If you notice an unauthorized charge or are dissatisfied with a product or service, disputing a Wells Fargo card charge can help you get your money back. Start by contacting the seller directly to resolve the issue. If they don't assist, reach out to Wells Fargo by calling or logging into your account to dispute the charge. Continue reading to learn the best steps for filing a dispute, understanding when it's necessary, securing your card details, and how merchants can respond to charge disputes.

How to Dispute a Transaction with Wells Fargo

To file a credit card dispute, call 1-800-390-0533 or log into Wells Fargo Online and navigate to More > Account Services > Dispute a Transaction. For debit card disputes, dial 1-800-869-3557. You’ll need to provide evidence to support your claim and wait for a response, which can take anywhere from 10 to 90 days.

Steps to File a Dispute with Wells Fargo

Reporting Fraudulent Charges

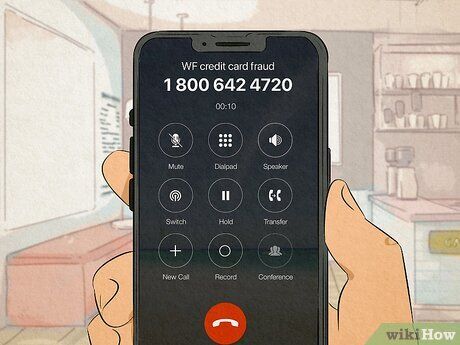

Call 1-800-642-4720 to report credit card fraud. If you notice any unauthorized charges on your credit card, contact Wells Fargo immediately at 1-800-642-4720 or use the number on the back of your card. A Wells Fargo representative will initiate a dispute claim on your behalf.

- Wells Fargo will reimburse you for any charges that you did not authorize.

- Your old credit card will be deactivated, and a new one will be sent to you after submitting the dispute.

- Wells Fargo typically takes 30 to 60 days to review the dispute, process your claim, and refund your money.

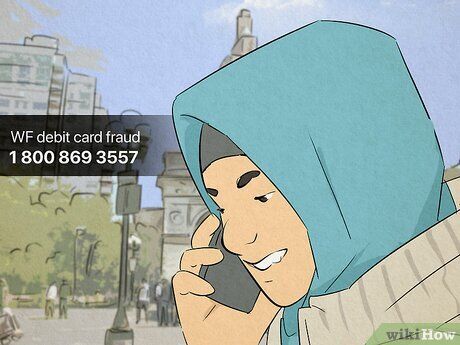

Call 1-800-869-3557 to report debit card fraud. If you spot an unauthorized charge on your debit card, call 1-800-869-3557 or the number on the back of your card as soon as possible. A Wells Fargo agent will help you file a dispute and recover your funds.

- Wells Fargo will reimburse you for unauthorized debit card charges as long as you report the claim within 60 days of the transaction date.

- A new debit card will be issued to you, and your old card will be canceled once the dispute is filed.

- Wells Fargo will investigate your dispute within 10 days and notify you of the decision within 3 days of completing their investigation.

If you suspect identity theft, visit identitytheft.gov. In case the unauthorized charges on your credit or debit card are a result of identity theft, visit identitytheft.gov to complete a fraud report. You’ll be guided through the steps to submit your report and receive a recovery plan.

- Get a free credit report from AnnualCreditReport.com to check for any inconsistencies or signs of suspicious activity. If any are found, dispute them with the respective credit bureau(s).

- Consider freezing your credit with the three major credit bureaus to protect your financial information and prevent unauthorized access to your credit.

Consider filing a police report with your local law enforcement. Although optional, this step can be valuable if the fraud occurred locally. Bring your FTC Identity Theft Report, proof of the fraudulent activity, and your ID to your local police department to file a report.

Disputing a Wells Fargo Credit Card Charge

Reach out to the company or seller first. Before filing a dispute with Wells Fargo, try contacting the company or seller directly if you are unhappy with a product or service. Many businesses are eager to resolve issues such as missing items, damaged products, or process refunds.

- If the company or seller fails to resolve your issue, proceed with filing a dispute with Wells Fargo.

- Contact Wells Fargo immediately if you notice any unauthorized charges on your credit card. Call the number on the back of your card or dial 1-800-642-4720 for assistance.

Call 1-800-390-0533 to initiate a dispute. Inform the Wells Fargo representative about the specific transaction you wish to dispute. Be ready to provide any necessary evidence or documentation to support your claim.

- Wells Fargo may request a receipt or communication records with the seller or business.

- You can also call the number on the back of your card to start the dispute process.

- Claims should be submitted within 60 days from the transaction date for most credit cards.

- There are no fees for submitting a dispute with Wells Fargo.

Alternatively, file your dispute through Wells Fargo Online. Log into your Wells Fargo Online account, navigate to the “More” menu, then select “Account Services” followed by “Dispute a Transaction.” Follow the steps to select the transaction and provide the required information.

- Calling Wells Fargo for the dispute may expedite the process.

Wait for Wells Fargo to investigate and resolve your dispute. Wells Fargo will take up to 90 days to investigate your claim and send you a final resolution letter with their decision to either approve or deny your dispute. You can track your claim status by calling 1-800-390-0533 or checking the “Dispute a Transaction” section in your online account.

- If Wells Fargo approves your claim, you won’t need to pay for the disputed transaction, including any associated fees or interest.

- If Wells Fargo rejects your claim, you are responsible for the transaction amount and any related fees or interest.

- If your claim is denied, you can challenge the decision within 10 days by contacting Wells Fargo.

- Note: If Wells Fargo accepts your claim, the business or seller can contest the decision, but they must provide evidence to have the dispute reversed.

Disputing a Wells Fargo Debit Card Charge

Contact the company or merchant about your issue. Before submitting a debit card dispute with Wells Fargo, reach out to the seller or business from which you made the purchase. If you are unhappy with the product or service, many reputable businesses will assist you in resolving the problem or offer a refund.

- If the company refuses to resolve your issue or provide a refund, proceed with filing a dispute through Wells Fargo.

- Immediately report unauthorized charges on your debit card to Wells Fargo. Call the number on the back of your card or dial 1-800-869-3557 for assistance.

Call Wells Fargo at 1-800-869-3557 or use the number on the back of your card to file a dispute. Inform the Wells Fargo representative of the transaction you wish to dispute and provide any supporting documentation they may request.

- Ensure your claim is submitted within 60 days of receiving the statement that contains the transaction in question.

- Filing a dispute with Wells Fargo is free of charge.

- Note: If you're disputing an unauthorized charge, Wells Fargo will deactivate your card and send a replacement within 5 to 7 days.

Wait for Wells Fargo to review your dispute and respond within 10 business days. Most dispute decisions are made within 10 business days. Once a decision is reached, Wells Fargo will send you a final resolution letter.

- If Wells Fargo approves your claim, the disputed transaction amount will be refunded to you, along with any related fees.

- If Wells Fargo rejects your claim, you will be responsible for paying the disputed transaction amount and any related fees.

- If you have questions or want to check the status of your claim, call 1-800-869-3557 or use the number on the back of your card.

- If Wells Fargo needs more information to complete the investigation, it may take longer than 10 business days. In such cases, Wells Fargo will issue a temporary credit for the disputed amount, and the investigation can take up to 45 days to conclude.

Valid and Invalid Reasons to File a Dispute

File a dispute if you suspect fraudulent charges. Federal law safeguards you against unauthorized transactions on your credit or debit card. You are within your rights to dispute a charge if:

- The charge wasn’t authorized by you.

- You suspect the transaction is fraudulent.

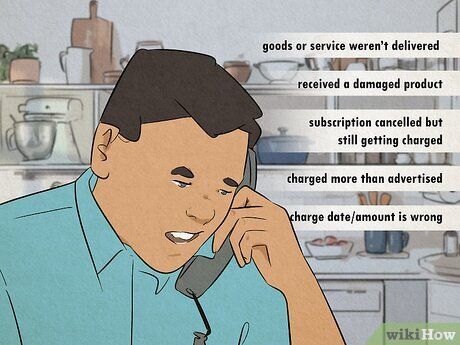

Dispute the charge if the goods or services weren’t delivered as promised. A charge dispute helps protect your interests when a purchase goes wrong. If you’ve attempted to resolve the issue with the merchant, you can file a dispute if:

- The product or service wasn’t delivered.

- You received a damaged item or one missing parts.

- You canceled a subscription but continue to be charged.

- You were overcharged beyond the advertised price.

- The date or amount of the charge is incorrect.

Don’t dispute a charge without contacting the merchant first. Charge disputes should be a last resort after exhausting other options with the seller. In some situations, disputes may be invalid if:

- You didn’t try to resolve the issue with the company or merchant.

- You haven’t requested a refund or return from the seller.

- You regret your purchase or have buyer’s remorse.

- You missed the merchant’s return, refund, or cancellation deadline.

- You forgot you made the purchase.

Preventing Unauthorized Charges

Set a strong, unique PIN and keep it secure. Avoid using easily identifiable information like your name or birthdate. Choose a PIN that’s hard to guess and memorize it instead of writing it down.

- Wells Fargo recommends changing your PIN every 6 months, or whenever you suspect fraud.

- Contact Wells Fargo immediately if you notice any unauthorized charges or suspicious activity in your account.

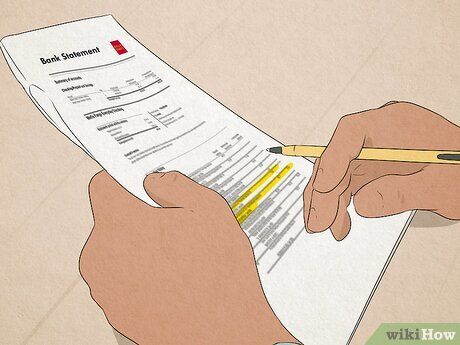

Review your monthly statements for errors and unauthorized transactions. Your bank is obligated to send you a record of your card activity each month. Take a few minutes to thoroughly check your statement for discrepancies or unfamiliar charges.

Create a strong and unique password for online banking. When setting up passwords for mobile and online banking, avoid using personal information (like your name or birthdate). Ensure that the password differs from those you use on other websites.

- Enable multi-factor authentication to enhance your account security.

- Always log out after using your account and ensure your devices—like your phone and computer—are password protected.

Never share your card details or PIN. At ATMs or in-store, always shield your card number and the keypad when entering your PIN. Refrain from sharing your card details over the phone unless you initiated the call to your bank.

Only shop from secure and trusted websites. Before entering your card details online, check that the website address matches the company’s name and starts with “https” to indicate a secure connection.

- Make purchases only when using your personal and secure Wi-Fi network. Public Wi-Fi can expose you to the risk of card theft.

Don’t open suspicious links or emails. If you receive an email or unexpected links from unfamiliar senders, avoid clicking on them. Instead, delete the message or mark it as spam.

- Suspicious links could lead to harmful websites that install viruses on your device, potentially stealing your personal data.

How to Handle Disputes with a Wells Fargo Merchant Account

Collect evidence if you believe the dispute is unfounded. When a customer challenges a charge, their bank sends you a chargeback request and deducts the transaction amount from your account. You will receive a notification containing a code that explains the reason for the dispute.

- If you think the dispute is incorrect, gather supporting evidence such as:

- Receipts, invoices, and purchase orders.

- Shipping records and delivery confirmation.

- Communications with the customer, like screenshots or transcripts.

- Steps you’ve taken to secure transactions.

- Your terms and conditions and refund policies.

- Note: Wells Fargo imposes a fee for each dispute filed by a customer, ranging from $25 to $150.

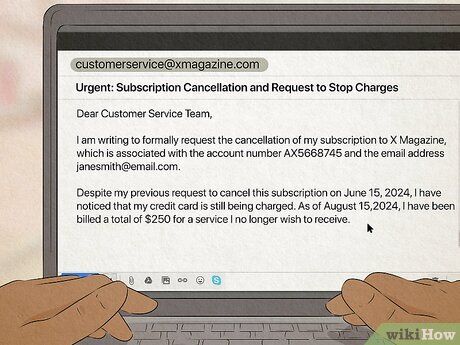

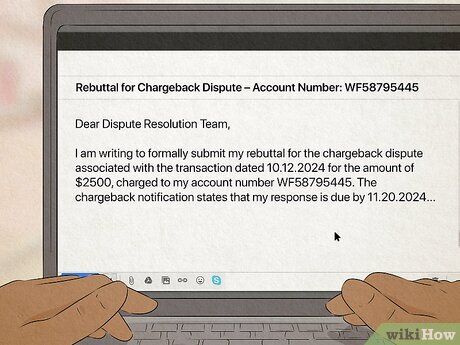

Write a rebuttal letter and submit your evidence before the deadline. Wells Fargo suggests drafting a rebuttal letter explaining the situation, including the timing and evidence to support your case. Then, follow the instructions provided in the dispute notice to submit your letter and evidence either electronically, by mail, or by fax.

- The chargeback notification will specify the deadline for your response.

- If you miss this deadline, Wells Fargo will proceed with the chargeback and you’ll lose the transaction amount.

Wait for the decision on your dispute. Wells Fargo will review the evidence and forward it to the customer’s bank, after which you’ll be notified of the outcome.

- If the customer’s bank finds your evidence convincing, the transaction amount will be refunded to you.

- If the customer’s bank does not find your evidence sufficient, the customer will receive a refund.

- If you win the dispute, the customer could still challenge the outcome and submit another chargeback. If this happens, arbitration may be required, though this is rare.

- Note: Even if you win, you’ll still be responsible for any associated chargeback fees.

How to Prevent Disputes as a Merchant

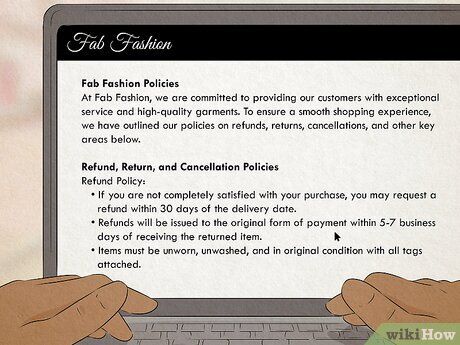

Offer excellent service and ensure transparency in your policies. While errors may happen when processing transactions or shipping products, disputes and chargebacks can be minimized through sound business practices and top-notch customer service. Here are some ways to prevent disputes:

- Clearly communicate your refund, return, and cancellation policies both in person and online (including on receipts and invoices).

- Ensure your return and refund process is simple and easy for customers to navigate.

- Respond promptly to customer inquiries or concerns.

- Process orders quickly and ship products without delay.

- Provide tracking information and timely shipping updates.

- Ensure your product images, descriptions, and prices are clear and accurate.

- Offer secure, convenient payment options for your customers.

-

If you file a credit card dispute, you won’t be required to pay for the disputed transaction or any related interest charges during the investigation. However, you still need to pay your credit card bill and any other fees or interest that aren’t connected to the disputed charge.