CPI, or Consumer Price Index, is a widely used concept in retail business, offering valuable insights for businesses and trade organizations. But what exactly does CPI entail? How does it relate to inflation, and what impact does it have? Let's delve into the details with Mytour's comprehensive guide below.

Learn more:Exploring Dark Memes: What Are They Really Like?

Understanding CPI:

CPI, short for Consumer Price Index, is a metric used to gauge the average amount of money an individual spends on a basket of goods. It reflects the fluctuation of prices of goods over a specific period.

Put simply, CPI informs you about the percentage increase in prices of goods compared to before. The unit of measurement for CPI is typically %. This index is used to measure expenses in various sectors, including:

- Food and beverages.

- Housing.

- Clothing.

- Transportation.

- Education, media.

- Entertainment.

- Healthcare services.

- Other goods, services.

Guide on Obtaining Personal Identification Codes for Children and New Students

Significance of CPI in Economics

It's evident that CPI holds significant meaning for businesses and retail organizations. So, what exactly is the main significance of the CPI index in economics?

- CPI reflects the level of retail price fluctuations of goods and services associated with individuals' livelihoods and households.

- When consumers spend, expenses increase, indicating changes in people's living costs over a certain period.

- A rise in CPI implies an increase in the average cost of living. Conversely, a decrease in the index means a reduction in people's consumption.

- Major items typically included in CPI calculation encompass: food, housing, clothing, healthcare, education, transportation, entertainment, and more.

- CPI is also regarded as a tool for assessing an economy's phase of inflation or deflation. Consequently, governments closely monitor this index to make appropriate adjustments, significantly influencing the development of a particular nation.

CPI indicates the level of consumer spending on particular items

CPI indicates the level of consumer spending on particular itemsConsumer Price Index Calculation Formula

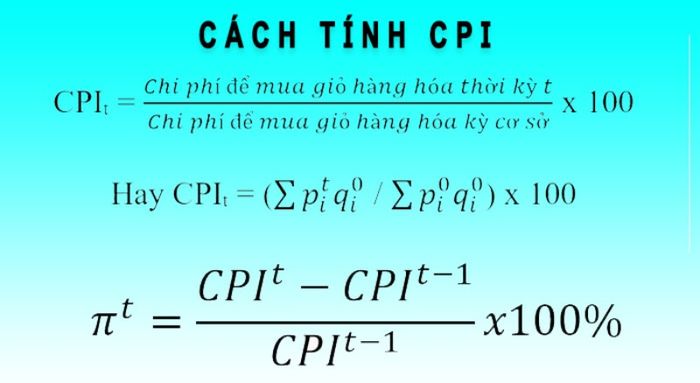

To calculate the Consumer Price Index, understanding various related indices is essential. The calculation process for this index is relatively straightforward, involving the following steps:

- Step 1: Initially, identify a typical basket of goods and services that customers commonly purchase. These items are essential for current consumption needs.

- Step 2: Next, determine the prices of all items in the consumer basket. Prices are recorded at the time of calculation.

- Step 3: Calculate the total value of purchasing the consumer basket. This is done by multiplying the quantity of each item by its price and summing them up.

- Step 4: Then, calculate the Consumer Price Index for months, quarters, or years using the following formula: CPIt = Cost to purchase the basket in period t / Cost to purchase the basket in the base period X 100.

- Step 5: Finally, calculate the inflation or deflation rate of the basket of goods.

Consumer Price Index Calculation Formula for a Fixed Basket of Goods

Consumer Price Index Calculation Formula for a Fixed Basket of GoodsRelationship between CPI and Inflation

CPI and inflation are closely related and have a significant correlation. When the Consumer Price Index increases, prices of goods and services in the market rise, leading to an increase in inflation. Those with lower incomes are heavily impacted when CPI rises because their wages remain unchanged, yet the prices of goods surge, resulting in reduced purchasing power.

Furthermore, when the CPI is low and prices of goods decrease, it leads to negative inflation, also known as deflation. During this period, individuals with lower incomes have better purchasing conditions than usual as they can afford more goods.

Addressing Common Questions

Does CPI reflect substitution effect when prices rise or fall?

NO, The primary limitation in calculating the Consumer Price Index (CPI) is its inability to reflect the substitution effect of goods when their prices rise or fall. This is because the calculation formula uses a fixed basket of goods. If the items in this basket all increase in price simultaneously, consumers are less likely to purchase them.

Calculating the CPI index also encounters many limitations, merely reflecting subjectively

Calculating the CPI index also encounters many limitations, merely reflecting subjectivelyOne observable aspect of consumer behavior is that when certain products or services increase in price, consumers tend to shift to alternatives. They lean towards other products or services with significantly lower prices. Consequently, this has led to the CPI overestimating compared to actual prices.

Does CPI increase or alter the quality of goods?

NO, Another issue in calculating the CPI index is the failure to accurately assess new product quality. This index solely relies on a fixed basket of goods, hence the emergence of new items alters the landscape.

During such times, consumers tend to use a particular currency unit to purchase more products. This inability of the CPI to reflect increased purchasing power of the currency unit leads to an overestimation compared to actual prices.

Does CPI indicate the emergence of new goods or services?

NO, the CPI index does not indicate their emergence. Using a fixed basket of goods, new items will alter consumption trends. Consumers will opt for a fixed currency unit that can buy the most products. Consequently, the index will not reflect the increased purchasing power of the currency.

Conclusion

Once you understand what CPI is, it will help you stay updated with more interesting and informative information. If you have any questions or need further assistance or updates, feel free to visit Mytour right away.