Keeping track of multiple reward credit cards can be a challenge, especially when you need to remember which card offers the best rewards for specific purchases. Some cards provide the most points on everyday expenses like groceries or gas, while others offer the highest rewards for booking with a particular airline or hotel. It can make you feel like giving up on the rewards game and just using the same card every time.

Previously, we mentioned AwardWallet, an early app that helped users track their miles and points. However, over time, it has become cumbersome and struggles with syncing to certain card issuers.

Don't worry, though! We've found three great apps that help you figure out which card to use, depending on your spending plans. Let's dive into each one.

MaxRewards

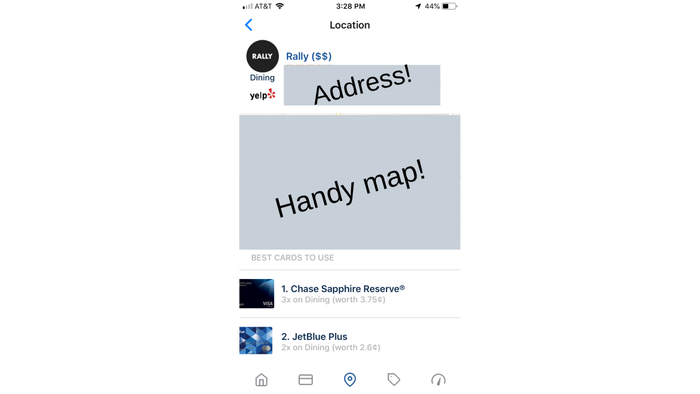

After linking your credit cards to MaxRewards (which currently supports over 70% of cards, according to the app), you can easily identify which card offers the best rewards at nearby locations. If a place isn’t shown on the map, you can search for a specific business by name.

For example, there’s a gas station with a convenience store near me. I assumed it didn’t matter which card I used at the store since I don’t have a card that gives rewards for filling up at gas stations. However, that convenience store is actually classified as a restaurant, meaning I earn 3x “dining” points with my Chase Sapphire Reserve card.

MaxRewards also provides a detailed list of your connected cards, showing your rewards balance in easy-to-understand dollar amounts, along with your current card balance. It displays your credit utilization so you can keep track of your spending habits. Additionally, if your card issuer provides them, you can view your FICO credit scores within the app.

One of my credit cards isn’t supported by MaxRewards, but the app still displays my points for various purchase categories, providing a handy reference for that card.

A new feature in MaxRewards is the “Deals” section. You’re probably familiar with cash-back offers available when using your credit card at specific stores. The problem is, you often have to manually unlock these deals in your card’s account, which I tend to forget about. MaxRewards simplifies this by automatically unlocking relevant deals for American Express, Bank of America, Chase, and SunTrust cards and includes them in your “best card” suggestions.

There is a cost to this convenience: for every $25 saved through unlocked deals, MaxRewards takes a $5 fee, and you’ll need to provide your credit card information for the fee to be deducted. However, if you’re not interested in these additional deals, you can skip this step, and the rest of the app remains free to use.

MaxRewards is ideal for: individuals who want a fast way to reference their credit card lineup and choose the best card for each location they plan to spend money.

Birch

Birch functions similarly to MaxRewards: link your credit cards, open the map to explore businesses nearby, and discover which card will earn you the most rewards at each location. You can also view recent transactions and connect your checking accounts to track your cash flow alongside credit card usage.

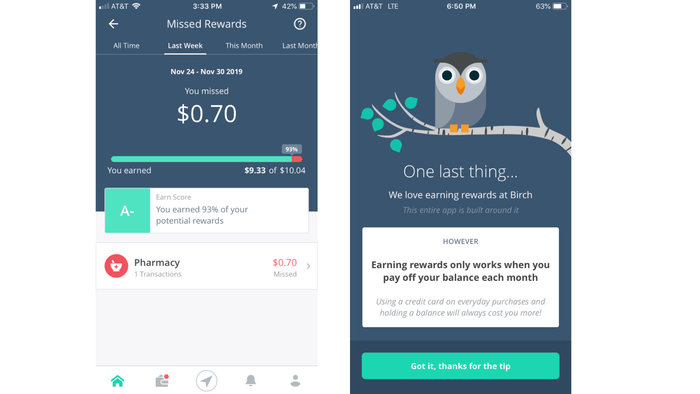

I compared MaxRewards and Birch at several identical locations, and they typically agreed on which card would generate the most points. However, while MaxRewards solely focuses on credit cards, Birch takes a more holistic approach, acting like a budgeting tool by showcasing your overall spending. It even highlights how many rewards you’ve “lost” by using the wrong card.

This feature is perfect if you're aiming to rack up as many points as possible. However, if you frequently use your debit card for certain purchases, those transactions will be labeled as “missed rewards” on Birch. This may give the impression that you’re not optimizing your rewards, even though you simply made a different payment choice.

Birch is ideal for: Individuals who want a comprehensive view of their financial picture while still maximizing their credit card rewards during everyday spending.

Maxivu

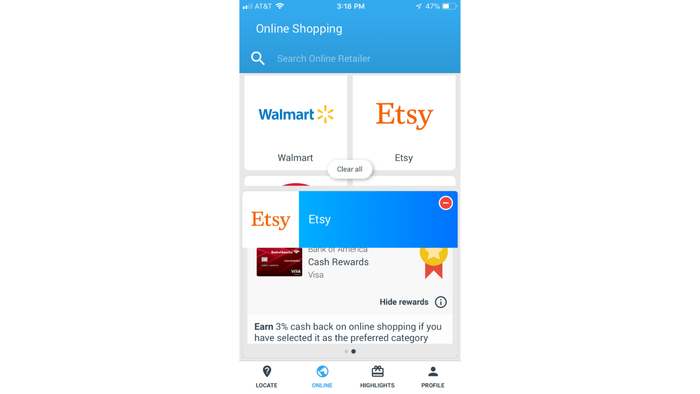

Maxivu takes the runner-up spot in my list as the simplest rewards-tracking app I tried. It doesn’t sync with any of your accounts to show real-time spending or balance updates, but it’s still quite useful. You simply choose the cards you have, and it reminds you of the rewards potential for each one. It also selects the “best” card for the places you search for or mark on the map.

Maxivu also provides insights into your earning potential for online shopping. If you have cards that offer rewards for online purchases, whether as a rotating or preferred category, it’s a good idea to check Maxivu’s directory before making your purchase.

Maxivu is ideal for: Individuals who prefer not to share too much personal information but still want to check their rewards earning potential.