Normally, I rely on tracking my expenses manually, but this month, I took on the challenge of finding the best app for expense management. I tested Daily Budget, Wally, EveryDollar, and Dollarbird by tracking my daily spending across all of them.

The experience gave me a new perspective on managing my budget, and it also made my friends more aware of how serious I am about my finances. Every time we hung out, I was in the corner, inputting my expenses into all four apps to make sure I didn’t forget any details.

So, which app emerged victorious? Technically, it’s more of a budgeting app than just an expense tracker. The winner is the creation of none other than Dave Ramsey, the reigning expert in personal finance.

I’m surprised, too. I don’t dislike Dave Ramsey; in fact, I agree with many of his principles for achieving financial health. However, I remain cautious about fully embracing his systems. But putting aside financial philosophies for the moment, what I really wanted was an easy-to-use expense tracker, and that’s exactly what I found with EveryDollar.

What makes EveryDollar so great?

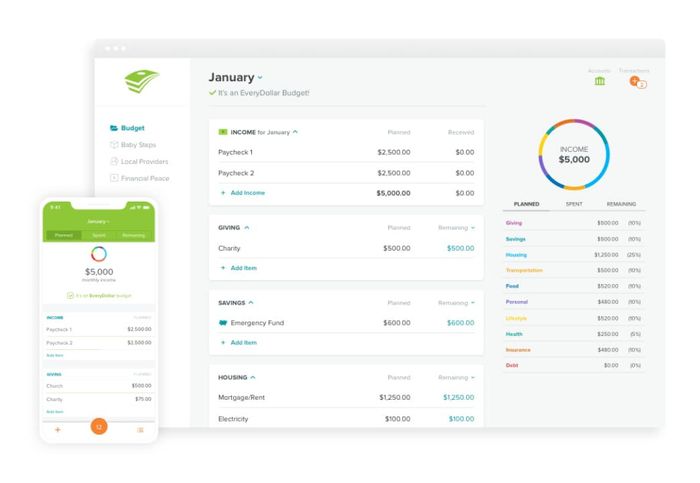

What I love about EveryDollar is its simplicity and intuitive interface. When you log an expense, you just enter the amount (it automatically includes the decimal for you), the merchant name, and select a category. If you don’t find a fitting category, you can create your own and remove any irrelevant suggestions. Plus, you can split your expenses across different categories—for example, if you buy food, shampoo, and a prescription at the same store, you can track your spending in groceries, personal care, and medicine. There’s also space to include a check number and any additional notes. That’s it!

Some apps try to guess your spending based on your location, but that can be awkward if you're not entering a receipt right where you made the purchase. Personally, I have a pretty clear sense of where I spend money, so I can easily type 'Bed Bath' instead of having to rely on the exact Bed Bath & Beyond location popping up on a map.

I also like that EveryDollar requires you to categorize your own expenses. While other apps may be decent at auto-categorizing based on your location, manually assigning categories feels more intentional and mindful.

If you’re after an app that automatically categorizes your expenses based on your notes (and lets you make adjustments as needed), Dollarbird does an excellent job. It can tell that 'tacos' belong under 'Eating Out' and 'lampshade' falls under 'Household.'

Isn’t EveryDollar mainly a budgeting app?

That’s right! Expense tracking is just one feature of the EveryDollar app, and it’s one of the many perks you get with the paid version, which costs $129.99 annually. For example, the paid version lets you directly import expenses from your bank account. But honestly, you don’t really need that.

When you first set up EveryDollar, you can establish spending limits for each category. Alternatively, you can simply log your expenses as they happen and let the total accumulate over the month. The first time you do this, seeing any category where you haven’t set a limit highlighted in red might be a bit startling. But don’t worry about the red, especially if you’re just gathering data. You’ll still be able to track the percentage each category contributes to your overall spending.

As you start recognizing where your money goes in each category, you may decide to set specific spending limits and take your tracking a step further. But that’s entirely your choice.

At the end of the day, the best expense tracker is one you’ll actually use and enjoy opening to enter your expenses. EveryDollar stood out as the most intuitive app I tested, earning it high marks from me.

For more from Mytour, make sure to follow us on Instagram @Mytourdotcom.