Seeking a trustworthy app for borrowing money? Look no further! Explore our curated list of the top 10+ most reputable money lending apps available in 2024.

Below, we present an overview of money lending apps, featuring the top 10+ most reliable options for 2024. Dive in now!

I. Understanding Money Lending Apps

2. Benefits of Borrowing via Loan Apps

Time-saving in Loan Application

Most online loan apps are owned by financial institutions, allowing users to complete the borrowing process directly on their phones without visiting physical branches. This saves borrowers considerable time.

Simple and Fast Online Loan Registration Procedures

Loan apps are designed to be simple and user-friendly, with straightforward borrowing processes to make loan registration easier for customers. Therefore, if you complete these procedures early, the likelihood of disbursal on the same day is extremely high.

No Collateral or Asset Guarantee Required

Due to the rapid online loan application and disbursal process, most loan apps do not require collateral or asset verification. Customers only need to present certain documents such as ID cards and proof of income to apply for loans instantly.

Rapid Profile Evaluation and Disbursal Process

Customers only need to meet certain specific requirements depending on each online loan app to have their profiles evaluated and funds disbursed swiftly.

3. Eligibility Criteria for Loan Apps

To qualify for reputable online loan apps, each app may have additional requirements for customers. However, when borrowing through reputable apps, customers typically need to meet the following conditions:

- Being a Vietnamese citizen, aged between 20 and 60 years old.

- Downloading the app of the financial company or bank you want to borrow from onto your phone.

- Having a valid ID card.

- Providing your active phone number, ensuring that the lending party can contact you using this number.

- Having a bank account.

- Some apps may also require customers to have no outstanding debts at the time of borrowing.

II. The Top 10 Most Reliable Loan Apps Today

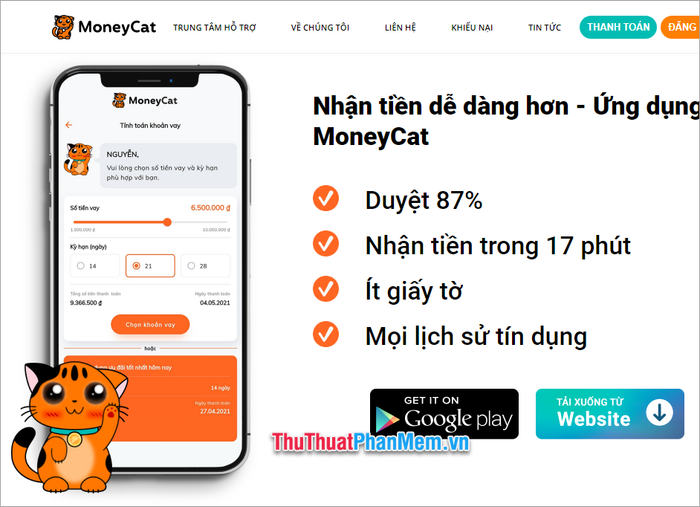

1. MoneyCat Loan App

MoneyCat stands out as the most trustworthy and efficient online loan app available today, exclusively on the Google Play platform for Android users. It offers flexible borrowing options, empowering customers to manage their finances according to their repayment capabilities. Users can easily select the most suitable online loan based on their financial abilities and spending plans.

Loan Information:

- Minimum loan term: 91 days - maximum 182 days.

- Loan amount: 1,000,000 VND to 10,000,000 VND.

- Interest rate: minimum 12% - maximum 18.25%.

Easier Money Access with MoneyCat App

- Approval rate up to 87%.

- Receive money within 17 minutes.

- Minimal paperwork hassle.

- Keeps track of all credit history.

2. Mcredit Loan App

Mcredit is a reputable loan app available for both Android and iOS. Mcredit, under MB Shinsei Financial Company Limited (Mcredit), established in 2016, is a joint venture financial company between Military Commercial Joint Stock Bank (MB Group) and Shinsei Bank (Japan). Offering a variety of loan products, it caters to all customer borrowing needs.

Loan Information:

- Loan amounts range from 10 million to 100 million dong.

- Loan terms from 6 months to 36 months.

- Interest rates from only 14.05% to 38.59% per year.

Features of the Mcredit App:

- Instant approval for your loan needs.

- Loan process takes just 5 minutes.

- Easy evaluation, lightning-fast disbursement.

- Swift electronic contract signing.

- Manage your loan anytime, anywhere.

- Find the nearest transaction location easily.

3. Oncredit Loan App

OnCredit is a reputable loan app under the OnCredit Financial Consulting Limited Liability Company, which provides financial advisory services, established and operated legally according to Vietnamese law.

Online loan advisory service available 24/7, allowing you to apply for loan advice anytime, anywhere. With just a device connected to the Internet, you can receive:

- Loan amounts up to 15,000,000 VND.

- Minimum loan term is 92 days.

- Maximum loan term is 183 days.

- Maximum annual percentage rate (APR): 14.6% (no additional fees).

Reasons to Choose OnCredit:

- No interest offer for the first online loan.

- Disbursement of personal loans within 20 minutes.

- Customer's personal and credit information is securely protected as per regulations.

- Funds transferred directly to the bank account.

- Loan status updates quickly via SMS notifications.

- Various attractive benefits for both new and loyal customers.

4. Robocash Loan App

Robocash provides fully automated quick online loan advisory services, disbursing funds within the day. Supported on the Robocash android app, customers can swiftly access loans through the app.

Robocash is an online service that serves customers without human intervention! Because this is a completely automated service. Any day of the week, any time, holidays or weekends, loans are approved.

Loan Information:

- Term from 3 to 6 months.

- Loan limit from 3,500,000 VND to 10,000,000 VND.

- Maximum interest rate of 18.3% per year.

Advantages of Robocash Loans:

- Fully automated service.

- It only takes 10 minutes for you to receive a loan of up to 10,000,000 dong into your account.

- All loan procedures are done online.

- No need for guarantors, documents, or collateral assets.

5. Tamo Loan App

Tamo is a reputable loan app from Tamo.vn, Tamo.vn is an online financial advisory and solutions platform available 24/7 to support your urgent financial needs. Borrowing money through the Tamo app enables you to conveniently apply for a loan and track your borrowing.

Temporary Loan Information:

- Loan amounts from 500,000 VND to 3,000,000 VND.

- Minimum repayment period of the loan is 91 days.

- Maximum repayment period of the loan is 120 days.

- Minimum annual percentage rate (APR) of the loan is 18.25% per year.

- Maximum annual percentage rate (APR) of the loan is 18.25% per year.

- Fee and interest rates are calculated in detail within the application.

Advantages:

- Simple application process, just apply for a loan online.

- No need for face-to-face meetings.

- No evaluation required.

- No need to prove income.

- Quick disbursement within the day.

- Fast online loan.

6. Homecredit Loan App

Home Credit is a reputable financial institution offering various reliable and best loan products. The HomeCredit mobile app allows customers to check their loan information anytime. Home Credit is available on both Android and IOS operating systems.

Loan Information:

- Diverse loan amounts from 5 million to 200 million.

- Flexible loan terms:

- Minimum duration is 3 months.

- Maximum duration is 57 months.

- Flat interest rates ranging from 0.65% to 2.33% per month (7.8% to 27.96% per year).

- You can repay the loan within 14 days without any fees.

All-in-one Solution with Home Credit App:

- Fast loan: receive preferential loans and apply entirely online.

- Quick loan calculation: flexible selection of loan amount and repayment period.

- New interface: vibrant interface provides great experience.

- Find good prices: flexible selection of loan amount and repayment period.

- Mobile app to check loan information anytime.

- All loan information is transparent without any additional fees.

- Your personal information is absolutely protected.

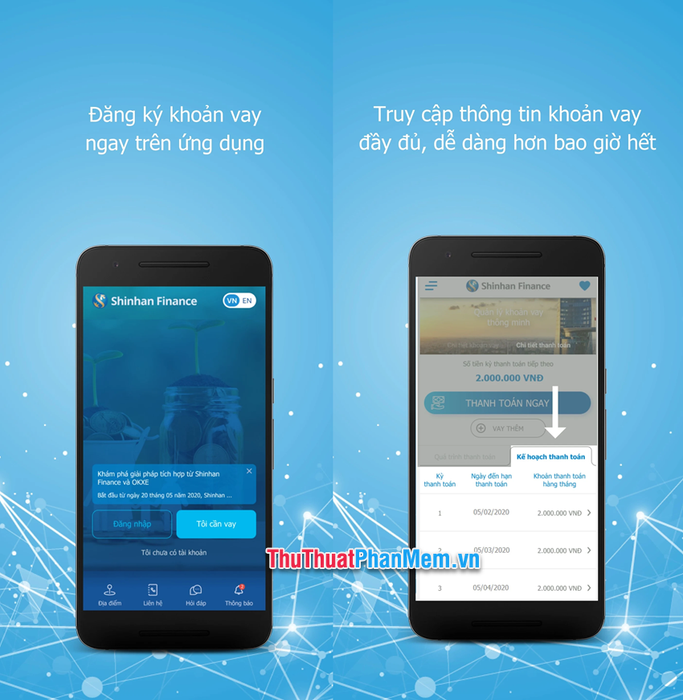

7. iShinhan Loan App

iShinhan is the application for Registration, Management, and Payment of consumer loans of Shinhan Vietnam Finance Company.

Shinhan Finance is a member of Shinhan Card (South Korea), a 100% foreign capital consumer finance company. With a strong combination of technology platform and superior financial products of Shinhan Card along with over 15 years of experience in developing the consumer loan market, Shinhan Finance is committed to becoming the best customer-supporting finance company in Vietnam (details at Shinhan Finance).

Customers can quickly borrow money through the reputable iShinhan app, available on both Android and IOS operating systems.

Loan Information:

- Loan amount: from 10,000,000 VND to 300,000,000 VND.

- Term: minimum duration is 12 months, maximum is 48 months.

- Fees: no advisory fees, application fees, profile appraisal fees, or any other fees.

- Interest rates from 18% per year to 35% per year, depending on customer assessment results and calculated on reducing balance.

- Overdue interest: Maximum 150% on overdue principal (As regulated by the SBV).

Key Features of the iShinhan App Include:

- Quick loan registration with Shinhan Finance.

- Updates on loan application progress.

- Management of loan contracts and applications with Shinhan Finance.

- View upcoming payment deadlines without logging in.

- Track payment schedules & history.

- Convenient online loan payments on iShinhan.

- Find the nearest payment location.

- Submit support requests quickly and easily.

- Exchange information via video call with staff directly on the app.

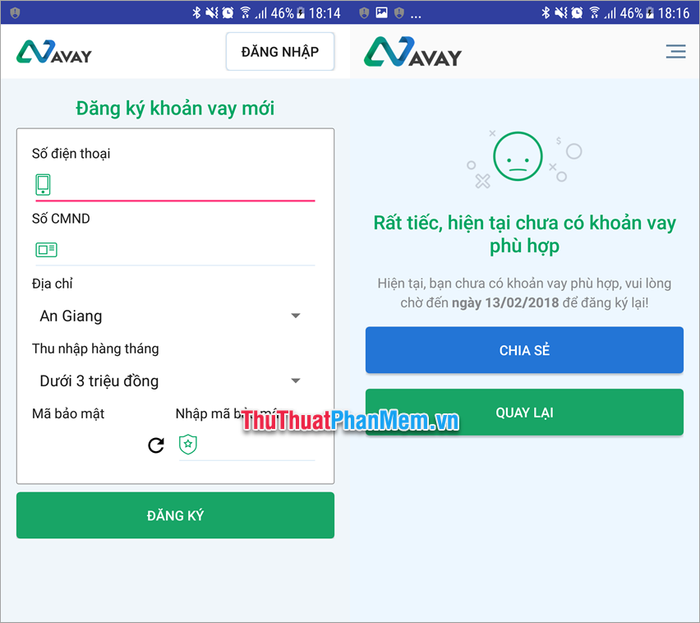

8. Borrow Money via the Avay App

The AVAY app makes experiencing personal loans easier than ever before. With AVAY, customers can borrow money swiftly through the app. AVAY is a transparent credit platform, finding you the highest chance of disbursement from top banks and financial institutions.

Loan Information:

- Loan Amount: 10 – 80 million dong.

- Loan Term: minimum 12 months, maximum 36 months.

- Interest Rate: 12 – 36% per year, subject to change depending on customer's profile.

Benefits of Borrowing Money via the AVAY App:

- Transparency & Trustworthiness: AVAY only collaborates with reputable banks and financial institutions such as FE Credit, Home Credit, OCB to bring you clear information and the simplest procedures, helping you eliminate all risks when borrowing from unorthodox organizations.

- Conditional approval within 2 minutes.

- Bringing the highest approval opportunity loans: with breakthrough data analysis technology, AVAY will accurately determine the borrowing conditions of each individual and thereby select the loans with the highest approval opportunity for you.

- Continuously update new borrowing opportunities: AVAY constantly selects, updates various loan packages, incentives from reputable financial partners so that you can quickly access loans when needed.

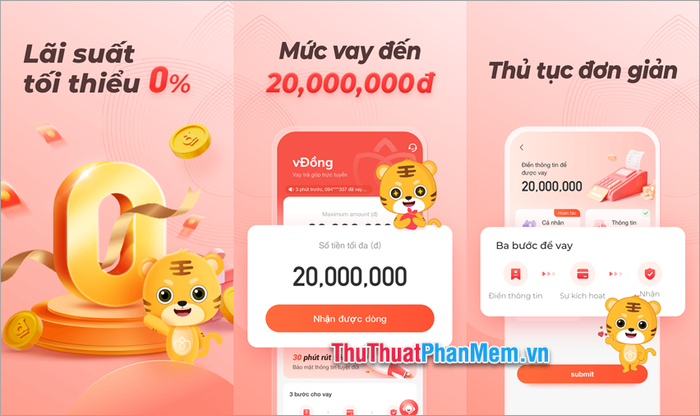

9. Borrow money through vDong app

vDong – a brand of a fast fintech company in Vietnam, operating in the field of Fintech (application of modern technology in finance).

vDong is a P2P Lending platform, applying technology to connect borrowers and investors, with the most reasonable costs for borrowers and maximizing profits for investors.

vDong is hailed as the smartest and most user-friendly loan app in Vietnam, with no upfront fees, installment loans, transparent costs, high approval rates, and excellent customer service.

Loan information:

- Loan amount: from 1,000,000 VND to 20,000,000 VND.

- Loan term: From 91 days to 120 days.

- Maximum interest rate: 19.71% per year (no additional fees).

- Processing fee: 0.

- Highest APR: 19.71%.

Advantages of online borrowing with vDong:

- Simply need an ID card for the loan process, suitable for individuals aged 18 and above.

- No processing fee, 0% interest in the first 5 days.

- vDong always assists customers in need of capital, also a potential environment for profitable lending investors;

- vDong's procedures are simple, with documents processed quickly and neatly.

- Flexible payments via e-wallet, bank transfer, or deposit through banks.

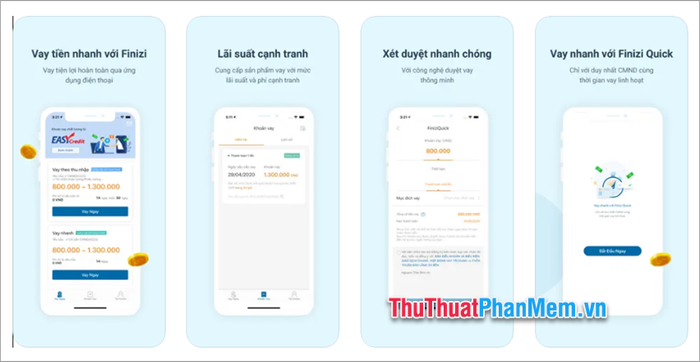

10. Borrow money via Finizi app

Finizi is also one of the reputable online lending apps created to introduce and connect borrowers with professional financial institutions licensed by the State Bank of Vietnam. Borrowing money through the Finizi app anytime, anywhere, quick loan disbursement, and simple document processing without complexity.

Some outstanding features of the Finizi loan app:

- Competitive costs, high transparency, all loan details are clearly displayed on the app when you register.

- Complete loan application entirely on the mobile app.

- Rapid document processing within 1-2 working days.

- No collateral required, no need to retain personal documents.

- Safe and secure, easy management of personal information and detailed profiles in the account.

Here at TechTipsSoftware.vn, we've shared with you the most reputable loan apps today. Specific loan information including loan limits, interest rates, loan terms, and prominent features of each loan app are provided. We hope this information helps you choose the most reliable loan app that suits your needs. Thank you for your attention and support.