You don’t need to master all aspects of money at once, but a course can provide you with a wealth of practical knowledge at a manageable pace. This is particularly useful if you’ve never been introduced to personal finance before—such a course will bring you up to speed with the fundamentals. Here are some of the best personal finance courses available, and the best part? They’re all free of charge.

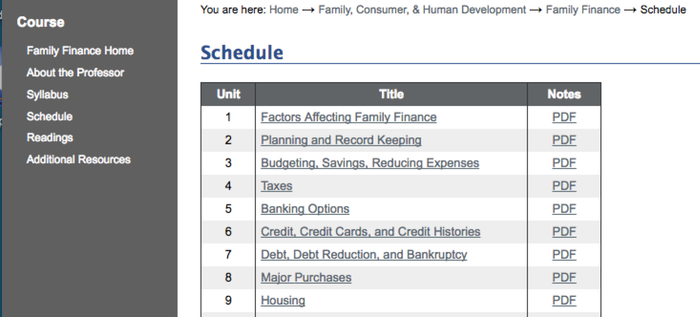

Family Finance, Utah State University

Alena Johnson, a professor in the Family, Consumer, and Human Development department at Utah State, offers this comprehensive 14-unit course. All lessons are downloadable and accessible as PDFs, allowing you to learn at your own pace. Each lesson lasts approximately 100 minutes. The course covers essential topics such as budgeting, taxes, and the pros and cons of buying versus leasing a car. You’ll also find assignments for each unit that provide actionable steps to help you manage your personal finances. For example:

FINANCIAL FILE - Create your personal financial file. For full credit, you must include the following folders: personal information (Social Security card, birth certificate, immunization records, etc.), financial statements (including worksheets from the Financial Checkup, credit history, and Social Security benefit statement), debt or loans, checking or savings accounts, insurance, and taxes. You can add additional folders if desired, but at a minimum, the above files are required for full credit—even if you don’t have information for any particular file. Once you’ve assembled your file, document the name of each file and the contents inside. Submit this written report.

The course emphasizes understanding personal values and goals, a key first step in managing your finances. By the end, you’ll be able to identify your values and create a financial plan that aligns with them.

Managing My Money, the Open University

This free eight-week course offers practical guidance on managing your finances, led by Martin Upton. To enroll, you’ll need to sign up, and the course is offered a few times a year (the next session starts January 9, 2017). You’ll cover the essentials of money management, including:

Creating a personal budget

Managing your debts and investments

Understanding how mortgages work

Managing pensions and building retirement savings, among other topics.

Although the course is based in the UK, it offers valuable information for a global audience. Each lesson includes a framework and practical tasks that allow you to apply the lessons to your own finances. The course lasts for eight weeks and requires three hours of your time per week.

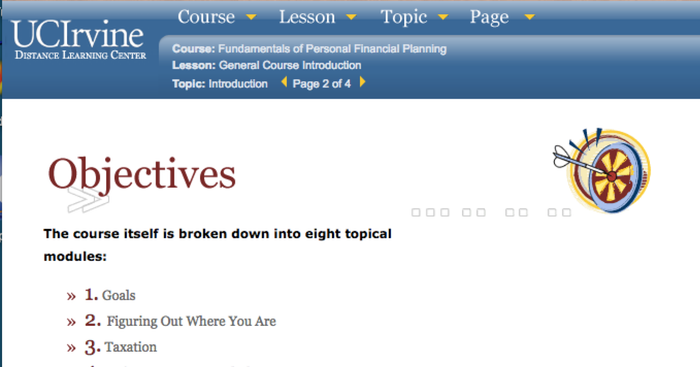

Fundamentals of Personal Financial Planning, the University of California-Irvine

This free course from the University of California is designed for individuals who cannot afford comprehensive financial planning but still want to improve their financial situation. It was created with support from the Certified Financial Planner Board of Standards and covers eight fundamental topics:

Setting Goals

Assessing Your Current Financial Situation

Understanding Taxation

Protection: Safeguarding Your Goals from Disruptions

Making Investments

Funding Your Retirement

Planning for College Expenses

Basics of Estate Planning

Each topic contains 1-6 lessons, and since it’s self-paced, you can select from different subjects. You can navigate through each lesson online and receive a brief summary of the goals you’ll achieve by the end. For instance, here’s a preview of the 'Calculating Retirement Need' module:

By the end of this lesson, you will be able to:

Use the Estimating Retirement Need Calculator to estimate the required amount of savings to sustain your retirement based on your specific needs.

Use the When Can I Retire? Calculator to determine the age at which you'll have accumulated enough funds to support your retirement as planned.

The entire course takes approximately 25 to 30 hours to complete.

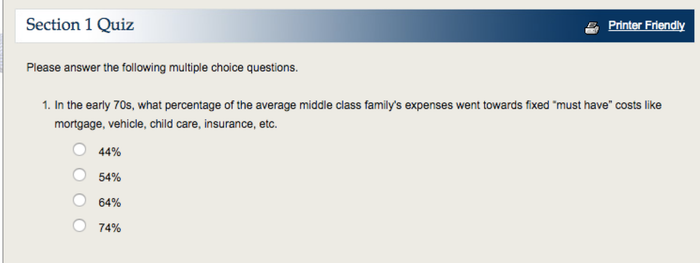

Free Personal Finance Course, the University of Arizona

This online course includes quizzes after each series of lessons covering topics from budgeting to investing. There’s no need to enroll, and you can proceed through the course at your own pace. Each lesson serves as a detailed guide, progressing from basic concepts to more advanced personal finance topics.

From start to finish, the course lasts around 15 hours. It’s part of the University’s Take Charge America Institute, which focuses on promoting financial literacy. They also offer Consumer Jungle, an interactive program designed for high school students to learn foundational financial and consumer literacy.

An Introduction to Credit Risk Management at Delft University of Technology

Credit can be complicated, and this course provides a clear explanation of the fundamentals of how credit works. Although it includes a lot of technical details, it’s a great choice if you’re aiming to improve your credit score or just want to understand the inner workings of the credit industry. Here’s what you’ll learn:

What credit risk is and its impact on banks and other financial institutions

How credit ratings are defined and used

The basics of Credit Default Swaps (CDS)

What stress testing is and how it benefits financial institutions

The course covers credit from both a consumer and organizational perspective, making it a versatile learning experience. However, it’s completely self-paced, so you can navigate the material at your own speed. The course takes approximately 48 hours to complete in total.

Planning for a Secure Retirement, Purdue University

This self-paced online course consists of 10 modules designed to introduce you to the fundamentals of retirement planning. It includes interactive quizzes, personality assessments, and calculators to help you personalize your retirement plan. You’ll also need to download the retirement guide to use throughout each lesson.

Each module is divided into several lessons with clear objectives. For example, in Module 1, you will explore:

1a: Retirement readiness assessment

Identify the personality traits that influence the way you manage your finances.

1b: Life expectancy estimators

Estimate the length of time you’re likely to live.

1c: Assessing risk tolerance

Evaluate your comfort level with risk when it comes to saving and investing.

1d: Your envisioned retirement lifestyle

Describe your ideal vision for retirement.

By the time you reach Module 10, you’ll also explore estate planning, long-term care options, and federal assistance programs available to seniors.

Additionally, we’ve put together helpful guides to assist you in mastering personal finance basics, which you can access here:

How to Begin Managing Your Money If You Never Learned Growing Up

Adult Budgeting 101: Creating Your First Budget in the Real World

How to Build a Simple, Beginner ‘Set and Forget’ Investment Portfolio

The Complete Guide to Buying a Home from Start to Finish

Regardless of Circumstances, Building Wealth Always Relies on These Four Core Pillars

There are numerous free resources available to help you understand money, but sometimes it's more convenient to have everything structured and organized for you. A course is designed to walk you through the essentials, allowing you to move on to more advanced subjects and make sure you master each one. If you're seeking a little guidance with the fundamentals of finance, these guides will help you begin your journey.

Artwork by Sam Woolley.