1. France

Official Gold Reserves: 2,436 tons

Percentage of Gold in Foreign Exchange Reserves: 65%

Much of France's gold reserves were accumulated during the 1950s and 1960s. Despite selling several hundred tons of gold in the early 21st century due to the economic crisis, France's gold stock has remained relatively stable since 2009. The French Central Bank's decision to sell some gold sparked calls for a halt to the practice, with Marine Le Pen, leader of the National Front, leading the campaign to not only stop the sales but also to repatriate all of France's gold reserves. In October 2014, Marine Le Pen wrote that "she wanted France’s gold to return home and that the central bank should hold even more gold." Most of this gold was purchased in the 1950s and 1960s and is stored in the vaults of the French Central Bank. In recent years, the bank has hardly sold any gold. Although it sold 572 tons of gold between 2004 and 2009, France remains one of the top countries with a large gold reserve, holding 2,436 tons, which makes up 65% of its foreign exchange reserves. From 2009 to 2014, France declared no intention of reducing its gold reserves.

2. Russia

Official Gold Reserves: 2,299.2 tons

Percentage of Gold in Foreign Exchange Reserves: 22.6%

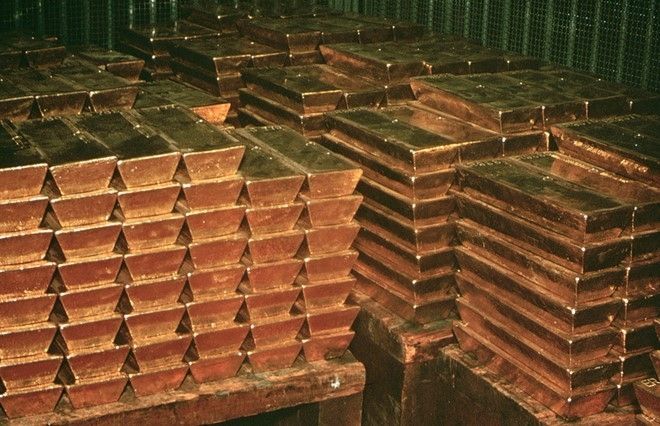

According to RT, Russia's international reserves have risen to $2.7 billion, an increase of 0.5% compared to June. This marks a $50 billion rise since July 2019. Russia's international reserves consist of highly liquid assets including gold stocks, foreign currency, and Special Drawing Rights (SDRs) under the control of the Central Bank and the Russian government. The current reserves exceed the target of $500 billion set by the Central Bank several years ago. Notably, Russia's gold and foreign currency reserves have grown for four consecutive years. Russia is also reshaping its international reserve strategy by reducing its USD holdings to prioritize gold reserves and other currencies.

Over the past 7 years, Russia's Central Bank has significantly increased its gold purchases. In 2017 alone, they bought more than 200 tons of gold to reduce dependency on the US dollar, especially after the deterioration of relations with the West following Russia's annexation of Crimea in 2014. Since 2006, Russia has been increasing its gold reserves to diversify its foreign exchange holdings and boost the ruble's standing. The central bank mainly purchases gold domestically and has ramped up buying since September 2018. Furthermore, Russia also operates a multi-billion-dollar gold mining industry, reducing its reliance on imported gold.

3. China

Official Gold Reserves: 1,948.3 tons

Percentage of Gold in Foreign Exchange Reserves: 3.4%

China is currently the largest gold producer in the world, accounting for 12% of the global supply of this precious metal. The country is also the world's largest consumer of gold, with demand surging in recent years due to the growing middle class. According to data from China's State Administration of Foreign Exchange, as of June 2020, the country's foreign exchange reserves totaled $3.112 trillion. Gold made up 3.4% of these reserves. Despite having an estimated $3.2 trillion in foreign exchange reserves, gold holds a relatively small proportion in China's overall reserves, which is typical compared to other countries where this percentage is around 10%. According to the Financial Times, Beijing is looking to increase its gold reserves to boost the international standing of the Chinese yuan.

Since resuming net gold purchases in December 2018, China has consistently imported gold and has added 100 tons to its national reserves. The People's Bank of China (PBOC) has become one of the largest central banks in the world in terms of gold imports. While many countries store their gold reserves in the vaults of the U.S. Federal Reserve (FED), all of China’s gold reserves are kept within the country. With gold prices continuing to rise, some nations are also bringing their gold reserves home from abroad.

4. Switzerland

Official Gold Reserves: 1,040.0 tons

Percentage of Gold in Foreign Exchange Reserves: 6.5%

Before 1999, Switzerland held up to 2,590 tons of gold before selling it off. The sale of thousands of tons of gold resulted in a loss of over $50 billion for the country. The populist UDC party argues that during the early 2000s, the Swiss government sold part of its gold reserves for just one-third of its current market value. As a result, the party called for a national referendum to bring all of Switzerland’s gold back home. They also demanded that the Swiss National Bank (SNB) hold at least 20% of its reserves in gold, double the current level. However, this proposal was rejected by the Swiss government.

Despite ranking 7th in total reserves, Switzerland has the largest gold reserves per capita in the world. The country primarily trades gold with Hong Kong and China. In 2014, the Swiss government held a referendum to decide whether to increase the gold reserves from 7% to 20% of its total foreign exchange reserves. However, 78% of voters opposed the plan, fearing it would lead to an appreciation of the Swiss Franc, negatively affecting exports. With 1,040.0 tons of gold, Switzerland ranks 7th among the countries with the largest gold reserves globally.

5. Japan

Official Gold Reserves: 765.2 tons

Percentage of Gold in Foreign Exchange Reserves: 3.1%

Japan's gold reserves in the 1950s were only around 6 tons, with a significant increase recorded in 1959 when 169 additional tons were purchased. In 2011, the Bank of Japan sold off a large portion of its gold to inject 20 trillion yen into the economy, helping to stabilize the financial markets in the wake of the devastating tsunami and nuclear disaster. The Bank of Japan has been one of the most aggressive central banks in recent years in terms of monetary easing. In 2016, it cut interest rates below zero, which drove up demand for gold.

As the world's third-largest economy, Japan has launched numerous economic stimulus packages to support businesses and citizens in the aftermath of the COVID-19 pandemic. These stimulus efforts have impacted inflation rates and the value of the yen, leading investors to increasingly turn to gold as a safe haven. While Japan does have some gold mines, production has been minimal over the decades. Due to recent economic fluctuations, the country is actively purchasing more gold to prepare for future risks.

6. India

Official Gold Reserves: 654.9 tons

Percentage of Gold in Foreign Exchange Reserves: 7.5%

In the first half of 2020, global gold prices surged by 16.8%, outpacing all other major assets to become one of the most profitable investment channels. By July 23, 2020, gold prices reached nearly $1,900 per ounce, the highest level since 2012. In October of the previous year, Prime Minister Narendra Modi declared that he wanted to “tap into the country’s precious metal reserves to reduce physical demand and limit imports by offering an alternative investment route.” Much of India’s gold is imported, especially during festivals and wedding seasons when gold sales are at their peak. Over the last two years, India has purchased more than 70 tons of gold, despite having very few active gold mines. Most of India's gold is imported to meet demand for jewelry and household reserves, rather than being stored in foreign exchange reserves.

India is currently the world’s second-largest consumer of gold and a key factor influencing global gold prices. For years, the Reserve Bank of India has been purchasing gold from the International Monetary Fund (IMF) whenever the institution sells gold, viewing it as a safe investment. However, New Delhi remains tight-lipped about its gold purchasing plans. As part of its 12th five-year plan, India intends to develop 33 new gold mines across the country by streamlining the gold mining licensing process.

7. Netherlands

Official Gold Reserves: 612.5 tons

Percentage of Gold in Foreign Exchange Reserves: 7.5%

In times of uncertainty, gold is one of the most favored assets by investors. Central banks worldwide also purchased a total of 650 tons of gold last year for reserves. In fact, gold is known for its ability to withstand political and economic volatility without depreciating in value, and it can be easily liquidated if needed.

The Dutch central bank has reported that it is capable of moving over 189 tons of gold (worth over $7 billion) from its vaults in Amsterdam. In 2019, the Dutch Central Bank (DNB) highlighted gold as a symbol of trust and a safe anchor for the financial system, helping prepare for the worst-case scenarios in the economy. In 1999, the Netherlands announced plans to sell 300 tons of gold over the next five years but ended up selling only 235 tons. Then, between 2004 and 2009, the country reiterated its intention to sell another 165 tons of gold. However, in the 2009-2014 period, Amsterdam decided to halt any further sales.

8. United States

Official Gold Reserves: 8,13 tons

Percentage of Gold in Foreign Exchange Reserves: 78.9%

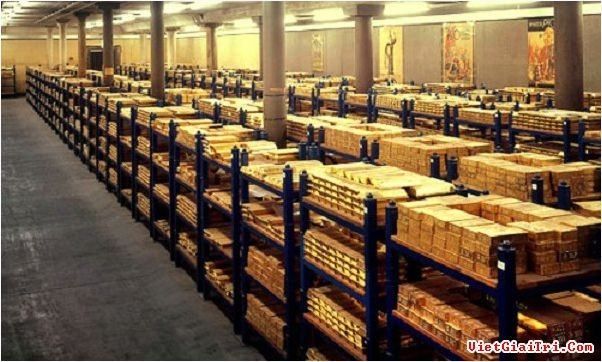

According to the World Gold Council (WGC) report, as of July 2020, countries held approximately 34,900 tons of gold. This gold is used to stabilize national currencies in the face of potential hyperinflation, particularly during major crises like the one the world is facing now. However, very few nations possess such significant gold reserves. In fact, about 80% of the world’s gold reserves are currently held by the central banks and finance ministries of just 25 countries.

With reserves totaling 8,13 tons, the United States holds more than twice the amount of Germany's reserves and nearly eight times that of China. However, this is not the highest figure in history. Back in 1952, the U.S. held a massive 20,663 tons of gold. It wasn’t until 1968 that this number first dipped below 10,000 tons. The U.S. also boasts the highest proportion of gold in its foreign exchange reserves worldwide. Around half of this gold is stored at the Fort Knox bullion depository.

9. Germany

Official Gold Reserves: 3,363.6 tons

Percentage of Gold in Foreign Exchange Reserves: 75.2%

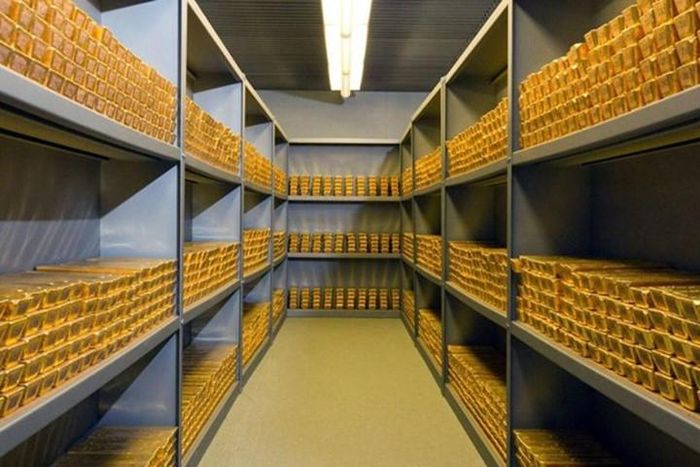

"After the European debt crisis, many Germans began to question whether the 3,363.6 tons of gold stored in the country still existed. This prompted the Bundesbank to release a detailed list of the gold bars in their reserves." As the largest economy in the European Union (EU), Germany naturally holds a significant amount of gold to support its financial market. The German government has been accumulating gold steadily since World War II due to concerns over economic disruptions impacting its currency—something that has happened before during previous crises.

During the Cold War, Germany spread its gold reserves across various locations such as the U.S. and the UK due to pressure from the Soviet Union. However, today about half of the country's gold reserves have been repatriated to Frankfurt. In 2015, Germany successfully reclaimed over 200 tons of gold back to Frankfurt. From 2012 to 2017, Germany repatriated almost 700 tons of gold from Paris and New York to Frankfurt. As a result, Germany has become the second-largest holder of gold reserves in the world. As Europe's economic leader, Germany maintains a massive gold reserve. Despite selling 4.7 tons of gold since September 2011, the country’s gold reserves remain the second-largest globally.

10. Italy

Official Gold Reserves: 2,451.8 tons

Percentage of Gold in Foreign Exchange Reserves: 70.8%

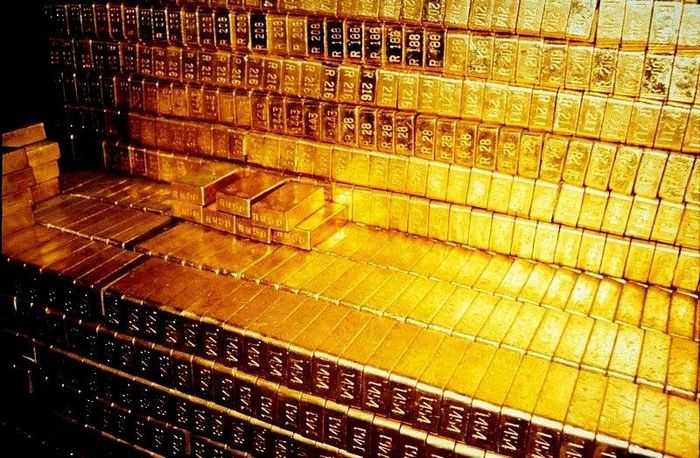

Throughout history and due to psychological factors, gold has always been viewed as a crucial component of central bank reserves. Salvatore Rossi, the Governor of Italy's central bank, emphasizes that gold serves as a solid foundation for the central bank's independence and a final proof of the country’s financial stability. This gold is stored in various vaults, including those in Rome, the Swiss National Bank, the Federal Reserve in the U.S., and the Bank of England. Despite financial struggles, Italy has no plans to sell off its gold reserves.

Although Italy is grappling with debt crisis, it still holds the third-largest gold reserves in the world. The Bank of Italy believes that gold reserves are key to maintaining the country's financial independence. Unlike most nations where gold in foreign exchange reserves belongs to the government and is managed by the central bank, in Italy, the gold reserves are owned by Banca d’Italia. These reserves are spread across various global locations, including vaults in Rome, the Swiss National Bank, the Federal Reserve in New York, and the Bank of England. During tough financial times, Italy has never sold a single gram of its gold, even though its reserves are incredibly large.