Progressive Leasing has been in the business for 20 years. If you’ve visited stores like Mattress Firm, Lowes, Kay Jewelers, Pandora, Big Lots, Metro PCS, Cricket Wireless, or Sam Ash, you’ve likely encountered the company’s name.

Instead of providing financing for purchases like a diamond ring, refrigerator, or electric guitar, Progressive Leasing offers short-term leasing options for high-cost items. Essentially, you rent the item until you've paid off the full amount.

But is this approach to financing a smart choice for consumers?

The Costs of Leasing

Washington Post retail journalist Abha Bhatterai recently covered Progressive Leasing’s partnership with Best Buy. If customers aren’t approved for a Best Buy credit card, they can opt to finance their purchase through Progressive Leasing, spreading the cost over 12 months with weekly, biweekly, or monthly payments automatically deducted from their bank account.

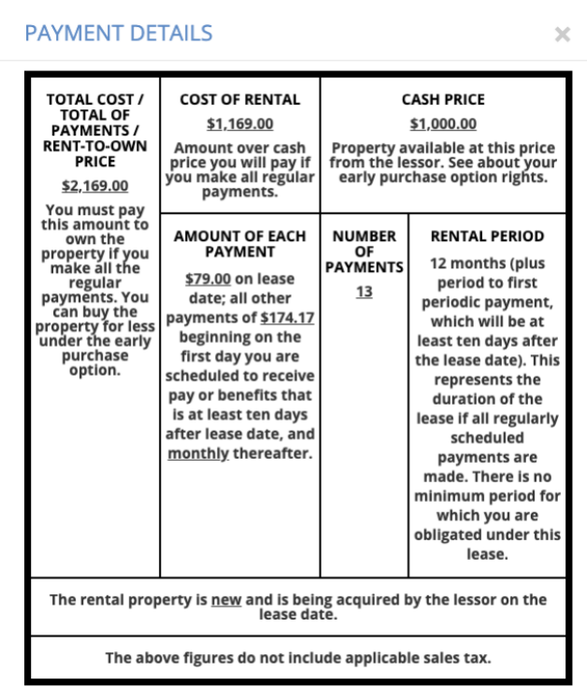

There’s no interest charged like with credit cards or traditional loans, but service fees are still applied. While the exact nature of the 'cost of lease services' fees isn’t fully explained, the total amount payable for the entire agreement is clearly outlined in the lease documentation.

The company clarifies in its FAQ that you're not borrowing funds. 'With a Progressive lease, we buy the item you choose from the retailer. Then, you enter into an agreement to lease it from Progressive,' the site states. 'Progressive owns the product, but you can take ownership once you've completed all required payments or through an early purchase option.'

Since this isn’t a loan, the lease isn’t considered a line of credit. This means your payment history won’t be reported to credit bureaus, so it won’t impact your credit score even if you consistently fulfill the lease terms.

A company representative mentioned that Progressive Leasing does not disclose customer demographic information but emphasized the company’s mission to offer accessible purchasing options for 'credit-challenged consumers,' as outlined on their website.

Is This a Better Option Than a Payday Loan?

If you settle the full balance within 90 days, you’ll pay a 'small amount more than the original retail price' (except in California), according to the Progressive Leasing FAQ. Between 90 days and the end of the lease, a 'significant discount' is offered if you pay off the balance early. A company spokesperson revealed that most customers opt for the 90-day purchase option, minimizing extra costs, or pay in full before their final payment.

However, if you take the entire lease term to pay off the balance, you could end up paying double the price of your item for the convenience of financing.

Compare the total cost of a Progressive Leasing agreement to that of a store credit card.

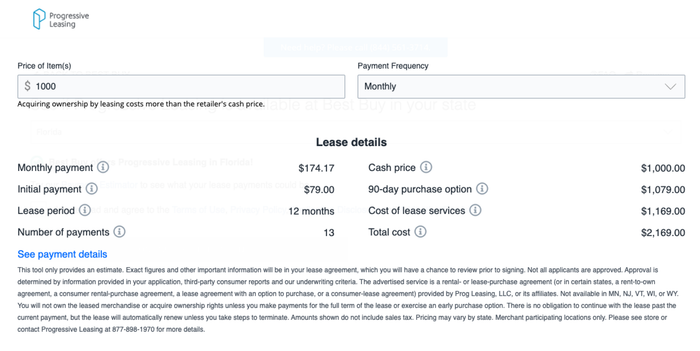

Imagine you want to buy an item for $1,000. With Progressive Leasing, you pay $79 upfront and have $174.17 deducted from your paycheck each month. If you settle the balance within 90 days, you’ll only pay an additional $79 on top of the original price of $1,000. However, if you take longer to pay, by the time you’ve fully paid off the lease, the total will have reached $2,169.

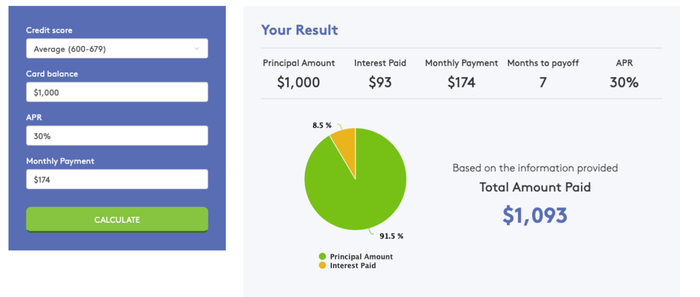

Now, compare that with what you’d pay using a store credit card. These cards are often seen as a poor choice for consumers because of their steep interest rates, typically around 26%.

Even if you used the same $1,000 balance on a credit card with a hefty 30% interest rate, it would take just seven months to pay off the balance with the same monthly payment as the Progressive Leasing option. The total interest paid would be $93, compared to the $1,169 extra cost for the lease.

Matt Schulz, the chief industry analyst at CompareCards.com, remarked, 'It takes a lot to make a store credit card seem like a good deal.' (MagnifyMoney, the site we used to demonstrate the total cost of using a store credit card, is a sister site to CompareCards.) He pointed out that even the 90-day payoff on a lease is often higher than what you'd pay with a store credit card.

However, if you're unable to qualify for a store credit card, a leasing option like this might appear to be your best alternative. Schulz explained that one benefit of personal loans and their alternatives is the greater transparency regarding total costs, something that credit cards don’t always provide. Still, this clarity might come with a significant price tag.

While it may be a more favorable option than a payday loan for individuals with poor credit—Bhatterai from The Post points out that payday loan interest rates can push the total cost to more than 300% of the original price—it still remains a situation that causes unease for many, including store staff.

'It can be helpful for some, but it’s very misleading for others,' said Joshua Howard, who worked in the premium home entertainment section of a Best Buy in Memphis until last month. 'I felt really bad offering it.'

If your lease doesn’t work out, you’ll never actually own anything

In certain circumstances, Progressive Leasing can offer a much-needed solution for someone who suddenly needs a new appliance or computer, for example.

The company allows individuals to apply either at a partner store or via its website, requiring only a Social Security Number, bank account details, and credit or debit card information. Instead of conducting a hard credit check, the company performs a soft pull that won’t affect an applicant’s credit score.

Is it a safer option than a payday loan if you're in a tight spot? Yes, it is.

However, when considering subprime lending options (and other similar terms), the instant-layaway programs from companies like Affirm, Klarna, and Afterpay may be more affordable. Affirm provides clear upfront information on the interest you’ll pay; Afterpay and Klarna allow for interest-free payments as long as you meet the payment deadlines. Schulz also noted that borrowing from family or friends could be the least expensive route.

No matter which method you choose, be cautious of details that could raise your overall cost.

Schulz highlighted the area where people often get into trouble, whether applying for a store card, installment loan, or lease program: the fine print. 'No one expects you to read every word in the fine print,' he said. 'But it's crucial to understand at least the rates, fees, and other major figures involved in any deal you sign.'