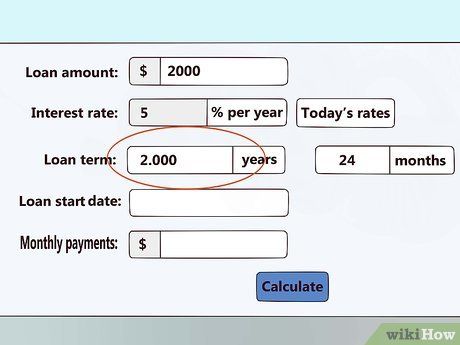

Enter the repayment period. This is the length of time you expect to pay off the loan. Use the period of repayment to calculate the minimum monthly payment. You can then reduce this period to calculate a higher monthly payment that will allow you to pay off the debt sooner.

- Paying off the debt in a shorter period is a good sign, as the total amount paid will be lower.

- Check if the program is calculating based on months or years in the settings next to this option.

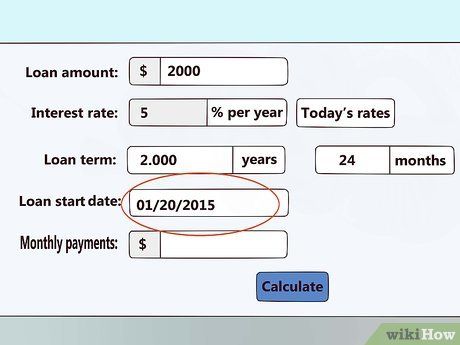

Select the start date. This feature is used to calculate the date when you will finish repaying the loan.

Click on calculate. Some calculators will automatically update the 'monthly payment' section once you enter all the information. Others will display the result after you click 'calculate,' providing a chart that shows the repayment schedule.

- 'Principal' is the remaining debt, while 'Interest' is the loan interest to be paid.

- These programs will show a fully amortized repayment schedule, meaning you will make equal monthly payments.

- If you pay less than the amount shown, you will owe more when the loan term ends, and the total amount you will need to pay will also increase.

Calculate Loan Repayment Yourself

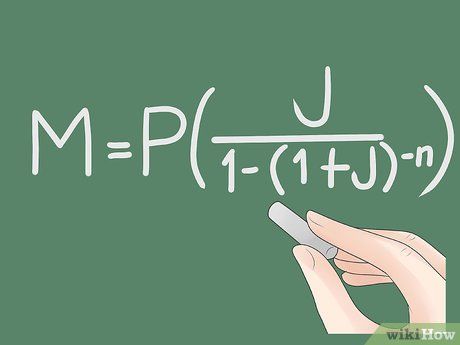

Write down the formula. The formula for calculating loan repayment is M = P * ( J / (1 - (1 + J)-N)). Follow the steps below to use the formula or see a quick explanation of the variables in the formula:

- M = the payment amount

- P = Principal debt, the initial loan amount

- J = Effective interest rate. Note that this is not the annual interest rate; see explanation below.

- N = Total number of payments

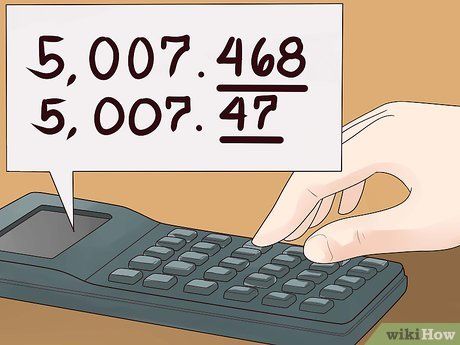

Be cautious about rounding results. It’s best to use a graphing calculator or software that calculates the entire formula in one line. If you’re using a calculator that only performs one step at a time, or if you want to follow the step-by-step calculations below, round to no more than 4 decimal places before moving to the next step. Rounding decimals can distort the final calculation.

- Simple calculators often have an 'Ans' button. This uses the previous result for the next calculation, which is more accurate than re-entering the number.

- The examples below are rounded after each step, but the final step includes both the manual calculation result and the quick calculation result so you can compare it with your own.

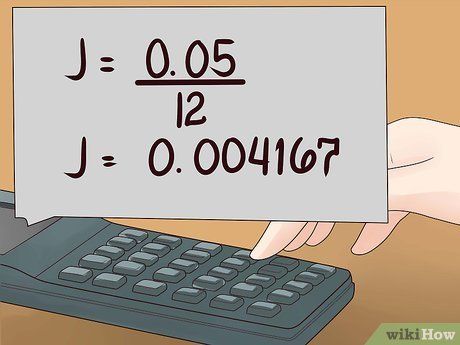

Calculate the effective interest rate J. Most loan terms mention the 'nominal annual interest rate,' but in reality, you don't repay the loan annually. Divide the nominal interest rate by 100 and convert it to decimal form, then divide by the number of periods in the year to get the effective interest rate.

- For example, if the annual interest rate is 5% and you pay monthly (12 payments per year), divide 5 by 100 to get 0.05, then divide by 12 to get J = 0.05 / 12 = 0.004167.

- In special cases, the interest may be calculated over a different period than the repayment schedule. For example, in Canada, mortgages are compounded semi-annually, although the borrower makes 12 payments per year. In this case, you would divide the interest rate by 2.

Pay attention to the total number of payments N. The loan terms may specify the number of payments, or you can calculate it yourself. For example, if the loan term is 5 years and you make 12 payments per month, the total number of payments would be N = 5 * 12 = 60.

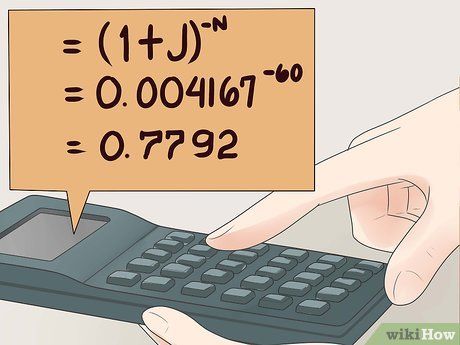

Calculate (1+J). First, add 1 + J, then raise it to the power of '-N'. Remember, there’s a negative sign before N. If your calculator cannot handle the negative sign, rewrite it as 1/((1+J)N).

- For our example, (1+J)-N = (1.004167)-60 = 0.7792

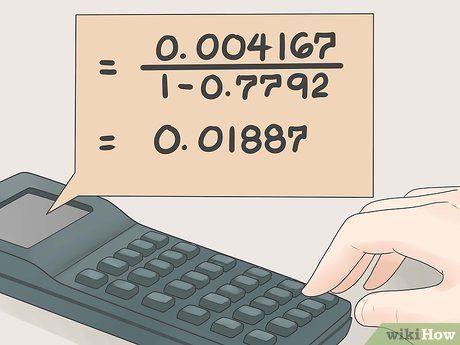

Calculate J/(1-(your previous result). In a simple calculation, first subtract the value you calculated in the previous step from 1. Then divide J by the result, using the effective interest rate J you calculated earlier.

- In our example, J/(1-(previous result)) = 0.01887

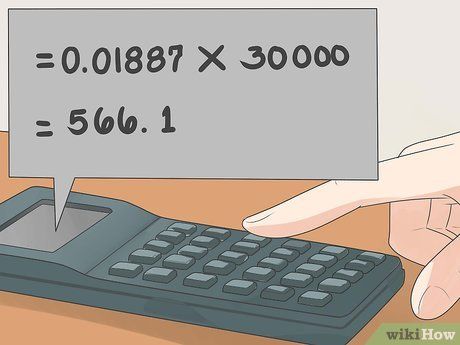

Calculate the monthly payment. Multiply the previous result by the loan amount P. The result will be the monthly payment required to repay the loan on time.

- For example, if you borrow 30 million VND (30,000,000), multiply the result from the last step by 30,000,000. Continuing our example: 0.01887 * 30,000,000 = 566,100 VND per month.

- This method applies to any currency.

- If you calculate our example in one line using software, you'll get a more accurate result, around 566,137 VND. If we pay 566,000 and 100 VND each month as calculated manually above, we'll pay close to the deadline and will need a few tens of thousands more to pay off the debt (less than 100,000 in this case).

Understand Loan Principles

Check if your loan has a fixed or adjustable interest rate. Loans generally fall into one of these two categories. Make sure you know which one applies to your loan:

- A 'fixed' loan has an interest rate that stays the same. Your monthly payments will remain fixed as long as you pay on time.

- An 'adjustable' loan means the interest rate is periodically adjusted to reflect the current rate, so you may end up owing more or less if the rate changes. The rate will only be recalculated during the 'adjustment period' specified in the loan terms. If you can calculate the current rate a few months before the adjustment, you can plan ahead.

Understand gradual principal repayment. Gradual principal repayment reduces the original loan amount (principal) over time. There are two main types:

- "Equal principal repayment": You pay a fixed amount every month throughout the loan term, covering both the principal and interest. The examples and instructions above follow this method.

- "Interest-only" repayment allows you to pay a lower amount during the 'interest-only' period, as you're only paying the interest, not the principal. After this period ends, your monthly payments will rise since you’ll be paying both the principal and interest. In the long term, this option will cost you more than the first method.

Pay extra at the beginning to save in the long run. Paying extra helps reduce the total loan and interest costs over time, as the interest will be lower. The earlier you pay, the more you save.

- On the other hand, paying less than the scheduled amount will result in higher payments later. Also, some loans require a minimum monthly payment, and you might incur extra charges if you fail to meet this minimum.

Advice

- You can find the following formula to calculate your payment value. These formulas are equivalent and yield the same results.

Warning

- A loan or mortgage with an "adjustable interest rate," also known as a "variable" or "floating" rate, can cause significant changes to your monthly payment if interest rates rise sharply or drop dramatically.

- The "adjustment period" for these loans tells you how frequently the interest rate will be modified. To determine if you can afford the payments in unfavorable scenarios, calculate your payment when the interest rate reaches the "cap".