Steps

Use the simple interest formula

Determine the total loan amount. Interest is paid on the principal amount, which is the original loan amount. If it’s an investment, your principal will be the total sum invested. In the formula for calculating simple interest, this amount is represented by the letter "P."

- For example, let’s say you buy a car priced at $12,000. You paid a $3,000 down payment and borrowed the remaining amount. The principal of your car loan will be $9,000.

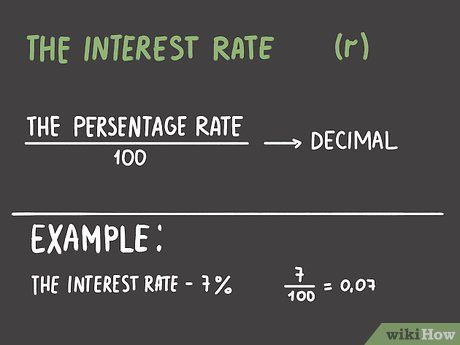

Convert the interest rate to a decimal. Interest rates are usually shown as percentages. You need to divide the percentage rate by 100 to convert it to a decimal. This decimal value will be used in the interest calculation formula.

- For instance, if your car loan has an annual interest rate of 7%, you would enter this as 0.07 in the simple interest formula.

Tip: Some calculators automatically convert percentages into decimals. Just remember to press the percentage button after entering the number.

Choose the appropriate loan term.

Choose the appropriate loan term.

Calculate the total amount of debt over the entire loan term.

Calculate the total amount of debt over the entire loan term.Compound Interest

Start with the initial loan or investment amount. Similar to simple interest, compound interest is calculated on the principal amount. However, unlike simple interest, compound interest is added to the principal. In the compound interest formula, the principal is represented by the letter "P" just as in the simple interest formula.

- For example, imagine purchasing a house for $150,000. You paid $50,000 upfront and financed the remaining amount with a mortgage. Thus, the principal of your mortgage loan is $100,000.

Express the annual interest rate as a decimal. Similar to the simple interest formula, the interest rate in the compound interest formula is represented by the letter "r." To convert the percentage to a decimal, divide it by 100.

- For example, if the annual interest rate on your mortgage is 8%, you would write 0.08 in the compound interest formula.

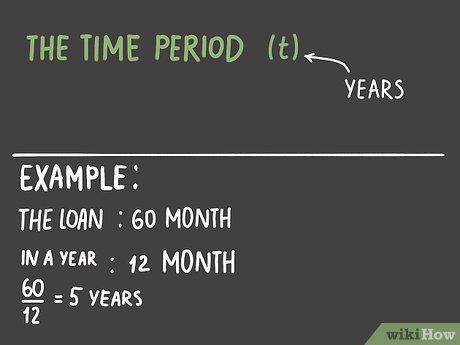

Determine the duration of the loan or investment. In the compound interest formula, the letter "t" represents the number of years for which the loan or investment is active. Similar to the simple interest formula, the value of "t" is in years, so if the loan term is given in months or weeks, you will need to convert it into years.

- For instance, with a 10-year mortgage, you would replace "t" with 10 in the compound interest formula.

Find the number of periods during which interest will be compounded within a year. When interest is compounded, it is added to the principal at the end of each period. In the next period, interest will be calculated on the total principal plus the interest from the previous period. This cycle continues throughout the term of the loan or until the loan is paid off.

- For example, if your mortgage's compound interest is calculated monthly, it will compound 12 times in a year. In the compound interest formula, this value is represented by the letter "n."

- In the case of investments, interest will compound until the end of the deposit term or until you withdraw your investment.

Calculate the total amount accumulated using the compound interest formula.nt

Calculate the total amount accumulated using the compound interest formula.ntTip: To calculate the total interest to be paid, simply subtract the principal amount from the total accumulated amount. The result will be the total interest you will pay over the loan or investment period.