Are you urgently in need of a 50 million VND installment loan with low-interest rates and a simple application process? The safest and most efficient solution for you is to apply for a loan with reputable financial companies. With straightforward procedures and competitive interest rates, you can easily obtain a 50 million VND loan tailored to your needs.

In today's market, numerous financial companies offer support for customers seeking a 50 million VND installment loan. However, which are the trustworthy companies that customers can rely on? In this article, we provide updated information on 10+ quick and low-interest 50 million installment loans.

1. Current Forms of 50 Million Installment Loans

To qualify for a 50 million VND installment loan, customers can explore various loan options such as online loans, unsecured bank loans, secured loans, salary-based loans, etc. Depending on each individual's specific conditions, they can choose loan packages that suit their needs.

1.1 Borrow 50 million online with just ID card

Online borrowing through loan apps is currently a popular choice for many customers due to its notable advantages, including quick approval, fast disbursement, and simple loan documentation without the need to prove income. However, the interest rates for online loans on these apps are relatively high, and customers may fall into the trap of fraudulent 'black credit' schemes.

| Ưu điểm |

Nhược điểm |

|

|

1.2 Borrow 50 million unsecured

Unsecured personal loans are a safe and reputable financing solution supported by leading banks and financial companies in Vietnam, such as VPBank, OCB, FE Credit, Home Credit, etc. To borrow 50 million VND through unsecured loans, customers won't need to prove their income based on their salary statement.

Information on salary-based unsecured loan packages:

- Interest rates range from 11 to 15% per year

- Simple loan documentation and procedures

- Salary requirement >3 million VND (varies by bank, some banks may have a minimum salary requirement of 7 million VND)

- Disbursement methods: in cash or through the banks' accounts

Pros and cons evaluation of bank salary-based unsecured loan packages:

| Ưu điểm |

Nhược điểm |

|

|

1.3 Asset-backed loans

Opting for collateralized loans means customers must have assets to ensure loan approval. The notable advantage of this type of loan is its lowest interest rate, ranging from 8 to 10% per year. Specific features of this loan package include:

- Mandatory collateral requirement (with a value greater than 50 million VND)

- Collateral can be documents or vehicles

- Quick approval process

- Disbursement methods: in cash or through bank accounts

Pros and cons evaluation:

| Ưu điểm khi vay 50 triệu online |

Nhược điểm |

|

|

2. 10+ Fast and Low-interest 50 Million VND Installment Loans

2.1 Borrow 50 Million from Home Credit

Home Credit is recognized as a leading financial company in Vietnam, specializing in providing services for installment loans, vehicle financing, business loans, and consumer personal loans. Customers can trust Home Credit for 50 million VND loans, receiving funds immediately after signing a simple contract without the need for income proof.

The eligibility criteria for a 50 million VND loan from Home Credit are not overly stringent. Applicants must be Vietnamese citizens aged 20 to 60 with stable employment and income. Importantly, at the current time, applicants should have no bad debts and no outstanding loans with Home Credit.

The interest rate for a 50 million VND loan at the financial institution Home Credit will be around 1.66% per month, and the loan term is typically flexible, extending up to 36 months.

2.2 Borrow 50 Million from FeCredit

FeCredit has long been known as a prominent financial institution in the Vietnamese market, offering rapid and convenient loan services. Customers can not only borrow 50 million but also up to 70 million VND, with a straightforward approval process and quick disbursement, making it suitable for those in urgent need of money.

Eligibility criteria for a 50 million VND loan at FeCredit:

Essential conditions that borrowers need to meet to quickly obtain a 50 million VND loan with a 36-month installment plan at FE Credit include:

- Customers must be Vietnamese citizens with full civil legal capacity to take responsibility for the registered loan at FE Credit.

- Aged between 20 and 60.

- Currently holding a stable job with an average income of at least 3 million VND per month, ensuring timely payment obligations as per FE Credit's regulations.

- No existing bad debts with any other credit institutions or banks.

Procedures for a 50 million VND loan at the FE Credit system:

To apply for a 50 million VND loan with a 36-month installment plan at FE Credit, customers will need to prepare the following documents:

- Copies of personal documents, including ID card/Citizen ID.

- 01 passport-sized photo (3×4).

- Proof of income documents, such as salary statements, labor contracts.

- Copies of permanent residence book or temporary residence card (K13) along with the originals for easy verification.

- Additional documents depending on the chosen loan type.

When using the loan services at this institution, customers need to prepare the following documents: Salary account statement/related life insurance contracts/electricity bills/vehicle registration or credit contracts.

2.3 Borrow 500 million from Tima

Tima, a reputable financial credit platform, currently partners with major banks to ensure customer loans are disbursed as quickly as possible with extremely favorable interest rates. Customers do not need to submit income proof documents; Tima's exclusive technology allows the bank to assess credit risk based on the consumer credit history of each customer when borrowing money here.

Once the application is approved, Tima's financial credit will provide at least 3 banks for disbursement, with successful loan application rates reaching over 90%, along with the lowest interest rate of approximately 1.67% per month.

| Đối tác |

Tima |

|

Lãi suất |

16.8 đến 45% |

|

Hạn mức |

1 triệu đến 80 triệu |

|

Thời hạn |

12 đến 36 tháng |

|

Thu nhập |

Không yêu cầu |

|

Ưu đãi |

Lãi suất theo dư nợ giảm dần |

|

Phí |

|

2.4 Borrow 50 million at Jeff

To quickly and easily borrow 50 million at Jeff, customers won't need to provide income proof documents. They have two options: mortgage loans or overdraft loans. These products don't require customers to prove assets, and those involved in business can choose business loan packages.

The lending conditions at this bank are quite simple. Only Vietnamese citizens aged between 20 and under 60, with permanent residency in areas where Jeff's branches operate, no history of bad debts with banks, and stable, legally compliant jobs and income are required.

Meeting the requirements for this loan involves customers providing collateral documents such as property papers for houses, cars, or having a payment account at Jeff.

The interest rate when borrowing from this bank is around 10% per year, and the loan term is highly flexible, with a maximum period of up to 48 months depending on the chosen loan package.

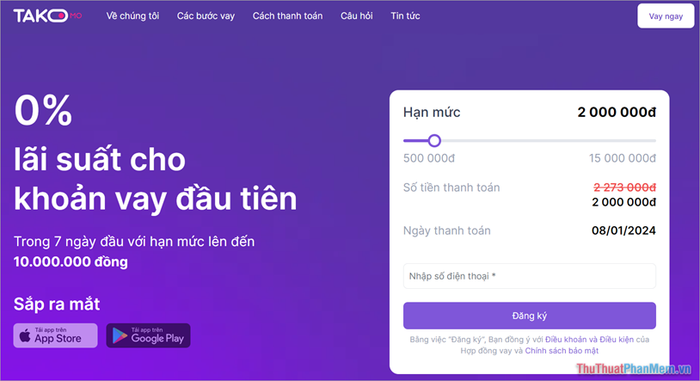

2.5 Installment loan at Takomo

Takomo is also known as a reputable cash and installment consumer loan organization in Vietnam. Takomo is a digital technology application that makes loan registration and approval very fast, convenient, and simple for customers.

2.6 Borrow 500 million at True Money

If you want to quickly borrow 500 million for personal debt repayment or business investment without the need for income proof, you can choose various loans at True Money, such as mortgage consumer loans or loans against valuable documents.

The borrowing conditions at this bank are Vietnamese citizens living in provinces or cities with household registration documents, aged between 20 and 60, having stable jobs and income, and having legal documents for collateral or mortgage assets.

The loan interest rate is very flexible, decreasing with the remaining balance, and the mortgage loan interest rate for a 500 million loan at True Money is around 12% per year.

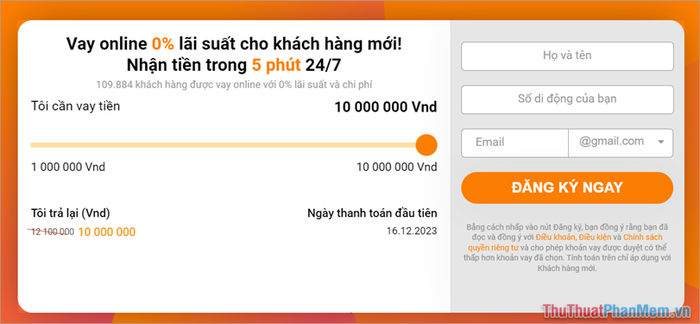

2.7 Borrow 50 million at MoneyCat

MoneyCat is an online personal loan financial company with very simple loan procedures and quick profile approval. Enjoy favorable loan interest rates with a high credit limit and swift disbursement. MoneyCat's loan products make it easy for you to handle financial issues when you need to borrow 50 million urgently.

Borrowing conditions:

- Age from 20 to 55

- Meet one of the following conditions: receive cash/transfer salary, bank account statement, loan against utility bills, loan against life insurance, etc.

- Reside in the MoneyCat-accepted area

- No bad debts from group 2 and group 3

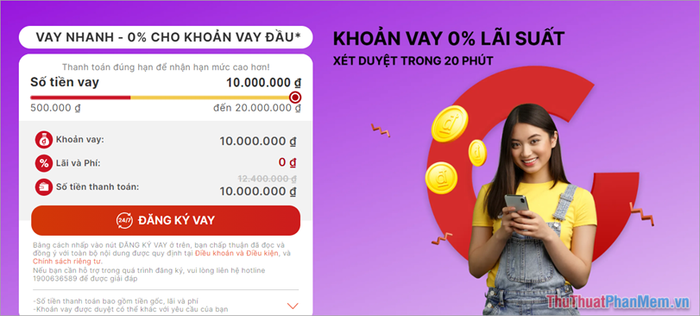

2.8 Borrow 50 million at Dong 247

Dong 247 is known as a company managing and developing the Dong 247 loan app until today. Dong 247 is rated as one of the most reputable loan apps of the year, offering diverse loan options and attractive incentives.

Simply ensure you have a valid ID card, your ATM card, and a minimum monthly income of 3 million, and you can easily apply for a loan here.

If you borrow money at Dong 247, you will get:

- Borrow money with a limit from 1 million to 10 million VND;

- Pay no interest for the first loan and bear an interest rate below 20% per year for subsequent loans;

- Support automatic profile approval.

2.9 Borrow 50 million at OnCredit

OnCredit is a reputable address for a 50 million loan, with the largest financial block at present. If you want to borrow a large amount quickly, OnCredit is a great choice for you.

The conditions to borrow at OnCredit are to have an ID card, a household registration book, and you don't need to prove your income or undergo any assessment.

When borrowing capital here, you will get:

- Borrow with a super large limit from 3 million VND to 1 billion VND;

- Enjoy 0% interest for the first loan;

- High profile approval rate up to 98%;

- Attractive interest rate of only 1.5% per month and 18% per year;

- Quick disbursement after 5 minutes of profile approval;

- Many attractive benefits.

2.10 Borrow 50 million at Vay VND

Vay VND is a money lending app operated by a reputable nationwide group. And the loans at Vay VND are only short-term loans, not exceeding 30 days.

The conditions to borrow money at Vay VND are extremely simple, including being between 21 and 60 years old, having your own bank account, and providing a valid ID card.

Vay VND supports you:

- Loans from 100,000 VND to 10 million VND;

- With an annual interest rate of 18.25%;

- And complete the loan within a minimum of 10 days to a maximum of 30 days.

3. What to know when quickly borrowing 50 million via app

Conditions for Unsecured Loans of 50 Million VND

Currently, to increase the customer base and expand the market, financial institutions and banks have simplified the conditions for unsecured loans of 50 million VND to the simplest level. However, customers still need to meet basic conditions as follows:

- Customers must be Vietnamese citizens, aged between 18 and 55.

- Monthly income must be stable, at least 3 million VND.

- Minimum working time of 1 year or a labor contract of at least 3 months.

- No bad debts or significant debts at credit institutions.

Documents for Urgent 50 Million Loans Include What?

When urgently in need of a 50 million VND loan, the borrower needs to prepare the following documents:

- ID card/Citizen ID or Original household registration book

- Payroll or labor contract (confirmed by the company of current employment)

- Utility bills for electricity, water, internet, and mobile phone for the last 3 months

- Business registration certificate

Repayment Methods for a 50 Million Installment Loan

Currently, repaying a loan through an app is extremely easy and flexible. As there are various loan methods, such as:

- Payment through e-wallets: Zalo Pay, MoMo, Viettel Pay,…

- Payment at collection points: Viettel Post, Winmart +,…

- Bank transfer: Vietcombank, MBBank, Agribank, BIDV,…

Things to Note When Borrowing a 50 Million Unsecured Loan

As analyzed above, the optimal solution when you urgently need a 50 million VND loan is an unsecured loan. However, during the borrowing process, customers should take note of the following points:

- Research multiple companies, lending institutions to find the most suitable loan product for your conditions.

- Check the interest rate calculation, besides interest, are there service fees, consultation fees for the loan or not.

- Thoroughly read the loan contract, payment periods, and installment amounts.

- Understand the penalty fees (late payment fees, loan settlement fees, overdue interest,…)

The above article has compiled information on 10+ Quick and Low-Interest Installment Loans of 50 million VND. If you find the article helpful, please support us by sharing it with your friends and family.