Salary increases can take different forms. You might receive a raise, a promotion, or even accept a new position with a higher salary. Regardless of the situation, it’s essential to know how to calculate the percentage increase based on your previous salary. Since inflation rates and living cost statistics are often expressed as percentages, calculating your salary increase percentage can help you compare the raise with other factors like inflation. Understanding how to calculate salary increase percentages also allows you to compare your salary with others in the same field.

Steps

Calculate the salary increase percentage

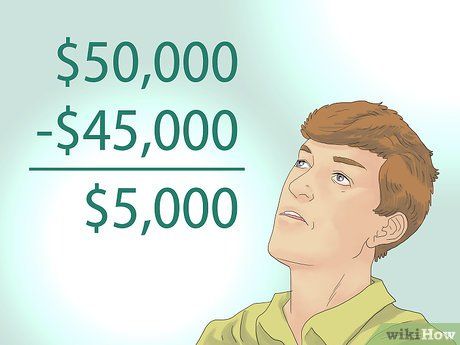

- If you're paid hourly and don't know your annual income, simply subtract your new hourly wage from the old one. For instance, if your old wage was $14/hour and your new wage is $16/hour, the difference is $16 - $14 = $2.

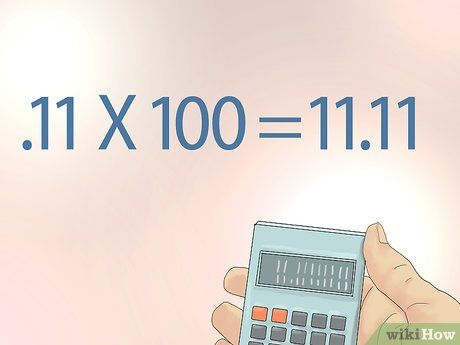

- For example, in Step 1, divide $5,000 by $45,000, which gives $5,000 / $45,000 = 0.111.

- If calculating the hourly wage increase, use the same method. For the hourly wage increase above, divide $2 by $14, which gives $2 / $14 = 0.143.

- For the hourly wage example, multiply the decimal by 100: 0.143 x 100 = 14.3%.

- To verify your calculation, multiply your old salary or hourly wage by the percentage increase. For example, $45,000 x 1.111 equals $49,995, rounded to $50,000. Similarly, $14 x 1.143 equals $16.002.

- Insurance Benefits - If both jobs offer insurance coverage, you’ll need to compare the benefits of each insurance plan. You should also factor in the amount deducted for insurance (if any) when making your decision. For example, if the insurance contribution increases from $100/month to $200/month for the same coverage, it could reduce the net increase in your salary. Consider also the scope of coverage (e.g., does it include dental or vision?), the total annual insurance premiums you need to pay, etc.

- Bonuses or Commissions - While these may not be part of the base salary, be sure to include bonuses and/or commissions in your calculations. Your new salary might provide a higher base income, but if your current job offers quarterly bonuses, does the higher salary still hold significant value? Keep in mind that bonuses are often variable and depend on your performance and/or the company’s financial results.

- Retirement Plans - Most companies in the U.S. offer private retirement plans (such as the 401k) that allow employees to contribute a portion of their pre-tax salary into a retirement fund. Depending on the company’s policy, many also contribute a certain percentage to the employee’s 401k. If your current employer doesn’t contribute to this while the new company offers up to 6%, this is an important factor to consider in your decision.

- Severance Pay - Some companies offer severance packages to employees who have been with the company for a certain number of years. If your current job offers a generous severance pay after 25 years of service, but the new job doesn’t provide such a benefit, you should consider this. A higher annual salary may offer more immediate income, but it’s worth weighing the long-term financial benefits of each job. However, keep in mind that severance packages are becoming less common and may not always be as generous as expected. In some cases, retirement funds may be poorly managed and leave little or nothing for retirees.

Understand the relationship between salary increases and inflation.

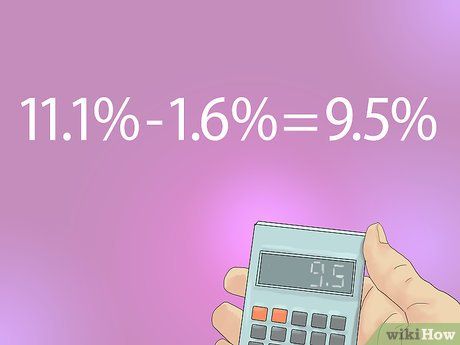

- In other words, you would need to spend 1.6% more of your money in 2014 to buy the same products as in 2013.

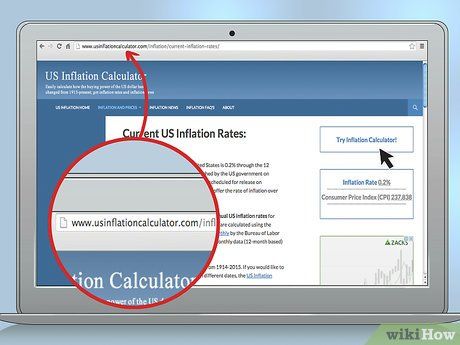

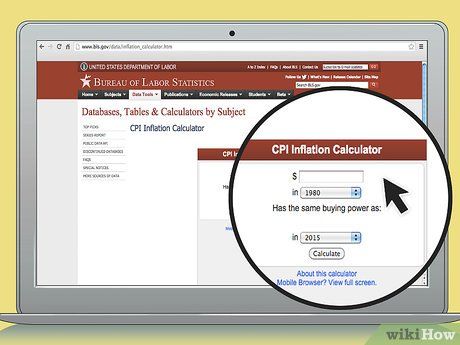

- The Bureau of Labor Statistics offers an easy way to compare purchasing power between years. You can access the tool here: http://www.bls.gov/data/inflation_calculator.htm

Tips

- You can use various online calculators to quickly compute your salary increase percentage.

- The examples above also apply accurately when using different currencies.

What You'll Need

- A calculator