VinFast offers various convenient and easy installment packages for users to own their favorite vehicles immediately. With the message 'Easy installment, joyfully welcome the ride', buyers nationwide can now choose between two main installment options.

1. Purchase Vinfast Electric Motorcycles with 0% Interest Installment through Credit Card Banks

Vinfast has partnered with 21 banks to provide 0% interest credit card installment plans. The list of banks includes: HSBC, VIB, Techcombank, VPBank, ACB, MBBank, TPBank, ...

By opting for VinFast electric motorcycle installment through credit card banks, you can enjoy 0% interest installment with installment periods ranging from 3, 6, 9, 12, 18, to 24 months.

Customers opting for installment payment don't need to provide collateral documents for their vehicle or proof of income. You only need to possess a valid credit card from one of the 21 partner banks with a sufficient credit limit to pay for the car you want to purchase and present your ID card.

Purchases made via credit card will be converted into monthly installment transactions on the credit card, with the installment amount divided according to the chosen installment period.

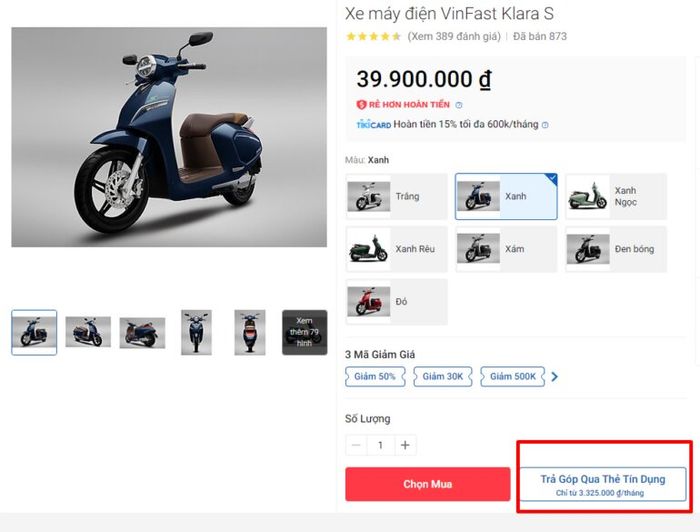

Buyers can opt for installment payments for Vinfast electric motorcycles through credit cards on Vinfast's official website or on e-commerce platforms such as Tiki, Shopee.

The process of purchasing Vinfast electric motorcycles on installment through credit cards is as follows:

Step 1: Choose the electric motorcycle product you want to purchase

Step 3: Provide complete delivery information such as full name, delivery address, etc., and select installment payment via credit card with an installment period that suits your preference

Step 4: Finally, input credit card information for installment payment and complete the ordering process.

2. Purchase Vinfast Electric Motorcycles on Installment through Financial Companies

The second option is to purchase VinFast electric motorcycles on installment through financial companies. Currently, VinFast has partnered with reputable financial companies in the market to support customers in purchasing products on installment, such as EVN Easy Credit, HDSaison, ACS, HomeCredit.

When using this method, regardless of your profession, you can borrow as long as you have no bad debts. However, with this installment method, users may have to bear various fees because the 0% installment option is only applicable to a few individuals at certain times. If opting for regular installment, you may have to endure a relatively high interest rate of 1.09% per month.

According to the chosen installment periods (6, 9, 12 months...), you will make installment payments to the financial company according to the signed credit contract.

When purchasing Vinfast electric motorcycles on installment through financial companies, buyers need to bring along documents such as: ID card; Household registration book; Income proof documents such as Payroll or business income proof documents such as business registration/tax settlement,... (if available)

– Implementation steps:

Step 1: You need to provide complete documentation along with the necessary personal documents required by the financial company.

Step 2: Next, the financial company will assess your loan application. If approved, you can proceed to purchase the vehicle.

Step 3: The VinFast electric vehicle dealer will issue an invoice and send documents for you to complete the vehicle registration process.

Step 4: After you have signed the credit contract with the financial company, the financial company will transfer the full amount for the installment purchase of the vehicle to the VinFast electric vehicle dealer.

Step 5: Finally, you receive the vehicle and complete all installment transactions.

Note:

– Currently, when purchasing VinFast electric motorcycles on installment through credit card banks or financial companies, most do not require customers to make any upfront payments.

– Buyers can borrow an amount equal to 100% of the vehicle's value. However, if financially feasible, buyers should consider making a down payment to reduce the amount of monthly installments in the future.