Market Share Analysis Results

Desktop CPU DynamicsQ2 2022 saw desktop CPU shipments at a near 30-year low, driven by OEM inventory cuts leading to plummeting demand. Against the odds, AMD secured growth, profit, and increased sales.

Recent earnings from Intel, AMD, and Nvidia indicate a long wait for market recovery. Intel's catastrophic earnings report last week marked its first loss in decades, primarily due to the PC market slump.

Contrastingly, AMD's revenue soared by an impressive 70% year-over-year. Excelling across all segments, AMD is on track with its Ryzen 7000 CPUs, RDNA 3 GPUs, and EPYC Genoa data center processors launches. Its steadfast adherence to its strategic plan has borne significant fruit.

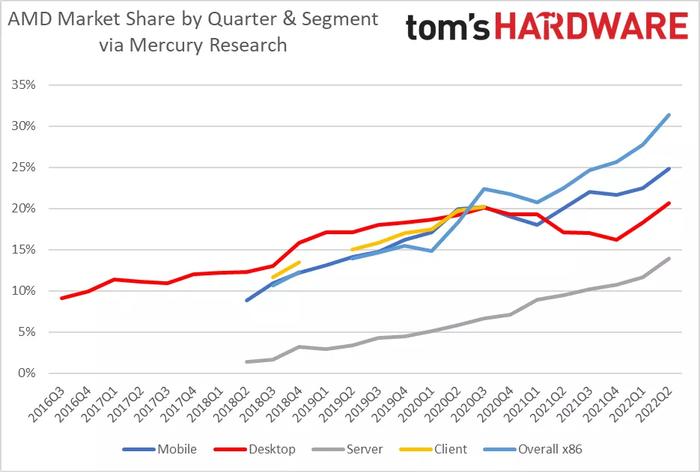

AMD made significant headway in the mobile/laptop segment, achieving a sales record with a 24.8% market share. In the server market as well,

AMD CPUscontinued their streak of sales growth for the 13th consecutive quarter, capturing 13.9% of the market. This period saw the largest quarterly growth in AMD's server segment history. In the x86 processor market, AMD also set a new record with a 31.4% overall market share.

Both Intel and AMD forecast a double-digit decline in the desktop and laptop markets by the end of this year. Nvidia expects a $1.4 billion revenue drop due to the sluggish GPU market, with shipments projected to halve. Distinguishing the impact on PC gaming from cryptocurrency mining remains challenging.

Q2 AMD vs. Intel Desktop Market Share

The PC market decline kicked off as the pandemic waned and global economic turmoil and inflation set in. AMD's desktop business saw a modest recovery from Q1's slump, while Intel's desktop CPU shipments continued to fall, heavily impacted by ongoing inventory adjustments from OEMs.

Laptop/Mobile Market Share

AMD experienced a slight increase in mobile CPU shipments in Q2, yet it remained significantly below normal levels. Both AMD and Intel faced a substantial year-over-year decline in mobile CPU shipments, grappling with reduced CPU demand. Overall, Intel is losing market share to AMD in this sector.

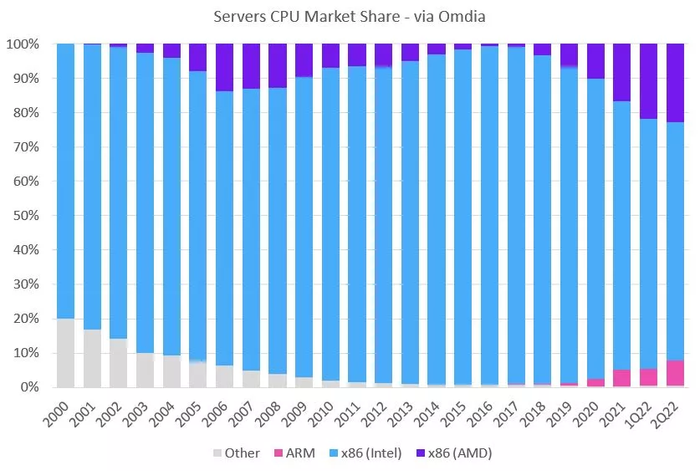

Server Market Share

AMD continued its three-year streak of quarterly market share growth, marking the largest quarterly increase since our records began in 2017. AMD has expanded its server market presence for the 13th consecutive quarter, achieving 13.9% market share with record revenue and shipments for the quarter.

Intel faces ongoing challenges in this segment, announcing another delay for their Sapphire Rapids product. While a specific launch date has not been set, expectations are for its release in the first quarter of the following year.

Arm vs. x86 Market Share

Arm CPU market share fell to 9.4% from the previous quarter's 11.3%, likely affected by a decrease in M1 device sales, leading to a drop in overall Arm chip market share. Despite this, Arm chips have seen some growth in the Chromebook segment. Apple's supply chain disruptions in China during the quarter impacted shipments, potentially affecting its market share growth against x86.

Conclusion

Market downturns are challenging for any manufacturer, but AMD seems to have navigated the economic volatility better this time. The recent decline suggests a delayed recovery for the CPU market, prompting manufacturers to adopt more fitting strategies to maintain their market share.

- Explore more Market Analysis articles