As soon as your credit card is issued, the first thing you should do is sign the back of the card. Sign it immediately after activating the card online or by phone. Use a permanent marker and sign just like you would any document. It's important not to leave it blank or just write “See ID” (ID stands for 'Identity Card') on the back of the card. While this step is often overlooked in Vietnam, signing the card is essential to protect your rights.

Steps

Sign Clearly

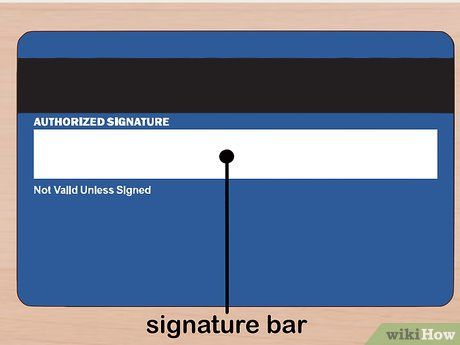

Locate the signature strip. Flip your credit card over and look for a long horizontal strip, typically white or light gray, on the back of the card.

- On some cards, the signature strip may have a label. If that’s the case, remove the label before signing.

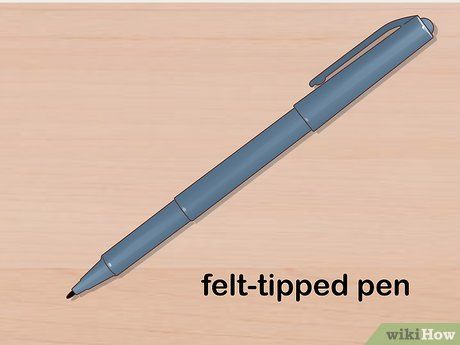

Use a permanent marker to sign. Since the back of a credit card is made of plastic, it doesn't absorb ink as paper does. Use a permanent marker or a Sharpie to ensure your signature won't smudge on the card.

- Some people prefer signing their credit card with a gel ink pen. These pens also dry quickly and rarely smudge.

- Avoid using unusual ink colors like red or green.

- Do not use a ballpoint pen, as the tip can scratch the surface and leave a faint signature on the credit card.

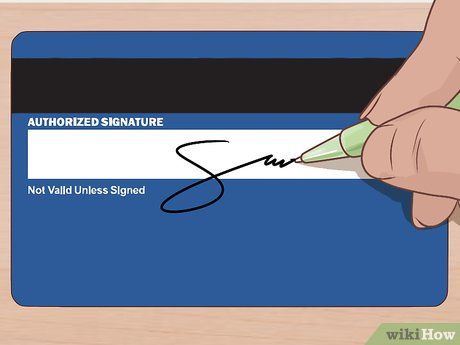

Sign as you normally would. Consistency and legibility are essential when signing the back of a credit card. Make sure your signature is the same as your regular one.

- If your signature is a bit rushed or hard to read, that's fine, as long as it resembles your official signature.

- If a store clerk suspects credit card fraud, the first thing they will do is compare the signature on the receipt with the one on the back of the card to see if they match.

Allow the ink to dry. After signing, don't put the card away immediately, as the ink could smudge and make your signature hard to read.

- Depending on the type of ink, it may take around 30 minutes for your signature to dry.

Avoid Common Mistakes

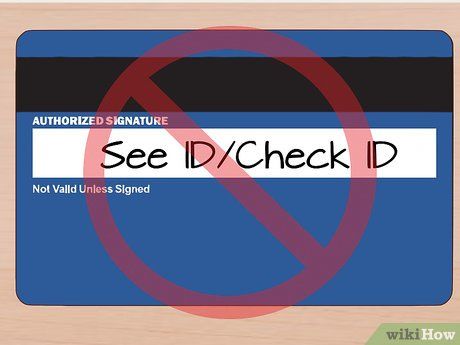

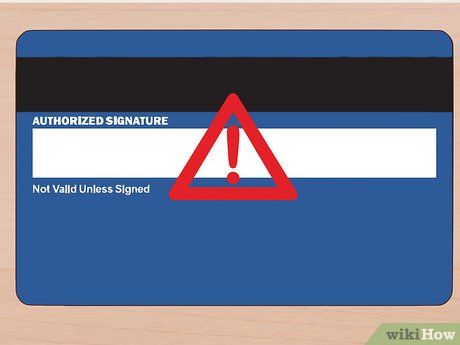

Don't write “See ID”. Some people suggest writing “See ID” or “Check ID” on the back of the card to prevent credit card fraud. The idea is that if someone steals your card, they won't be able to use it without the matching ID. However, most stores cannot accept a card without the cardholder’s signature.

- Look for the small print on your card: “Invalid without an authorized signature” or “Không hiệu lực nếu thiếu chữ ký” (Not valid without a signature).

- Moreover, most store employees proceed with the transaction without checking the back of the card for the signature, rendering what you wrote on the card useless.

Don't leave the signature strip blank. Legally, you must sign the back of your credit card before using it for authentication. Some stores may refuse to swipe your card if you haven’t signed it.

- Today, self-service credit card readers are becoming more common (you’ll often encounter them abroad, such as at self-service gas stations), so store staff may not always have the opportunity to verify your signature on the card.

- Even if you leave the back of your credit card unsigned, security issues aren’t guaranteed to be resolved. Thieves could easily use your card, whether or not there’s a signature on the back.

Check with your issuing bank about credit card fraud protection. If you’re concerned about the possibility of thieves using your credit card, the best approach is to check with the issuing bank about their card security services. Contact the bank's customer support to inquire whether they offer credit card fraud protection insurance.

- With credit card fraud insurance services, the value and terms of compensation will vary by bank. You should carefully research before enrolling.

- Not all banks provide credit card fraud insurance. To find out if your issuing bank offers this service, call their customer service hotline or visit a nearby branch to inquire about their policies.